Question: Thank you. Q1 Based on historical returns, a portfolio has a Sharpe ratio of 2.0. If the mean return to the portfolio is 20%, and

Thank you.

Thank you.

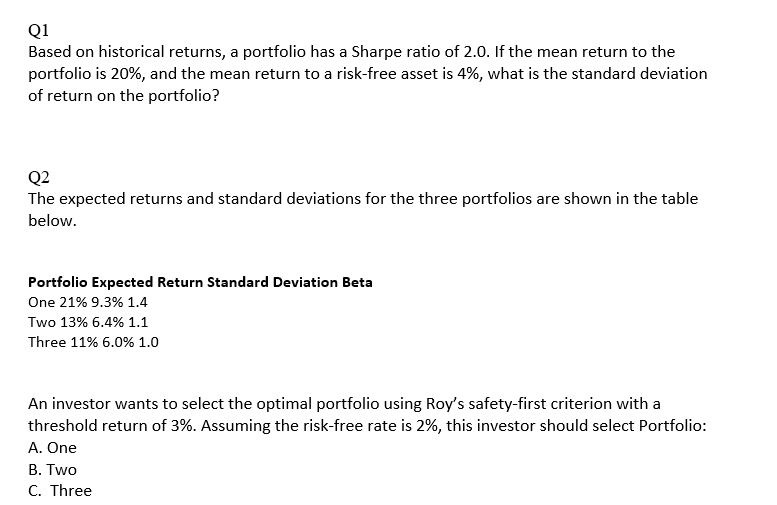

Q1 Based on historical returns, a portfolio has a Sharpe ratio of 2.0. If the mean return to the portfolio is 20%, and the mean return to a risk-free asset is 4%, what is the standard deviation of return on the portfolio? Q2 The expected returns and standard deviations for the three portfolios are shown in the table below. Portfolio Expected Return Standard Deviation Beta One 21% 9.3% 1.4 Two 13% 6.4% 1.1 Three 11% 6.0% 1.0 An investor wants to select the optimal portfolio using Roy's safety-first criterion with a threshold return of 3%. Assuming the risk-free rate is 2%, this investor should select Portfolio: A. One B. Two C. Three

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock