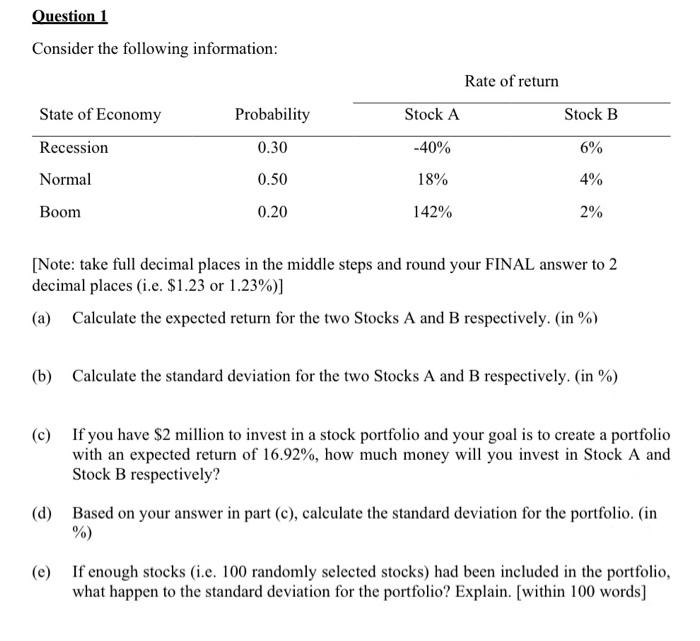

Question: thanks for your help Question 1 Consider the following information: Rate of return Probability Stock A Stock B State of Economy Recession Normal 0.30 -40%

Question 1 Consider the following information: Rate of return Probability Stock A Stock B State of Economy Recession Normal 0.30 -40% 6% 0.50 18% 4% Boom 0.20 142% 2% [Note: take full decimal places in the middle steps and round your FINAL answer to 2 decimal places (i.e. $1.23 or 1.23%)] (a) Calculate the expected return for the two Stocks A and B respectively. (in %) (b) Calculate the standard deviation for the two Stocks A and B respectively. (in %) (c) If you have $2 million to invest in a stock portfolio and your goal is to create a portfolio with an expected return of 16.92%, how much money will you invest in Stock A and Stock B respectively? (d) Based on your answer in part (c), calculate the standard deviation for the portfolio. (in %) (e) If enough stocks (i.e. 100 randomly selected stocks) had been included in the portfolio, what happen to the standard deviation for the portfolio? Explain. (within 100 words)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts