Question: Thanks for your help :) the question is the required part 1) prepare the current tax worksheet and 2) prepare the dferered tax worksheet CURRENT

Thanks for your help :)

Thanks for your help :) the question is the required part 1) prepare the current tax worksheet and 2) prepare the dferered tax worksheet

the question is the required part 1) prepare the current tax worksheet and 2) prepare the dferered tax worksheet

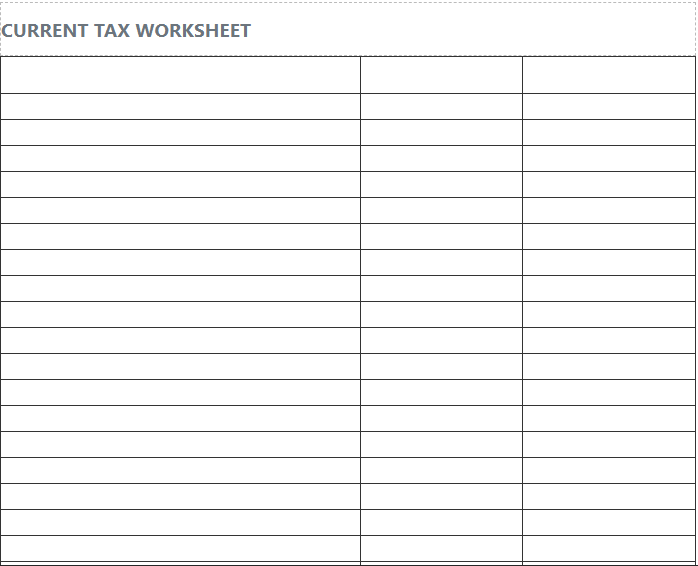

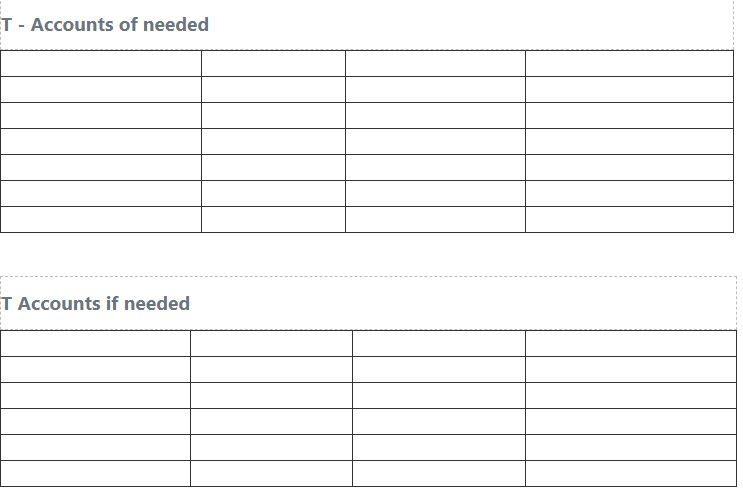

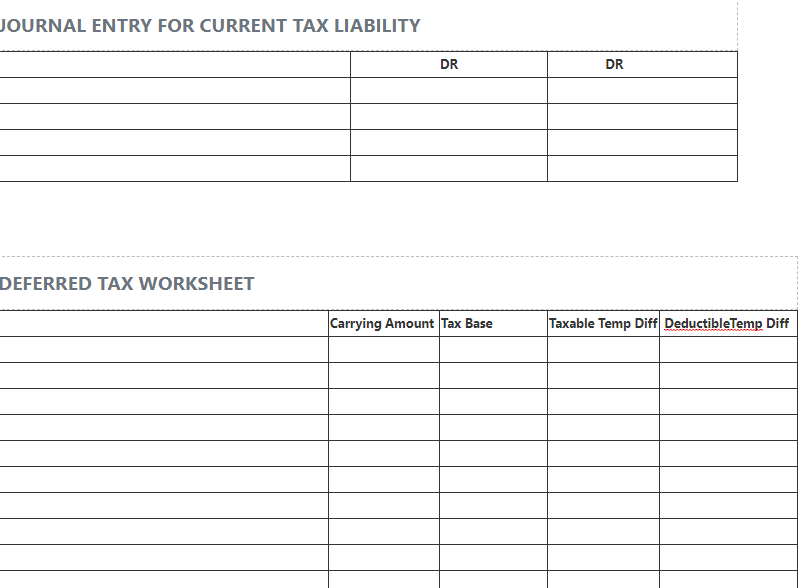

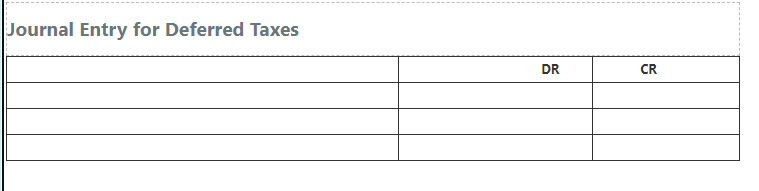

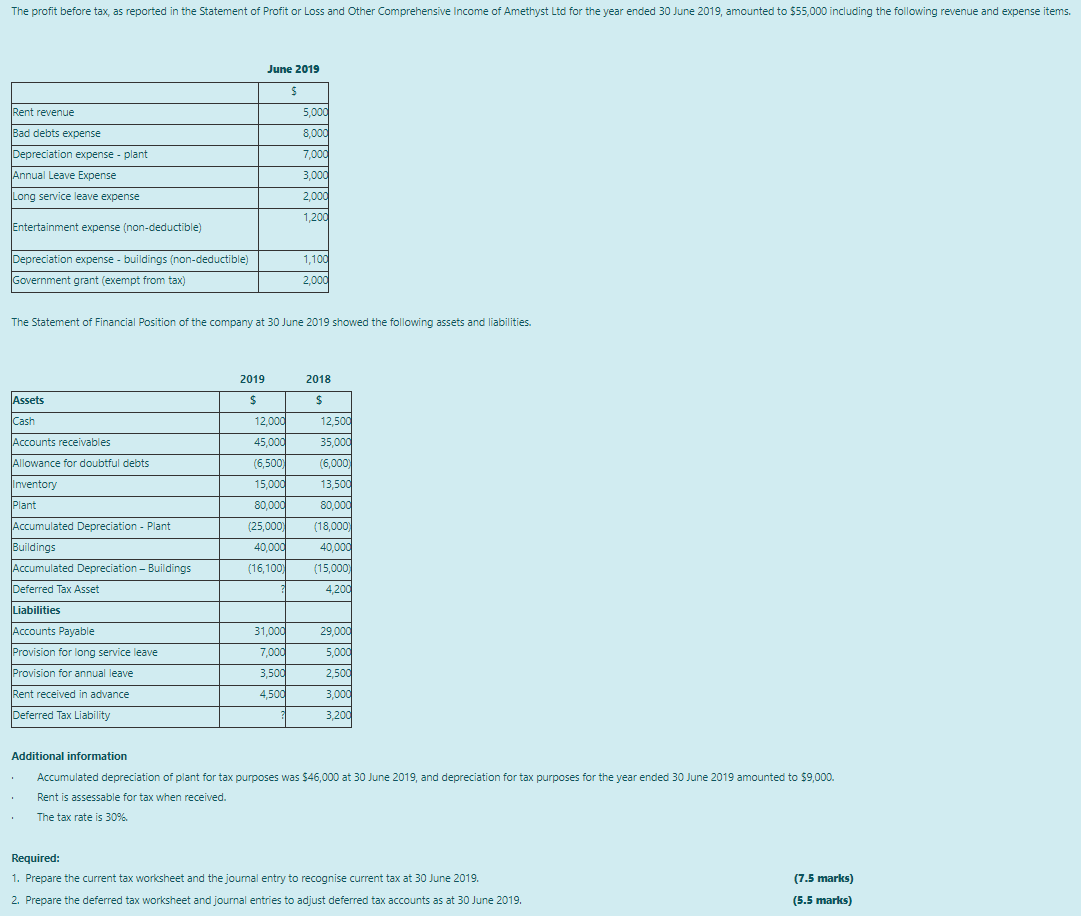

CURRENT TAX WORKSHEET T - Accounts of needed T Accounts if needed JOURNAL ENTRY FOR CURRENT TAX LIABILITY DR DR DEFERRED TAX WORKSHEET Carrying Amount Tax Base Taxable Temp Diff DeductibleTemp Diff Journal Entry for Deferred Taxes DR CR The profit before tax, as reported in the Statement of Profit or Loss and Other Comprehensive Income of Amethyst Ltd for the year ended 30 June 2019, amounted to $55,000 including the following revenue and expense items. June 2019 $ Rent revenue 5,000 Bad debts expense 8,000 Depreciation expense - plant 7,000 3,000 Annual Leave Expense Long service leave expense 2,000 1,200 Entertainment expense (non-deductible) 1.100 Depreciation expense - buildings (non-deductible) Government grant (exempt from tax) 2,000 The Statement of Financial Position of the company at 30 June 2019 showed the following assets and liabilities. 2019 2018 Assets $ Cash 12.500 $ 12,000 45,000 (6,500 Accounts receivables 35,000 Allowance for doubtful debts (6,000 Inventory 13,500 15,000 80,000 Plant 80,000 (25,000 40,000 (18,000 40,000 Accumulated Depreciation - Plant Buildings Accumulated Depreciation - Buildings Deferred Tax Asset (16,100) (15,000 4200 Liabilities 31,000 29,000 Accounts Payable Provision for long service leave Provision for annual leave 5,000 7,000 3.500 2.500 4,500 Rent received in advance Deferred Tax Liability 3,000 3,200 Additional information Accumulated depreciation of plant for tax purposes was $46,000 at 30 June 2019, and depreciation for tax purposes for the year ended 30 June 2019 amounted to $9,000. Rent is assessable for tax when received. The tax rate is 30% . Required: 1. Prepare the current tax worksheet and the journal entry to recognise current tax at 30 June 2019. 2. Prepare the deferred tax worksheet and journal entries to adjust deferred tax accounts as at 30 June 2019. (7.5 marks) (5.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts