Question: thanks ACCT3000 Written Assignment 1 - chapter 11 EXERCISE 2 (Revaluation Accounting) PETER Group uses revaluation accounting for a class of equipment it uses in

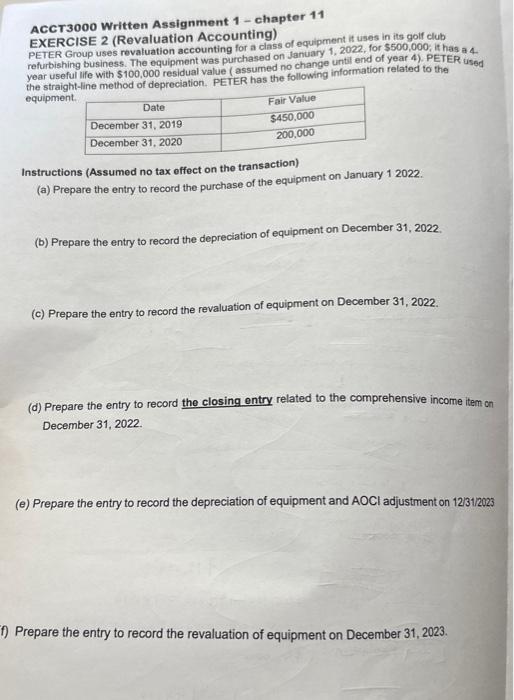

ACCT3000 Written Assignment 1 - chapter 11 EXERCISE 2 (Revaluation Accounting) PETER Group uses revaluation accounting for a class of equipment it uses in its golf club refurbishing business. The equipment was purchased on January 1,2022 , for $500,000; it has a 4. year useful ufe with $100,000 residual value (assumed no change until end of year 4). PETER used the straight-ine methror af denreciation. PEIER has the following information related to the equipment. Instructions (Assumed no tax effect on the transaction) (a) Prepare the entry to record the purchase of the equipment on January 12022. (b) Prepare the entry to record the depreciation of equipment on December 31, 2022. (c) Prepare the entry to record the revaluation of equipment on December 31, 2022. (d) Prepare the entry to record the closing entry related to the comprehensive income item on December 31, 2022. (e) Prepare the entry to record the depreciation of equipment and AOCl adjustment on 12/31/2023 Prepare the entry to record the revaluation of equipment on December 31,2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts