Question: Thank you so much NAME: SCORE SECTION: PROFESSOR: Multiple Choice 1. Which of the following might appear as an item in a statement of changes

Thank you so much

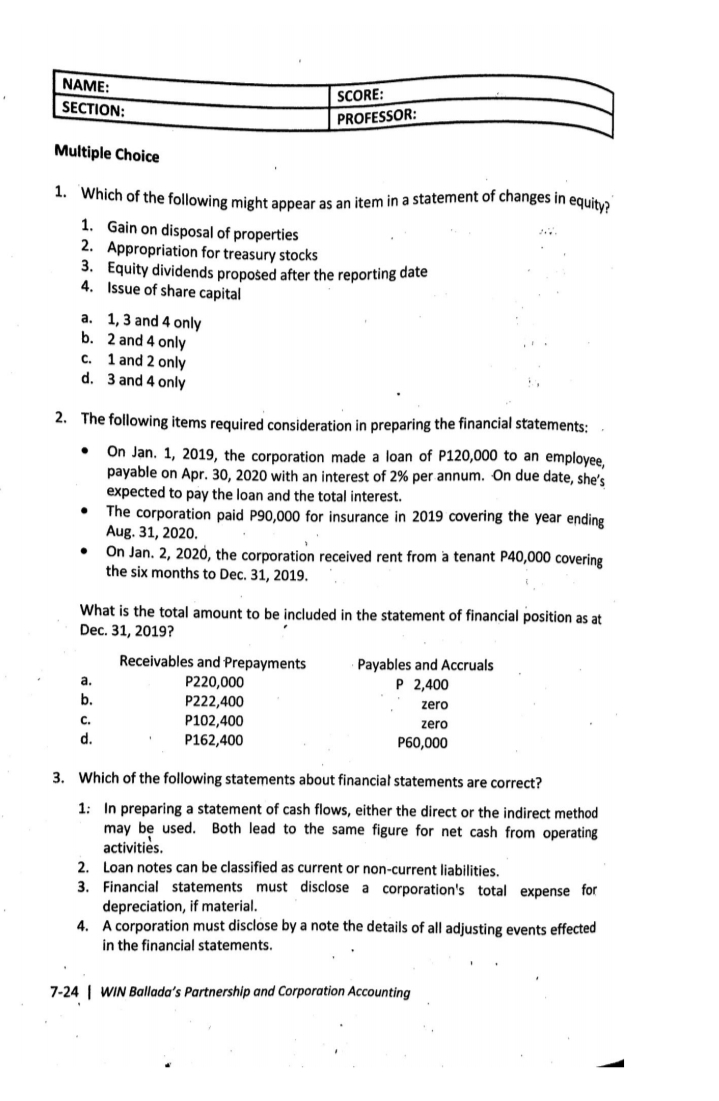

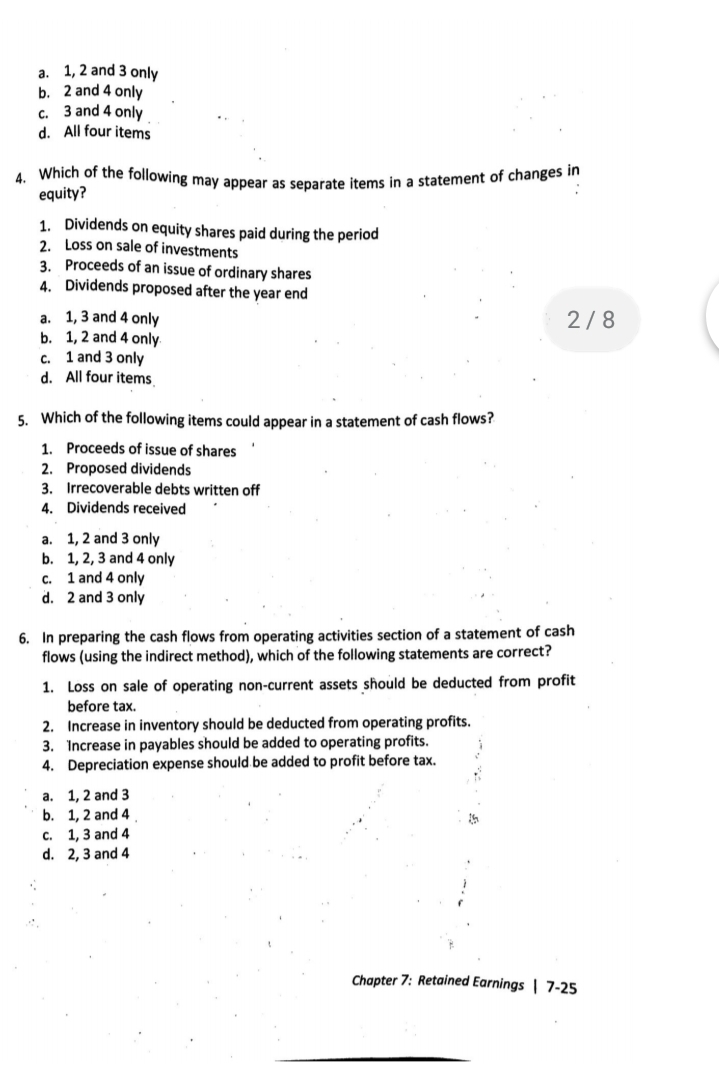

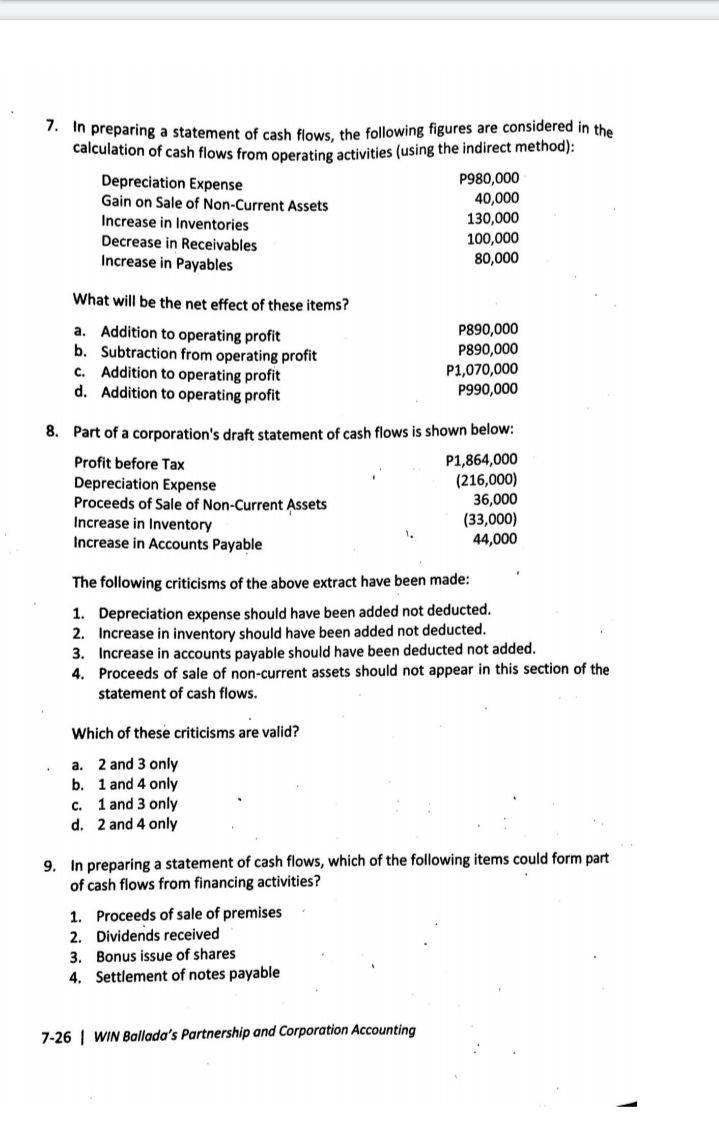

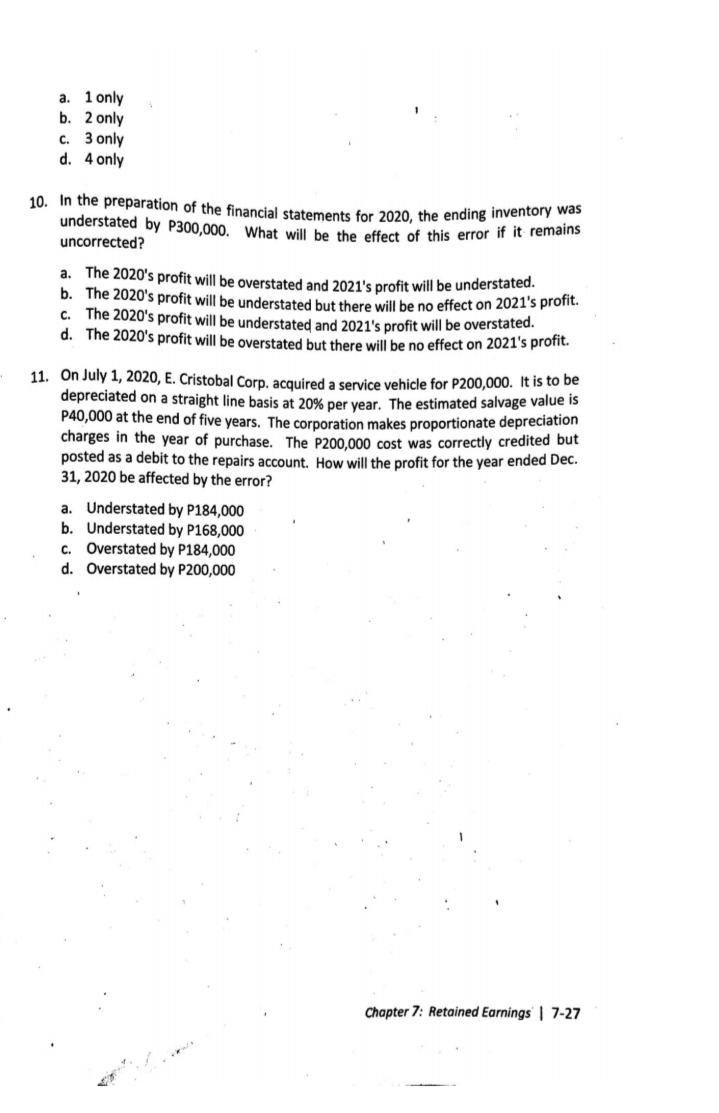

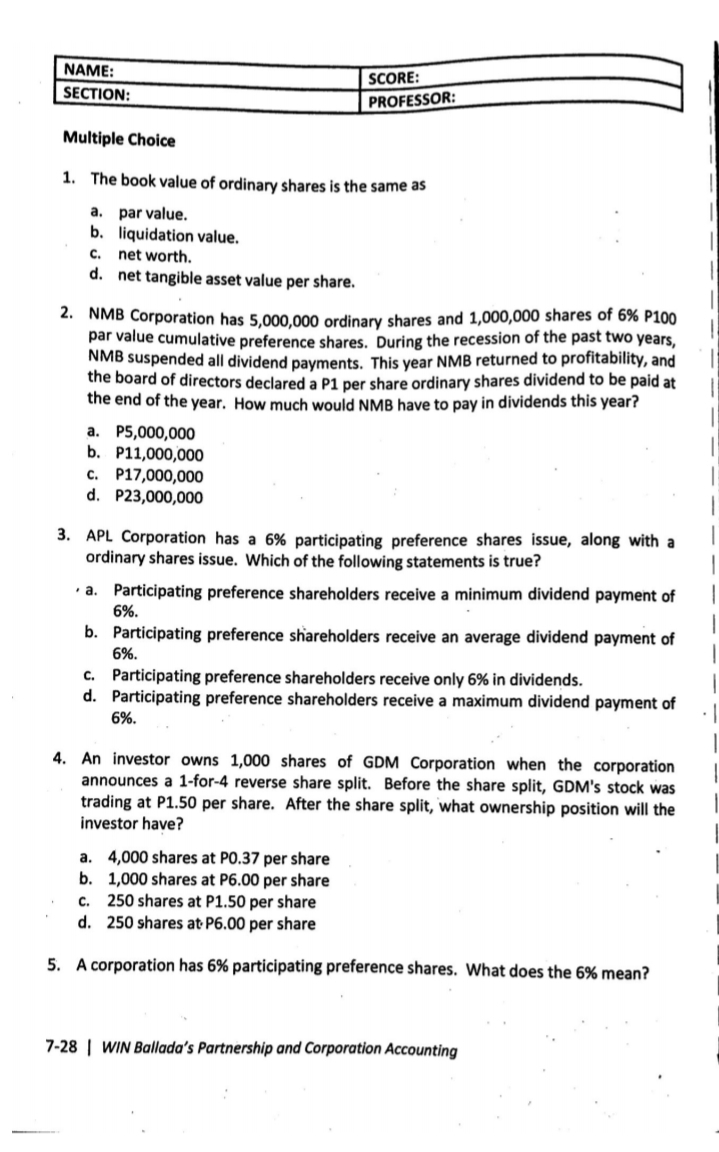

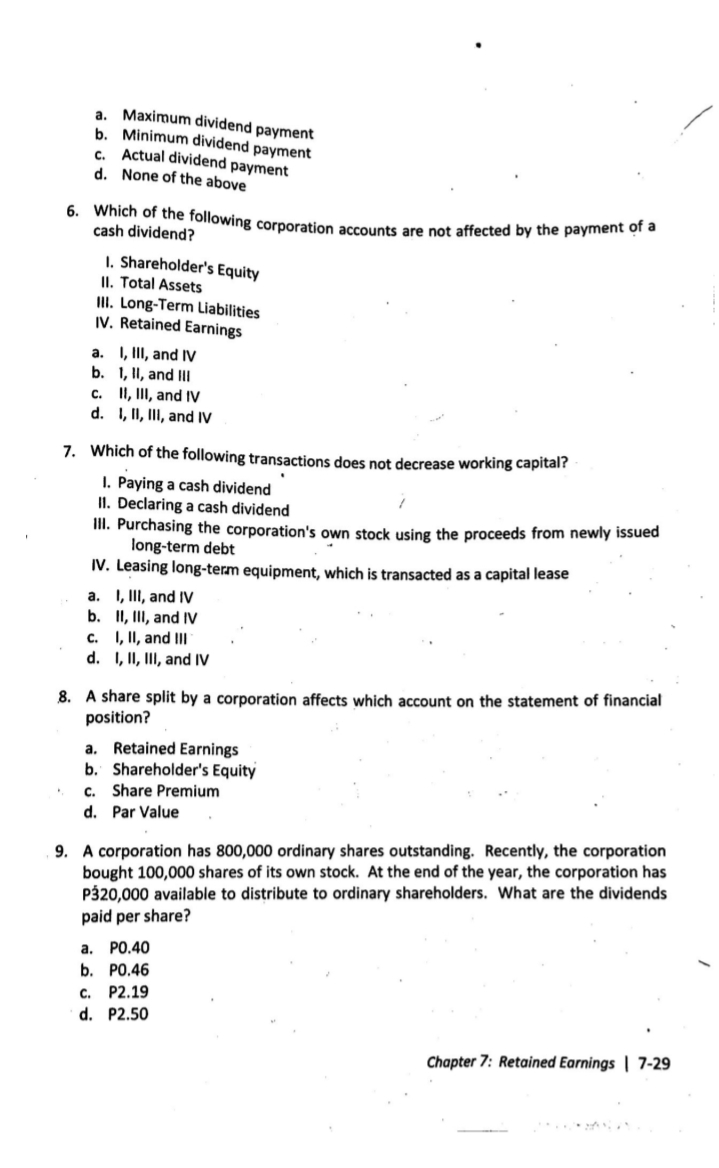

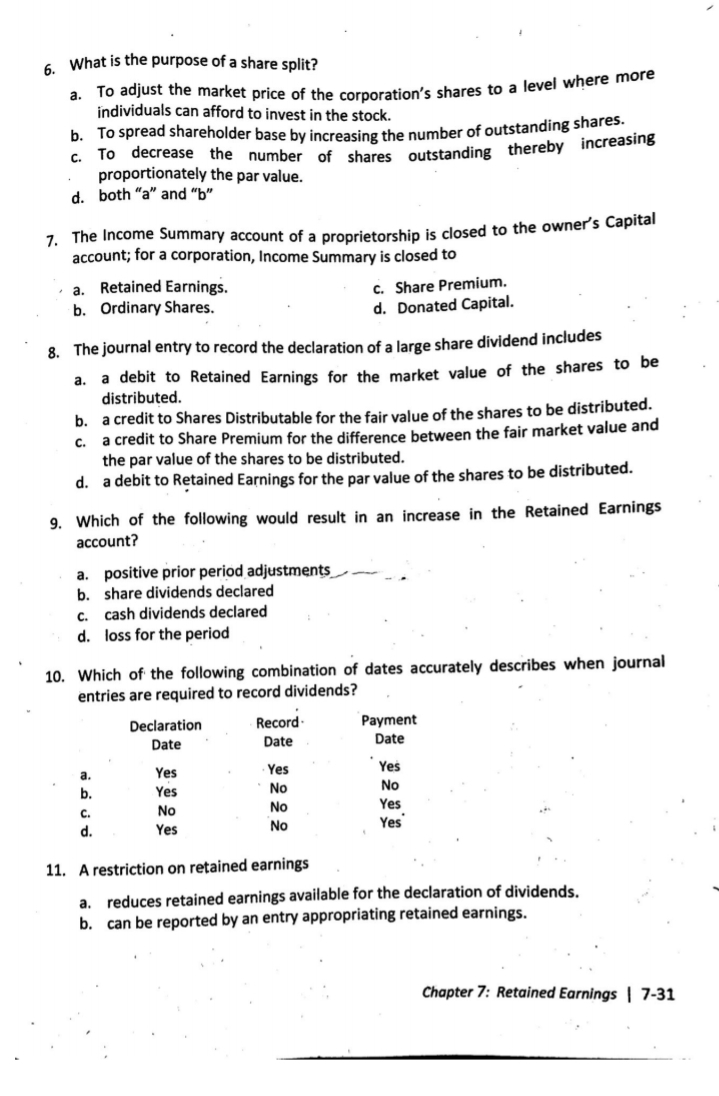

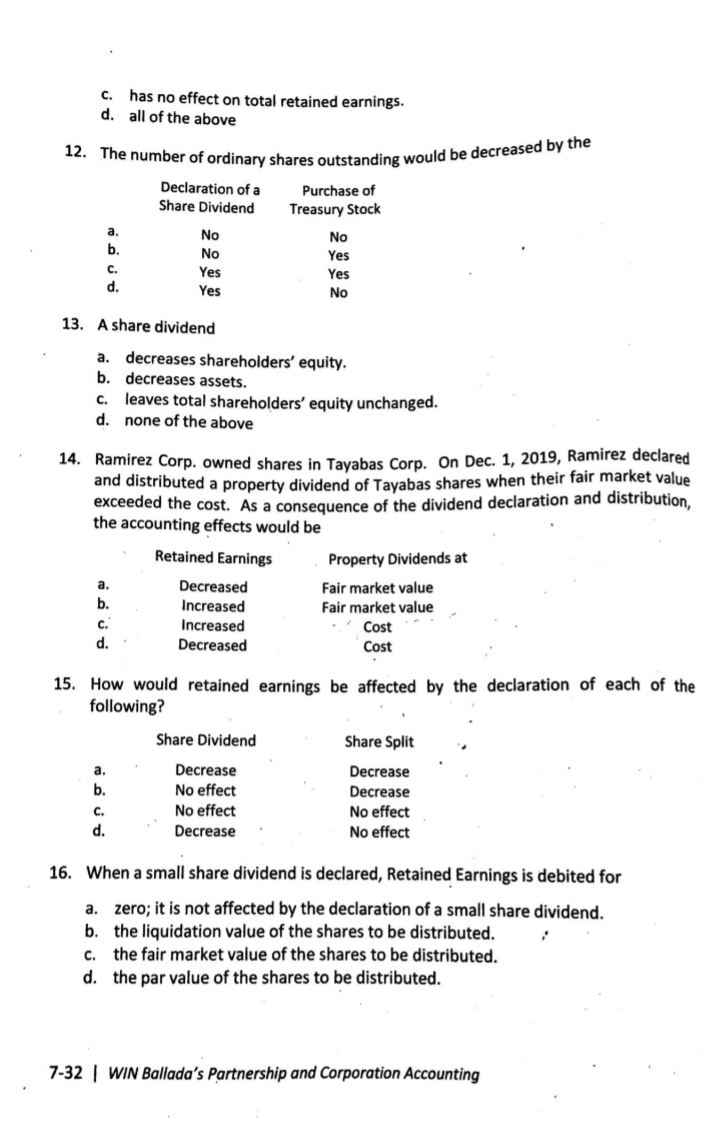

NAME: SCORE SECTION: PROFESSOR: Multiple Choice 1. Which of the following might appear as an item in a statement of changes in equitya 1. Gain on disposal of properties 2. Appropriation for treasury stocks 3. Equity dividends proposed after the reporting date 4. Issue of share capital a. 1, 3 and 4 only b. 2 and 4 only c. 1 and 2 only d. 3 and 4 only 2. The following items required consideration in preparing the financial statements: . On Jan. 1, 2019, the corporation made a loan of P120,000 to an employee, payable on Apr. 30, 2020 with an interest of 2% per annum. On due date, she's expected to pay the loan and the total interest. . The corporation paid P90,000 for insurance in 2019 covering the year ending Aug. 31, 2020. On Jan. 2, 2020, the corporation received rent from a tenant P40,000 covering the six months to Dec. 31, 2019. What is the total amount to be included in the statement of financial position as at Dec. 31, 2019? Receivables and Prepayments Payables and Accruals a. P220,000 P 2,400 P222,400 zero C. P102,400 zero P162,400 P60,000 3. Which of the following statements about financial statements are correct? 1: In preparing a statement of cash flows, either the direct or the indirect method may be used. Both lead to the same figure for net cash from operating activities. Loan notes can be classified as current or non-current liabilities. 3. Financial statements must disclose a corporation's total expense for depreciation, if material. 4. A corporation must disclose by a note the details of all adjusting events effected in the financial statements. 7-24 | WIN Ballada's Partnership and Corporation Accountinga. 1, 2 and 3 only b. 2 and 4 only c. 3 and 4 only d. All four items 4. Which of the following may appear as separate items in a statement of changes in equity? 1. Dividends on equity shares paid during the period 2. Loss on sale of investments 3. Proceeds of an issue of ordinary shares 4. Dividends proposed after the year end a. 1, 3 and 4 only 2/8 b. 1, 2 and 4 only c. 1 and 3 only d. All four items 5. Which of the following items could appear in a statement of cash flows? 1. Proceeds of issue of shares 2. Proposed dividends 3. Irrecoverable debts written off 4. Dividends received a. 1, 2 and 3 only b. 1, 2, 3 and 4 only c. 1 and 4 only d. 2 and 3 only 6. In preparing the cash flows from operating activities section of a statement of cash flows (using the indirect method), which of the following statements are correct? 1. Loss on sale of operating non-current assets should be deducted from profit before tax. 2. Increase in inventory should be deducted from operating profits. 3. Increase in payables should be added to operating profits. 4. Depreciation expense should be added to profit before tax. a. 1, 2 and 3 b. 1, 2 and 4 C. 1, 3 and 4 d. 2, 3 and 4 Chapter 7: Retained Earnings | 7-257. In preparing a statement of cash flows, the following figures are considered in the calculation of cash flows from operating activities (using the indirect method): Depreciation Expense P980,000 Gain on Sale of Non-Current Assets 40,000 Increase in Inventories 130,000 Decrease in Receivables 100,000 Increase in Payables 80,000 What will be the net effect of these items? a. Addition to operating profit P890,000 b. Subtraction from operating profit P890,000 C. Addition to operating profit P1,070,000 d. Addition to operating profit P990,000 8. Part of a corporation's draft statement of cash flows is shown below: Profit before Tax P1,864,000 Depreciation Expense (216,000) Proceeds of Sale of Non-Current Assets 36,000 Increase in Inventory (33,000) Increase in Accounts Payable 44,000 The following criticisms of the above extract have been made: 1. Depreciation expense should have been added not deducted. 2. Increase in inventory should have been added not deducted. 3. Increase in accounts payable should have been deducted not added. 4. Proceeds of sale of non-current assets should not appear in this section of the statement of cash flows. Which of these criticisms are valid? a. 2 and 3 only b. 1 and 4 only c. 1 and 3 only d. 2 and 4 only 9. In preparing a statement of cash flows, which of the following items could form part of cash flows from financing activities? 1. Proceeds of sale of premises 2. Dividends received 3. Bonus issue of shares 4. Settlement of notes payable 7-26 | WIN Ballada's Partnership and Corporation Accountinga. 1 only b. 2 only c. 3 only d. 4 only 10. In the preparation of the financial statements for 2020, the ending inventory was understated by P300,000. What will be the effect of this error if it remains uncorrected? a. The 2020's profit will be overstated and 2021's profit will be understated. b. The 2020's profit will be understated but there will be no effect on 2021's profit. c. The 2020's profit will be understated and 2021's profit will be overstated. d. The 2020's profit will be overstated but there will be no effect on 2021's profit. 11. On July 1, 2020, E. Cristobal Corp. acquired a service vehicle for P200,000. It is to be depreciated on a straight line basis at 20% per year. The estimated salvage value is P40,000 at the end of five years. The corporation makes proportionate depreciation charges in the year of purchase. The P200,000 cost was correctly credited but posted as a debit to the repairs account. How will the profit for the year ended Dec. 31, 2020 be affected by the error? a. Understated by P184,000 b. Understated by P168,000 c. Overstated by P184,000 d. Overstated by P200,000 Chapter 7: Retained Earnings | 7-27NAME: SCORE: SECTION: PROFESSOR: Multiple Choice 1. The book value of ordinary shares is the same as a. par value. b. liquidation value. c. net worth. d. net tangible asset value per share. 2. NMB Corporation has 5,000,000 ordinary shares and 1,000,000 shares of 6% P100 par value cumulative preference shares. During the recession of the past two years, NMB suspended all dividend payments. This year NMB returned to profitability, and the board of directors declared a P1 per share ordinary shares dividend to be paid at the end of the year. How much would NMB have to pay in dividends this year? a. P5,000,000 P11,000,000 c. P17,000,000 d. P23,000,000 3. APL Corporation has a 6% participating preference shares issue, along with a ordinary shares issue. Which of the following statements is true? . a. Participating preference shareholders receive a minimum dividend payment of 6%. b. Participating preference shareholders receive an average dividend payment of 6%. c. Participating preference shareholders receive only 6% in dividends. d. Participating preference shareholders receive a maximum dividend payment of 6%. 4. An investor owns 1,000 shares of GDM Corporation when the corporation announces a 1-for-4 reverse share split. Before the share split, GDM's stock was trading at P1.50 per share. After the share split, what ownership position will the investor have? a. 4,000 shares at PO.37 per share b. 1,000 shares at P6.00 per share c. 250 shares at P1.50 per share d. 250 shares at P6.00 per share 5. A corporation has 6% participating preference shares. What does the 6% mean? 7-28 | WIN Ballada's Partnership and Corporation Accountinga. Maximum dividend payment b. Minimum dividend payment c. Actual dividend payment d. None of the above cash dividend? 6. Which of the following corporation accounts are not affected by the payment of a 1. Shareholder's Equity Il. Total Assets Ill. Long-Term Liabilities IV. Retained Earnings a. I, Ill, and IV b. 1, II, and Ill c. II, III, and IV d. I, II, III, and IV 7. Which of the following transactions does not decrease working capital? 1. Paying a cash dividend I1. Declaring a cash dividend Ill. Purchasing the corporation's own stock using the proceeds from newly issued long-term debt IV. Leasing long-term equipment, which is transacted as a capital lease a. I, Ill, and IV b. II, Ill, and IV c. I, II, and Ill d. I, II, Ill, and IV 8. A share split by a corporation affects which account on the statement of financial position? a. Retained Earnings b. Shareholder's Equity c. Share Premium d. Par Value 9. A corporation has 800,000 ordinary shares outstanding. Recently, the corporation bought 100,000 shares of its own stock. At the end of the year, the corporation has P320,000 available to distribute to ordinary shareholders. What are the dividends paid per share? a. P0.40 b. P0.46 c. P2.19 d. P2.50 Chapter 7: Retained Earnings | 7-296. What is the purpose of a share split? a. To adjust the market price of the corporation's shares to a level where more individuals can afford to invest in the stock. b. To spread shareholder base by increasing the number of outstanding shares. c. To decrease the number of shares outstanding thereby increasing proportionately the par value. d. both "a" and "b" 7. The Income Summary account of a proprietorship is closed to the owner's Capital account; for a corporation, Income Summary is closed to a. Retained Earnings. c. Share Premium. b. Ordinary Shares. d. Donated Capital. 8. The journal entry to record the declaration of a large share dividend includes a. a debit to Retained Earnings for the market value of the shares to be distributed. b. a credit to Shares Distributable for the fair value of the shares to be distributed. c. a credit to Share Premium for the difference between the fair market value and the par value of the shares to be distributed. d. a debit to Retained Earnings for the par value of the shares to be distributed. 9. Which of the following would result in an increase in the Retained Earnings account? a. positive prior period adjustments b. share dividends declared c. cash dividends declared d. loss for the period 10. Which of the following combination of dates accurately describes when journal entries are required to record dividends? Declaration Record . Payment Date Date Date Yes Yes Yes Yes No No No No Yes Yes No Yes 11. A restriction on retained earnings a. reduces retained earnings available for the declaration of dividends. b. can be reported by an entry appropriating retained earnings. Chapter 7: Retained Earnings | 7-31C. has no effect on total retained earnings. d. all of the above 12. The number of ordinary shares outstanding would be decreased by the Declaration of a Purchase of Share Dividend Treasury Stock No No No Yes Yes Yes Yes No 13. A share dividend a. decreases shareholders' equity. b. decreases assets. c. leaves total shareholders' equity unchanged. d. none of the above 14. Ramirez Corp. owned shares in Tayabas Corp. On Dec. 1, 2019, Ramirez declared and distributed a property dividend of Tayabas shares when their fair market value exceeded the cost. As a consequence of the dividend declaration and distribution, the accounting effects would be Retained Earnings Property Dividends at a. Decreased Fair market value Increased Fair market value Increased Cost Decreased Cost 15. How would retained earnings be affected by the declaration of each of the following? Share Dividend Share Split Decrease Decrease No effect Decrease No effect No effect Decrease No effect 16. When a small share dividend is declared, Retained Earnings is debited for a. zero; it is not affected by the declaration of a small share dividend. b. the liquidation value of the shares to be distributed. c. the fair market value of the shares to be distributed. d. the par value of the shares to be distributed. 7-32 | WIN Ballada's Partnership and Corporation Accounting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts