Question: Thankyouuuu please show complete solution, DO NOT WRITE, answer must be ENCODED using keyboard thankyouuuu Suppose you invested $1000 per 2 points quarter over a

Thankyouuuu please show complete solution, DO NOT WRITE, answer must be ENCODED using keyboard thankyouuuu

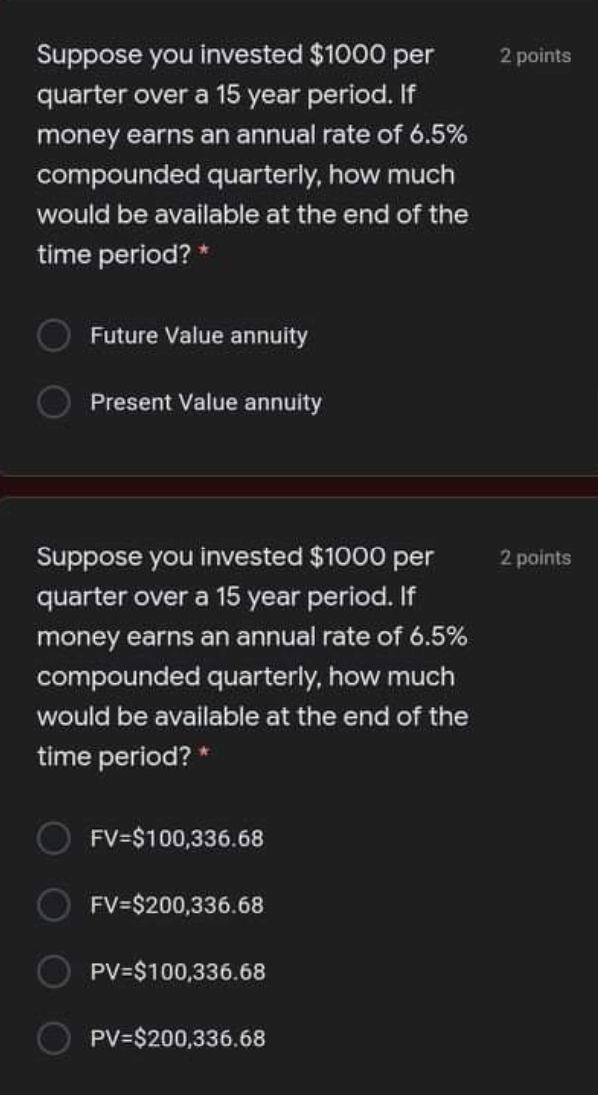

Suppose you invested $1000 per 2 points quarter over a 15 year period. If money earns an annual rate of 6.5% compounded quarterly, how much would be available at the end of the time period? O Future Value annuity Present Value annuity Suppose you invested $1000 per 2 points quarter over a 15 year period. If money earns an annual rate of 6.5% compounded quarterly, how much would be available at the end of the time period? O FV=$100,336.68 FV=$200,336.68 O PV=$100,336.68 O PV=$200,336.68

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts