Question: Thanks for explaining question and provide answer to above question explaining how to use work Sheet. Thank you. TAX FORM/RETURN PREPARATION PROBLEMS 12-55On Oct 12-55

Thanks for explaining question and provide answer to above question explaining how to use work Sheet. Thank you.

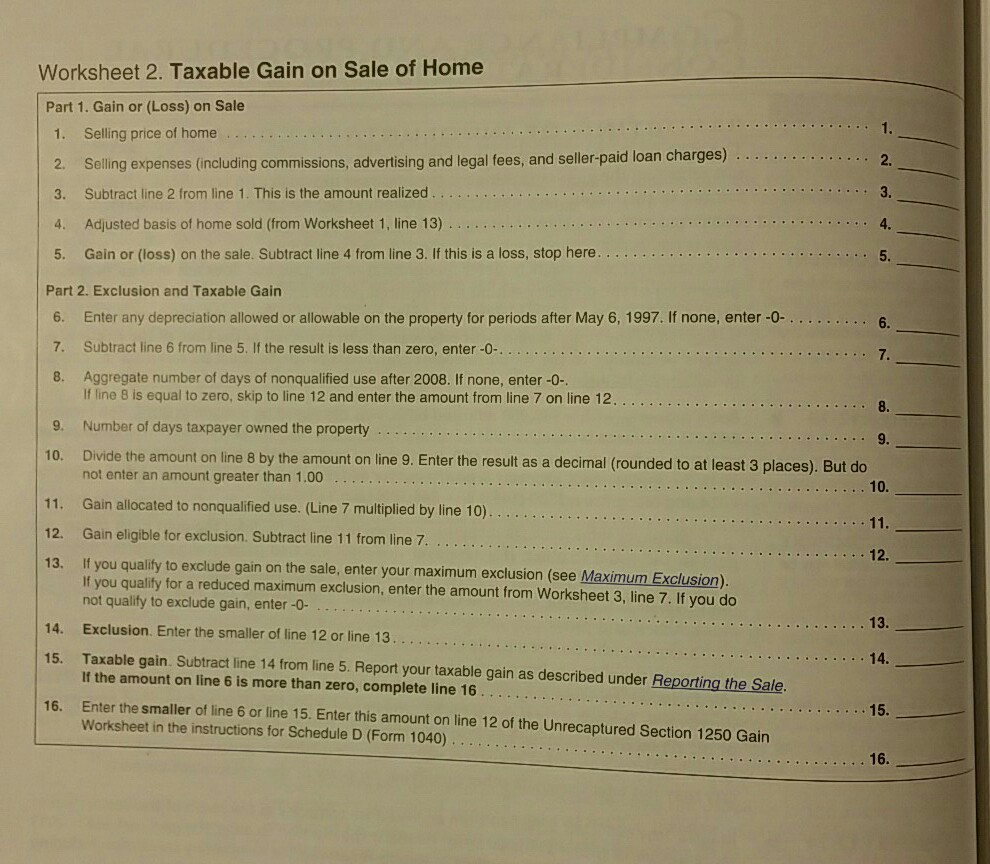

TAX FORM/RETURN PREPARATION PROBLEMS 12-55On Oct 12-55 On October 29, 2014, Miss Joan Seely (SSN 123-45-6789) sells her principal residence for $150,000 cash. She purchased the residence on May 12, 2005, for $85,000. She spen $12,000 for capital improvements in 2005. To help sell the house, she pays $300 for mino repairs. The realtor's commission amounts to $7,500. Her old residence is never rented ou or used for business. Complete the worksheet on page 12-24 for Miss Seely for 2014 or used for business. Complete the worksheet on page 12-24 for Miss Seely for 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts