Question: Thapelo is faced by a liability that he should settle in three (3) years' time. The yield curve is currently flat at 12% but it

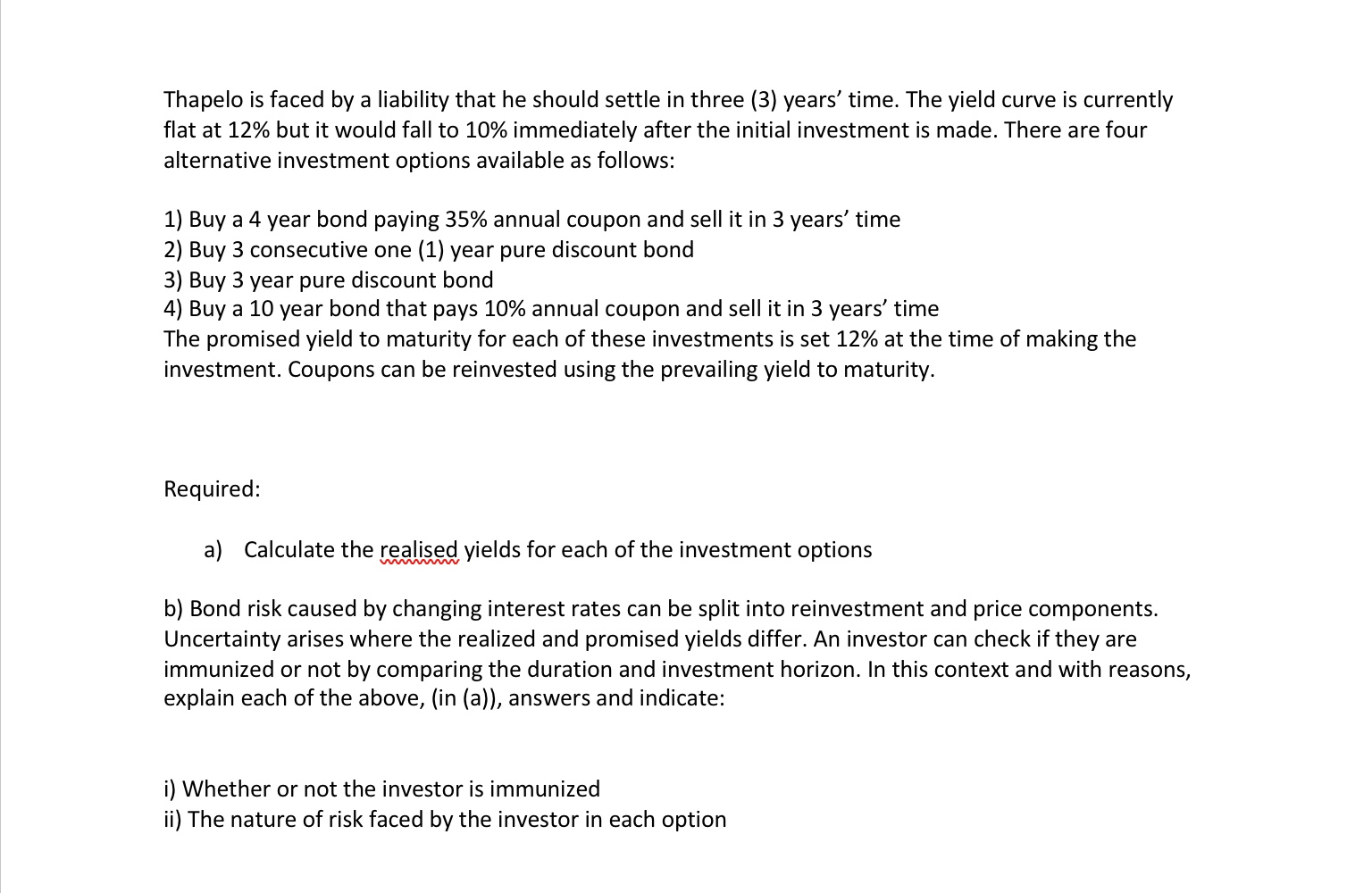

Thapelo is faced by a liability that he should settle in three (3) years' time. The yield curve is currently flat at 12% but it would fall to 10% immediately after the initial investment is made. There are four alternative investment options available as follows: 1) Buy a 4 year bond paying 35% annual coupon and sell it in 3 years' time 2) Buy 3 consecutive one (1) year pure discount bond 3) Buy 3 year pure discount bond 4) Buy a 10 year bond that pays 10% annual coupon and sell it in 3 years' time The promised yield to maturity for each of these investments is set 12% at the time of making the investment. Coupons can be reinvested using the prevailing yield to maturity. Required: a) Calculate the realised yields for each of the investment options b) Bond risk caused by changing interest rates can be split into reinvestment and price components. Uncertainty arises where the realized and promised yields differ. An investor can check if they are immunized or not by comparing the duration and investment horizon. In this context and with reasons, explain each of the above, (in (a)), answers and indicate: i) Whether or not the investor is immunized ii) The nature of risk faced by the investor in each option Thapelo is faced by a liability that he should settle in three (3) years' time. The yield curve is currently flat at 12% but it would fall to 10% immediately after the initial investment is made. There are four alternative investment options available as follows: 1) Buy a 4 year bond paying 35% annual coupon and sell it in 3 years' time 2) Buy 3 consecutive one (1) year pure discount bond 3) Buy 3 year pure discount bond 4) Buy a 10 year bond that pays 10% annual coupon and sell it in 3 years' time The promised yield to maturity for each of these investments is set 12% at the time of making the investment. Coupons can be reinvested using the prevailing yield to maturity. Required: a) Calculate the realised yields for each of the investment options b) Bond risk caused by changing interest rates can be split into reinvestment and price components. Uncertainty arises where the realized and promised yields differ. An investor can check if they are immunized or not by comparing the duration and investment horizon. In this context and with reasons, explain each of the above, (in (a)), answers and indicate: i) Whether or not the investor is immunized ii) The nature of risk faced by the investor in each option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts