Question: Thankk you so much!!!! Problem # 1 Tha the completed mortgage amortization table for these questions. 1. (3 points) Upload a copy of your eompleted

Thankk you so much!!!!

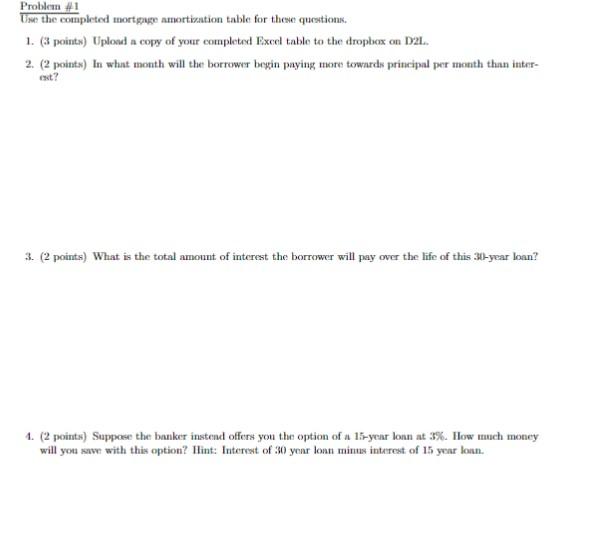

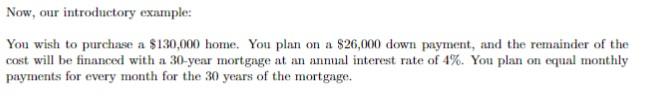

Problem \# 1 Tha the completed mortgage amortization table for these questions. 1. (3 points) Upload a copy of your eompleted Excel table to the dropbox on D2L. 2. (2 points) In what month will the borrower begin paying more towards principal per month than interast? 3. (2 points) What is the total amount of interest the borrower will pay over the life of this 30-year loan? 4. (2 points) Suppose the banker instend offers you the option of a 15-year lon at 3\%. How much money will you save with this option? Hint: Interest of 30 year loan minus inturest of 15 year loan. Now, our introductory example: You wish to purchase a $130,000 home. You plan on a $26,000 down payment, and the remainder of the cost will be financed with a 30 -year mortgage at an annual interest rate of 4%. You plan on equal monthly payments for every month for the 30 years of the mortgage. Problem \# 1 Tha the completed mortgage amortization table for these questions. 1. (3 points) Upload a copy of your eompleted Excel table to the dropbox on D2L. 2. (2 points) In what month will the borrower begin paying more towards principal per month than interast? 3. (2 points) What is the total amount of interest the borrower will pay over the life of this 30-year loan? 4. (2 points) Suppose the banker instend offers you the option of a 15-year lon at 3\%. How much money will you save with this option? Hint: Interest of 30 year loan minus inturest of 15 year loan. Now, our introductory example: You wish to purchase a $130,000 home. You plan on a $26,000 down payment, and the remainder of the cost will be financed with a 30 -year mortgage at an annual interest rate of 4%. You plan on equal monthly payments for every month for the 30 years of the mortgage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts