Question: Thanks ** SHOW YOUR WORK ** Question 1 Corinth Biotech Limited (CBL) started operations in January 2018. CBL reports under IFRS. The following activities occurred

Thanks

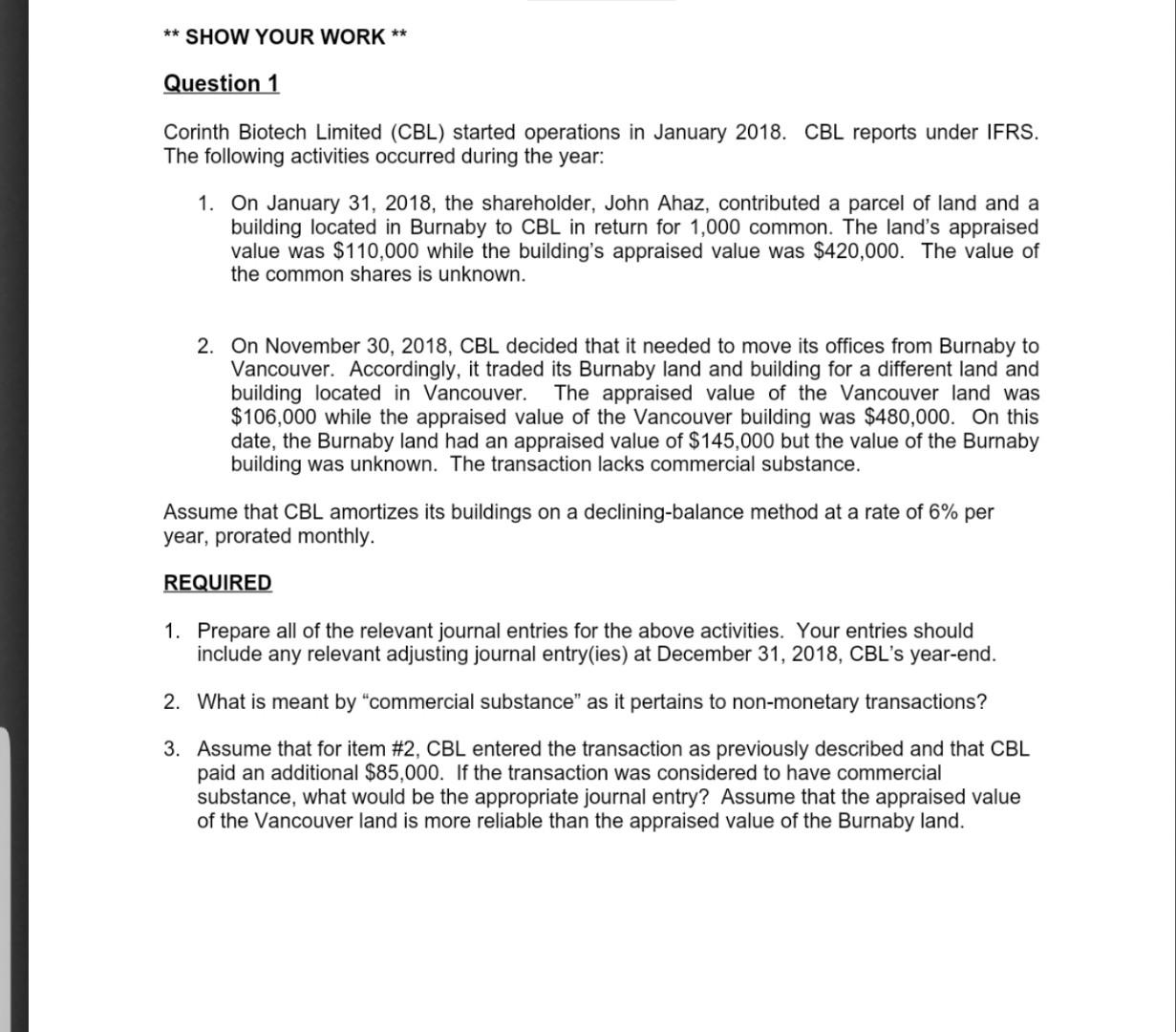

** SHOW YOUR WORK ** Question 1 Corinth Biotech Limited (CBL) started operations in January 2018. CBL reports under IFRS. The following activities occurred during the year: 1. On January 31, 2018, the shareholder, John Ahaz, contributed a parcel of land and a building located in Burnaby to CBL in return for 1,000 common. The land's appraised value was $110,000 while the building's appraised value was $420,000. The value of the common shares is unknown. 2. On November 30, 2018, CBL decided that it needed to move its offices from Burnaby to Vancouver. Accordingly, it traded its Burnaby land and building for a different land and building located in Vancouver. The appraised value of the Vancouver land was $106,000 while the appraised value of the Vancouver building was $480,000. On this date, the Burnaby land had an ap sed value of $145,000 but the value of the Bu aby building was unknown. The transaction lacks commercial substance. Assume that CBL amortizes its buildings on a declining-balance method at a rate of 6% per year, prorated monthly. REQUIRED 1. Prepare all of the relevant journal entries for the above activities. Your entries should include any relevant adjusting journal entry(ies) at December 31, 2018, CBL's year-end. 2. What is meant by "commercial substance" as it pertains to non-monetary transactions? 3. Assume that for item #2, CBL entered the transaction as previously described and that CBL paid an additional $85,000. If the transaction was considered to have commercial substance, what would be the appropriate journal entry? Assume that the appraised value of the Vancouver land is more reliable than the appraised value of the Burnaby land

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts