Question: Thank you! Nguyen & Evans Incorporated, is a software development company that recently reported the following amounts (in thousands) in its unadjusted trial balance as

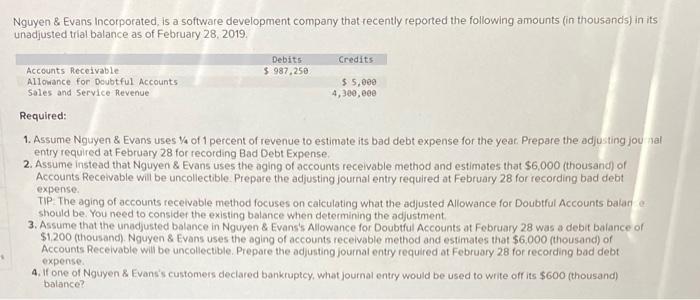

Nguyen & Evans Incorporated, is a software development company that recently reported the following amounts (in thousands) in its unadjusted trial balance as of February 28, 2019, Credits Debits $987.250 Accounts Receivable Allowance for Doubtful Accounts Sales and Service Revenue $ 5,000 4,300.ece Required: 1. Assume Nguyen & Evans uses Va of 1 percent of revenue to estimate its bad debt expense for the year. Prepare the adjusting jou sal entry required at February 28 for recording Bad Debt Expense. 2. Assume instead that Nguyen & Evans uses the aging of accounts receivable method and estimates that $6,000 (thousands of Accounts Receivable will be uncollectible. Prepare the adjusting journal entry required at February 28 for recording bad debt expense. TIP The aging of accounts receivable method focuses on calculating what the adjusted Allowance for Doubtful Accounts balan should be You need to consider the existing balance when determining the adjustment 3. Assume that the unadjusted balance in Nguyen & Evans's Allowance for Doubtful Accounts at February 28 was a debit balance on $1200 (thousand). Nguyen & Evans uses the aging of accounts receivable method and estimates that $6.000 (thousands of Accounts Receivable will be uncollectible. Prepare the adjusting journal entry required at February 28 for recording bad debt expense. 4. If one of Nguyen & Evans's customers declared bankruptcy, what journal entry would be used to write off its $600 (thousand) balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts