Question: thanks! The Golf Club is considering adding a driving range to its facility. The range would cost $45,000, would be depreciated on a straight-line basis

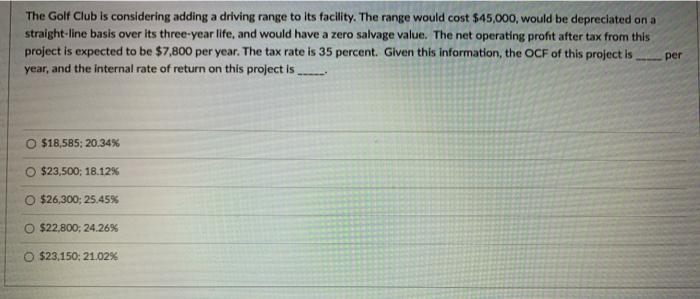

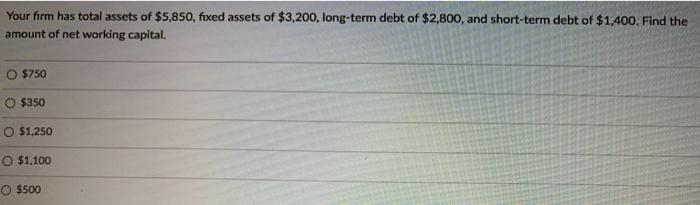

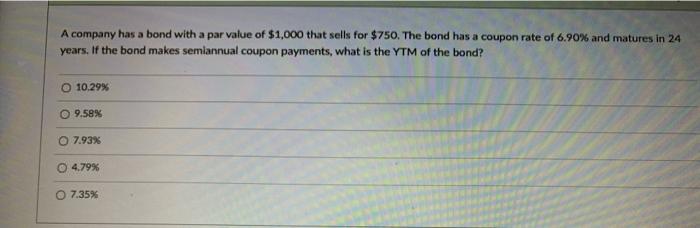

The Golf Club is considering adding a driving range to its facility. The range would cost $45,000, would be depreciated on a straight-line basis over its three-year life, and would have a zero salvage value. The net operating profit after tax from this project is expected to be $7,800 per year. The tax rate is 35 percent. Given this information, the OCF of this project is year, and the internal rate of return on this project is per $18,585: 20.34% O $23.500; 18.12% $26,300; 25.45% O $22,800; 24.26% $23,150: 21.02% Your firm has total assets of $5,850, fixed assets of $3,200, long-term debt of $2,800, and short-term debt of $1,400. Find the amount of net working capital. O $750 O $350 O $1,250 O $1,100 O $500 A company has a bond with a par value of $1,000 that sells for $750. The bond has a coupon rate of 6.90% and matures in 24 years. If the bond makes semiannual coupon payments, what is the YTM of the bond? O 10.29% 9.58% O 7.93% 4.79% 7.35%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts