Question: Thank you, will rate :) Required information Problem 6-4A (Algo) Preparing a bank reconciliation and recording adjustments LO P3 [The following information applies to the

![to the questions displayed below.] Saved The following information is available to](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67185b0471eed_41167185b03cd8e5.jpg)

Thank you, will rate :)

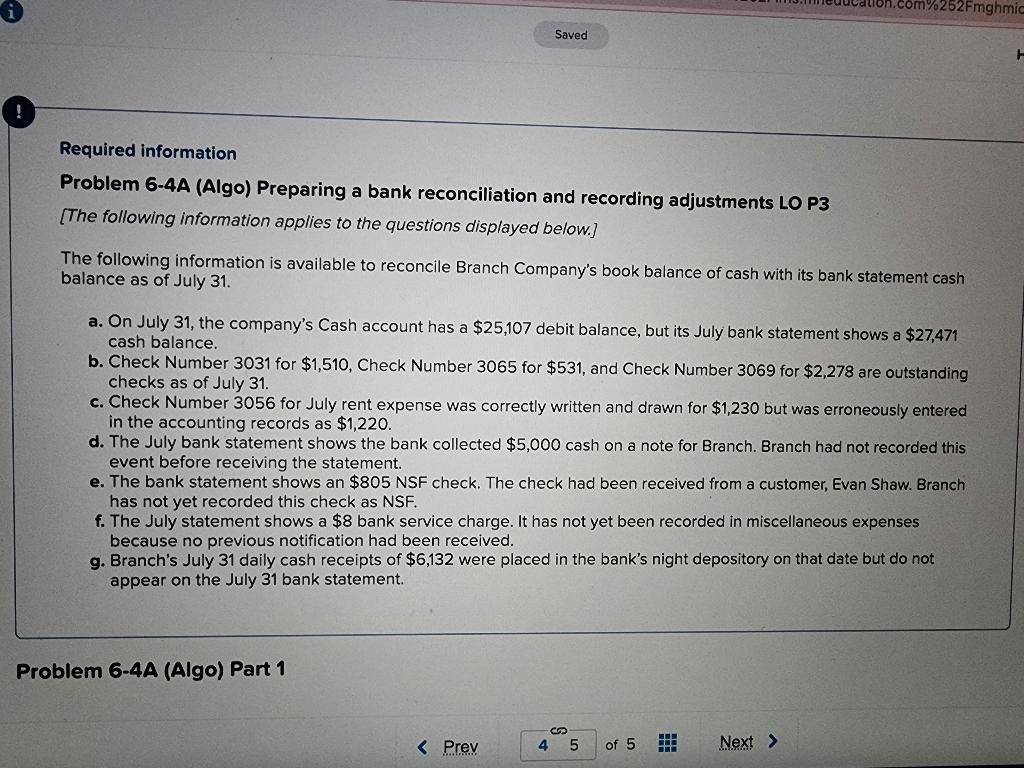

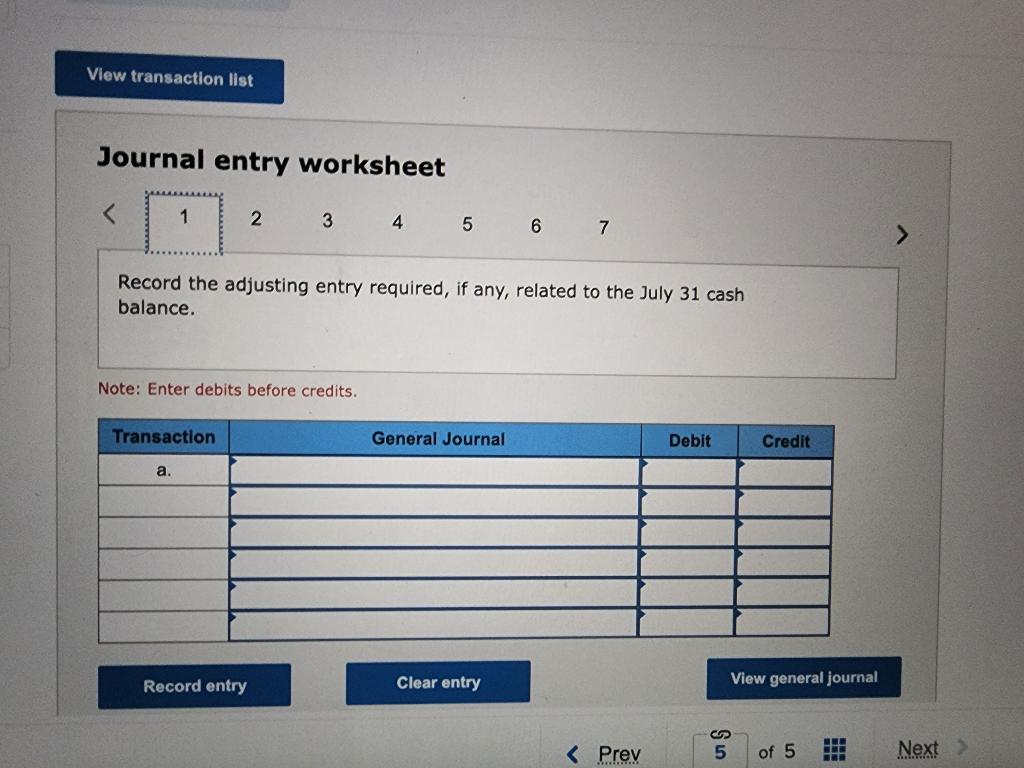

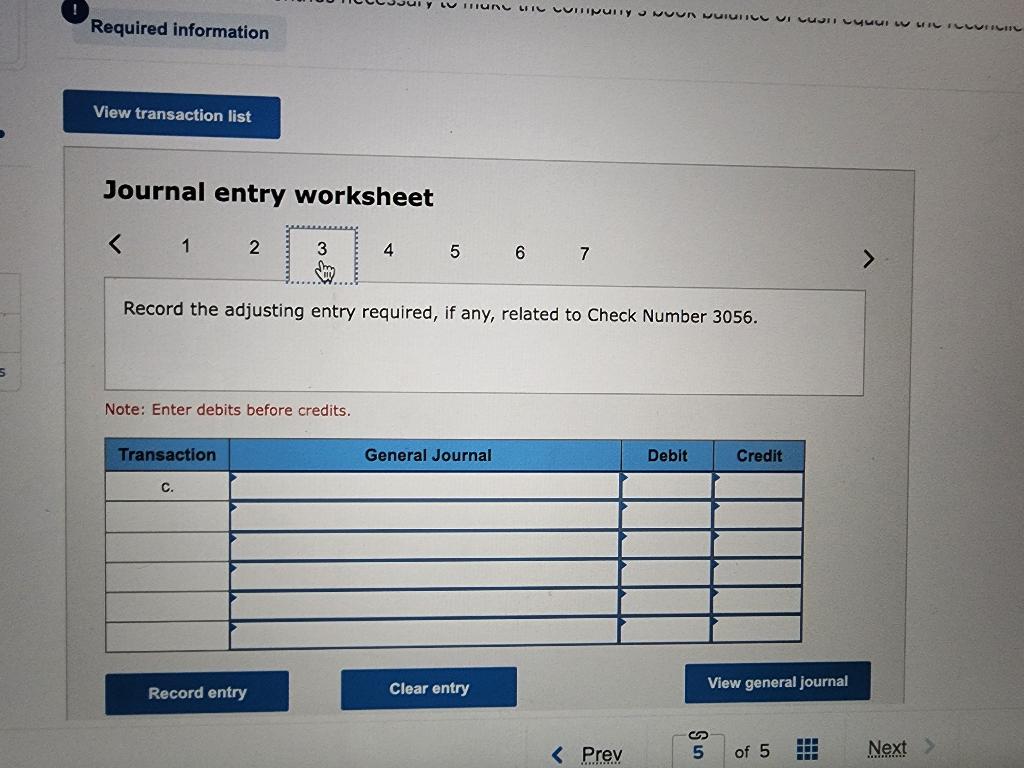

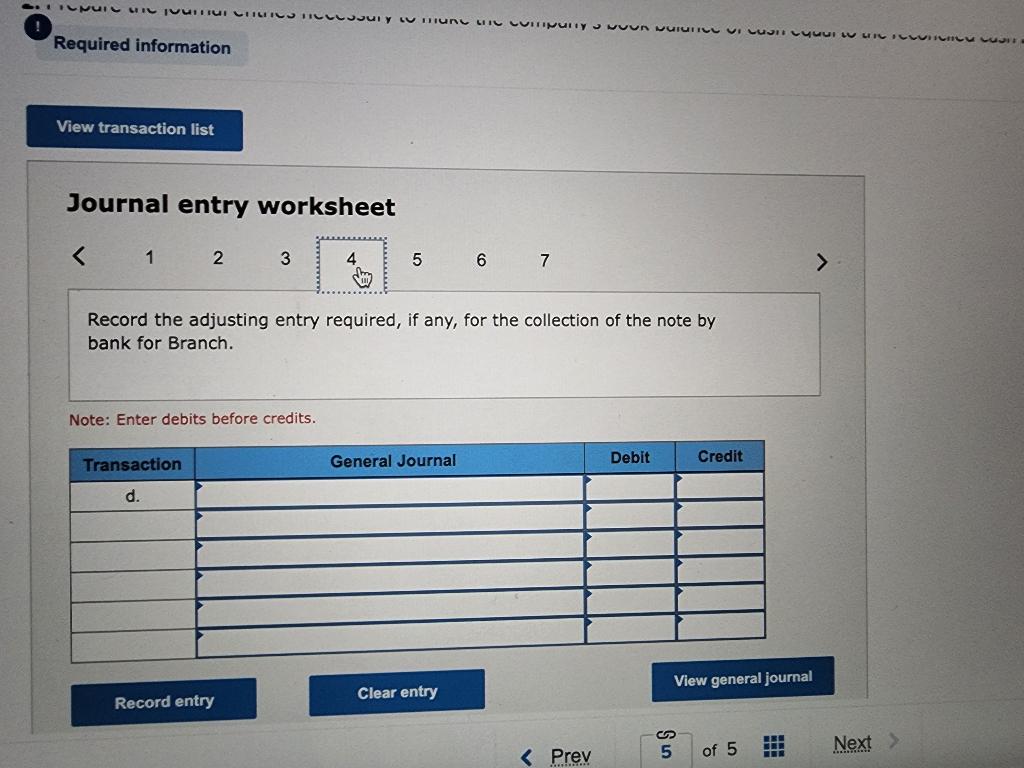

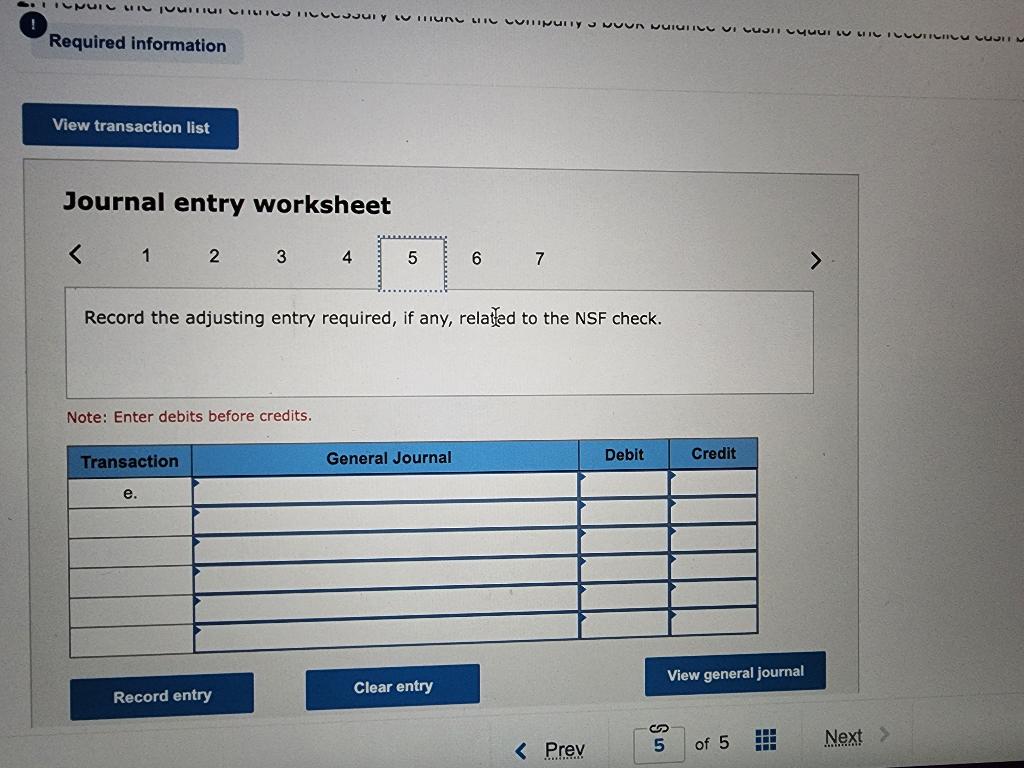

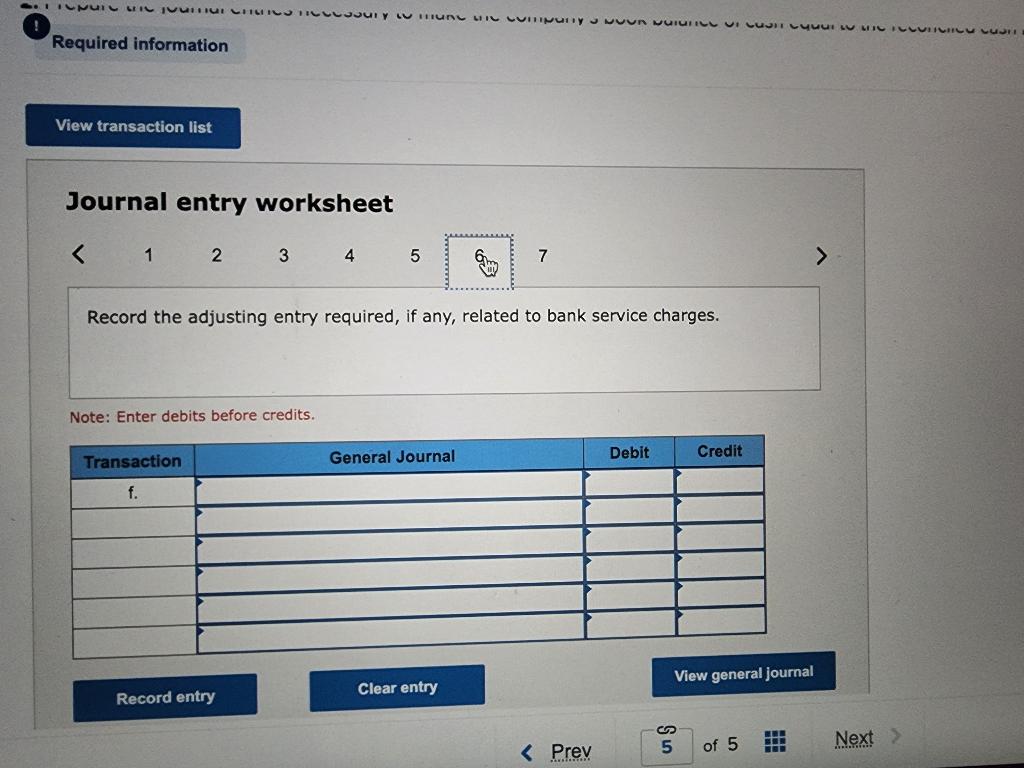

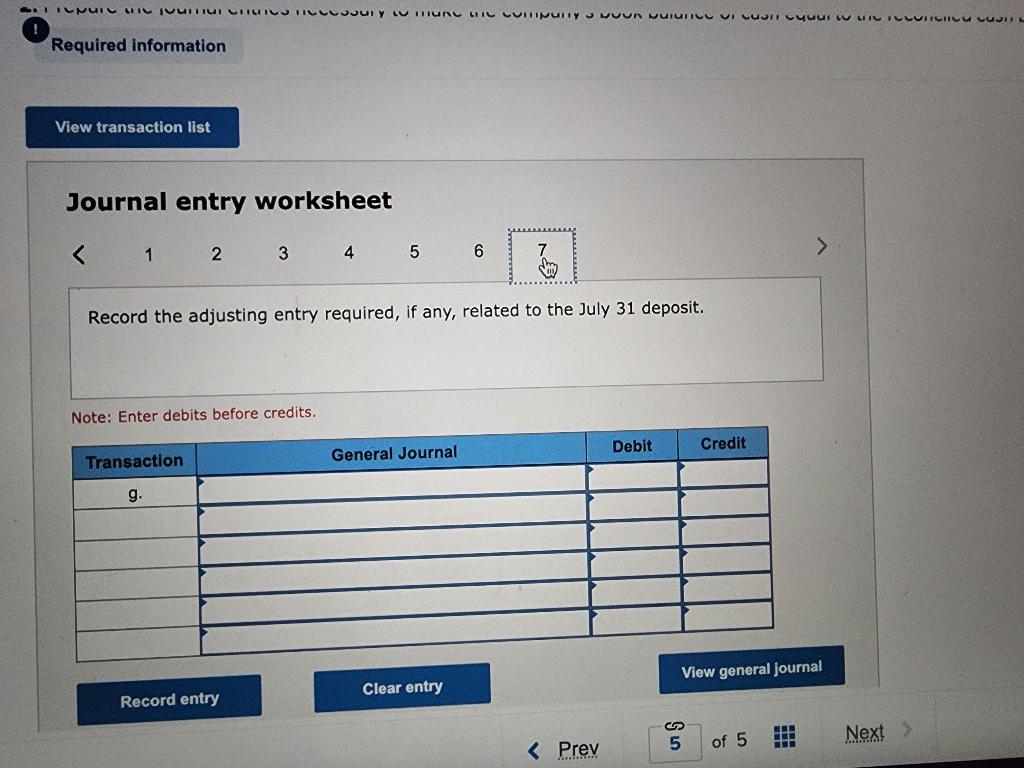

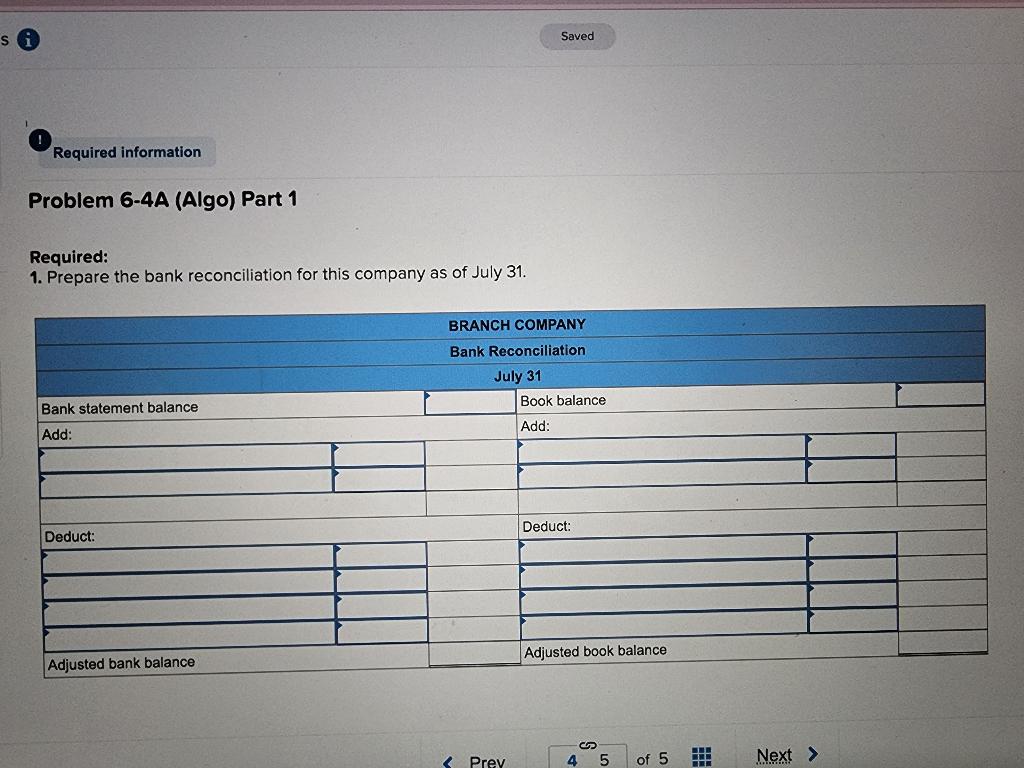

Required information Problem 6-4A (Algo) Preparing a bank reconciliation and recording adjustments LO P3 [The following information applies to the questions displayed below.] Saved The following information is available to reconcile Branch Company's book balance of cash with its bank statement cash balance as of July 31. a. On July 31, the company's Cash account has a $25,107 debit balance, but its July bank statement shows a $27,471 cash balance. Problem 6-4A (Algo) Part 1 b. Check Number 3031 for $1,510, Check Number 3065 for $531, and Check Number 3069 for $2,278 are outstanding checks as of July 31. c. Check Number 3056 for July rent expense was correctly written and drawn for $1,230 but was erroneously entered in the accounting records as $1,220. d. The July bank statement shows the bank collected $5,000 cash on a note for Branch. Branch had not recorded this even before receiving the statement. e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. f. The July statement shows a $8 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification had been received. g. Branch's July 31 daily cash receipts of $6,132 were placed in the bank's night depository on that date but do not appear on the July 31 bank statement. H View transaction list Journal entry worksheet 1 Transaction a. 2 Note: Enter debits before credits. 3 Record entry Record the adjusting entry required, if any, related to the July 31 cash balance. 4 5 General Journal 6 7 Clear entry Required information View transaction list Journal entry worksheet Next > Required information View transaction list Journal entry worksheet SIGNUP CHUT TILLSJUTY TNC CULTY OUR VISI Required information View transaction list Journal entry worksheet INICIO COSTURY Mun e punya UUTT Required information View transaction list Journal entry worksheet 1 2 Transaction e. 3 Note: Enter debits before credits. Record entry 4 5 Record the adjusting entry required, if any, related to the NSF check. General Journal 6 Clear entry 7 Next > STTUNUT Required information View transaction list Journal entry worksheet 1 2 Transaction f. 3 Note: Enter debits before credits. Record entry 4 LUTHUR I ompany VR MUIUTI VICOSITY CIVIC JI 5 Record the adjusting entry required, if any, related to bank service charges. General Journal $ Clear entry 7 SIGNUL IN CHRISTIELLUJUTY LUTHUNG TO CUTTINUITY Un Dulu TOURICTION CUL Required information View transaction list Journal entry worksheet si Required information Problem 6-4A (Algo) Part 1 Required: 1. Prepare the bank reconciliation for this company as of July 31. Bank statement balance. Add: Deduct: Adjusted bank balance Saved BRANCH COMPANY Bank Reconciliation July 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts