Question: Thank you! Requlred Information SB Exercise 7-14 through Exercise 7-15 (Algo) [The following information applies to the questions displayed below.] Chuck Wagon Grills, Incorporated, makes

![[The following information applies to the questions displayed below.] Chuck Wagon Grills,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66eac1cb33f56_06666eac1ca962de.jpg)

Thank you!

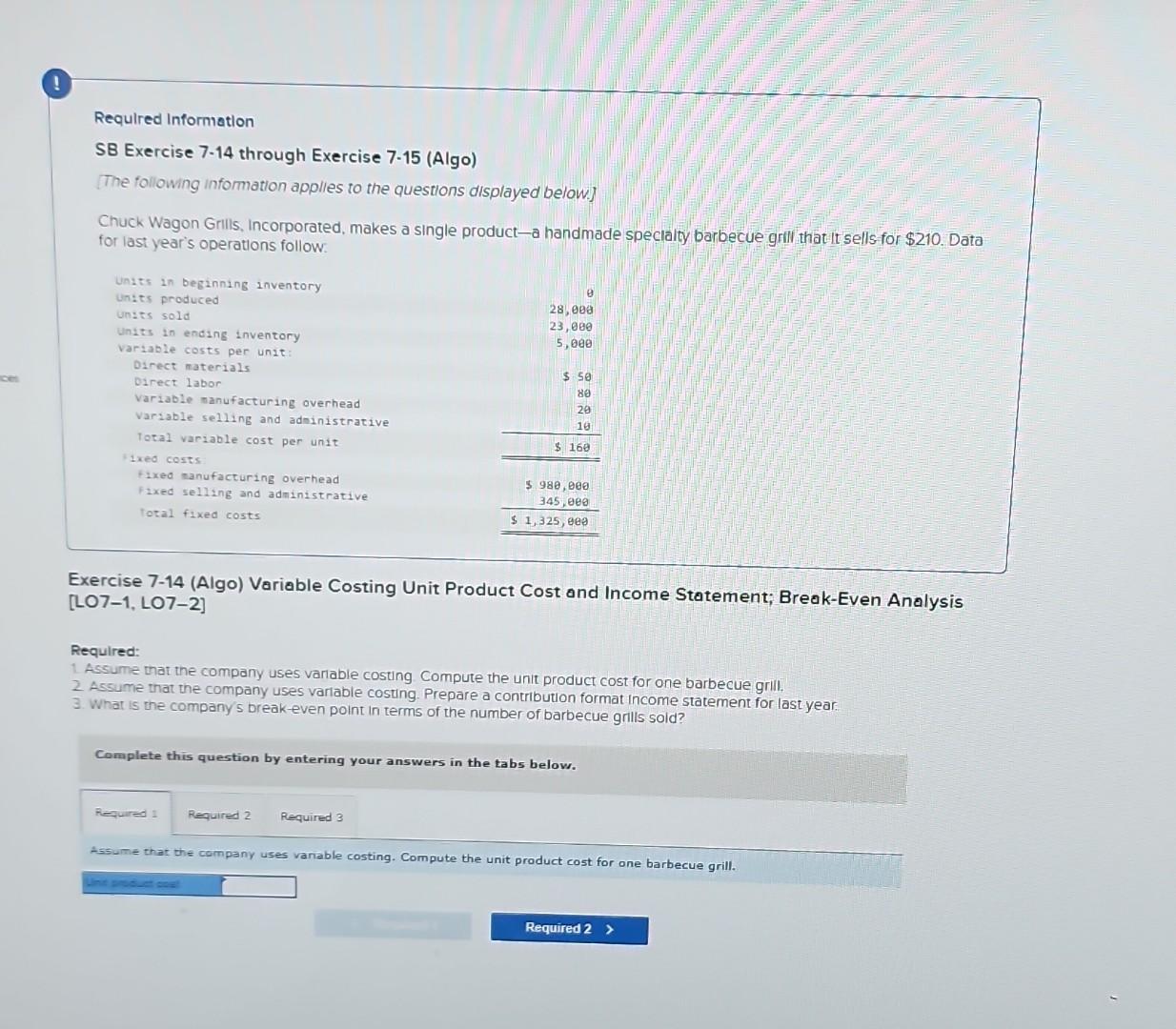

Requlred Information SB Exercise 7-14 through Exercise 7-15 (Algo) [The following information applies to the questions displayed below.] Chuck Wagon Grills, Incorporated, makes a single product-a handmade specialty barbecue grill that it sells-for $210. Data for last year's operations follow. Exercise 7-14 (Algo) Variable Costing Unit Product Cost and Income Statement; Break-Even Analysis [LO7-1, LO7-2] Required: 1. Assume that the company uses variable costing. Compute the unit product cost for one barbecue grili. 2. Assume that the company uses variable costing. Prepare a contribution format income statement for last year: What companys breakeven point in terms of the number of barbecue grills sold? Complete this question by entering your answers in the tabs below. Assume that the company uses vanable costing. Compute the unit product cost for one barbecue grill. Regulred Ascirms mant the comoany ukes varabie costing Comoute the unit product cost for one barbecue grill Acsums that the company uses variabie costing Prepare a contribution format income statement for last year Whar is me pmoans s breas even Doth in terms of the number of barbecue grilis sold? 9. Compute the unit product cost for one barbecue griil 9. Preoare a contrbution format income statement for last year of the number of barbecue grilis sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts