Question: Thapter Seven Help Save & Exit Submit Check my work Required information (The following information applies to the questions displayed below! On January 1, 2019,

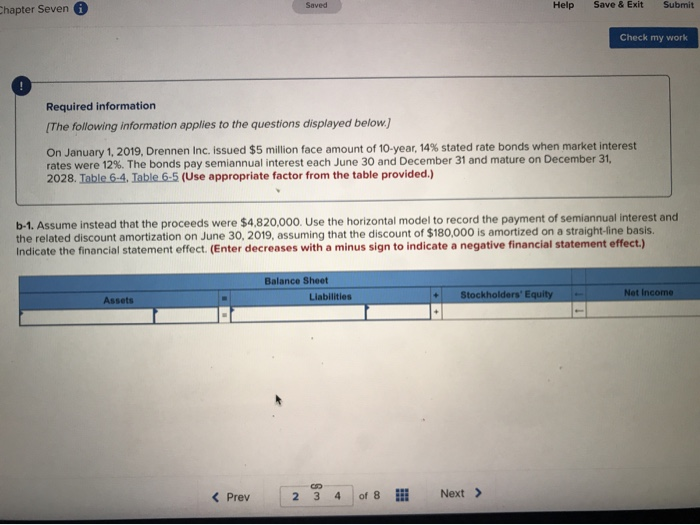

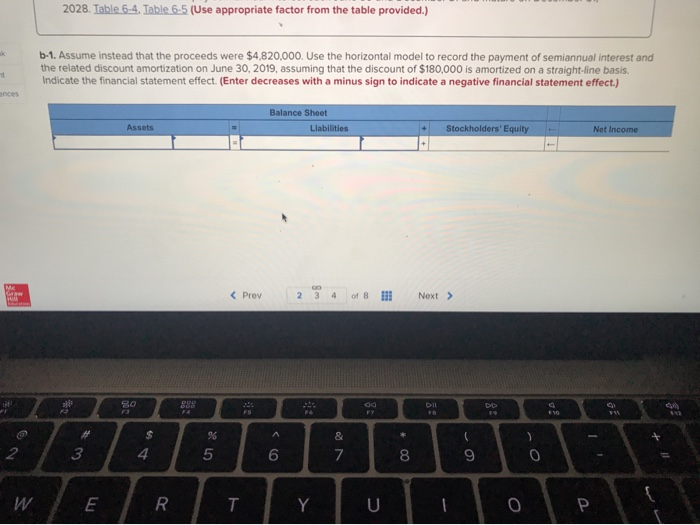

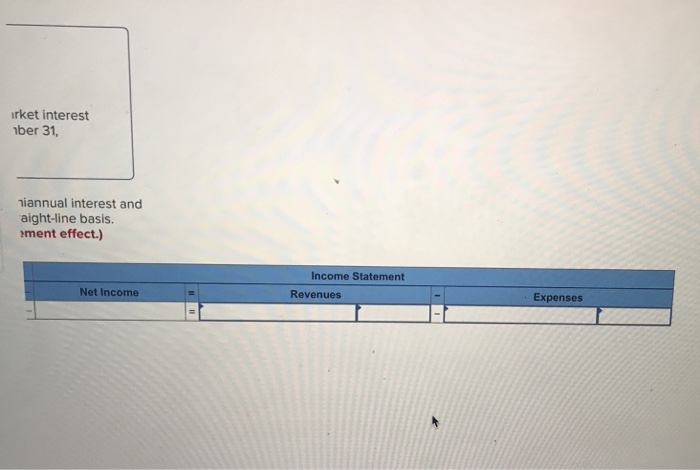

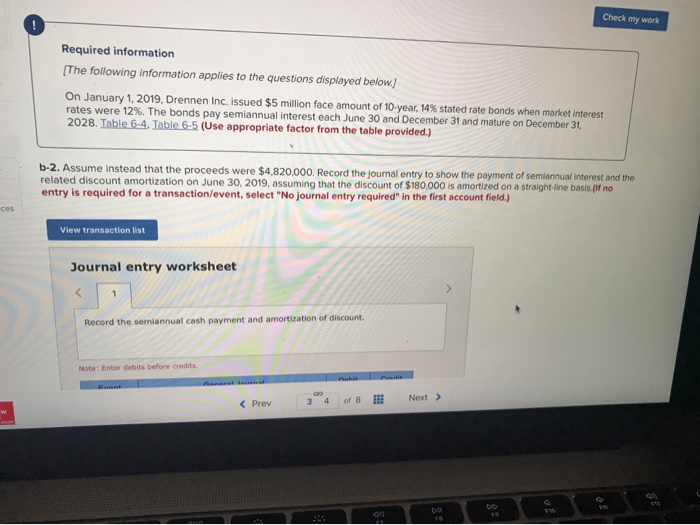

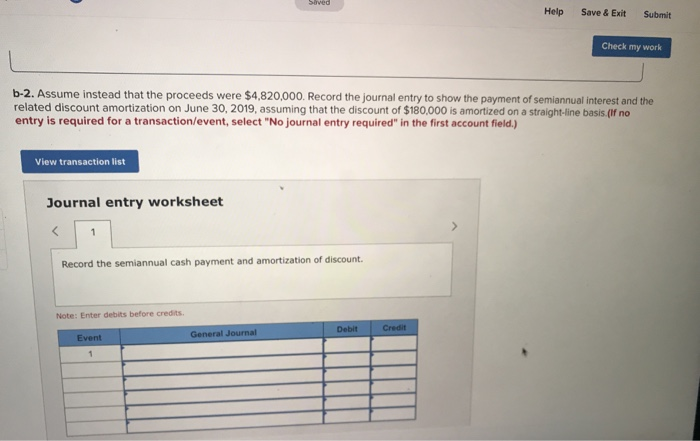

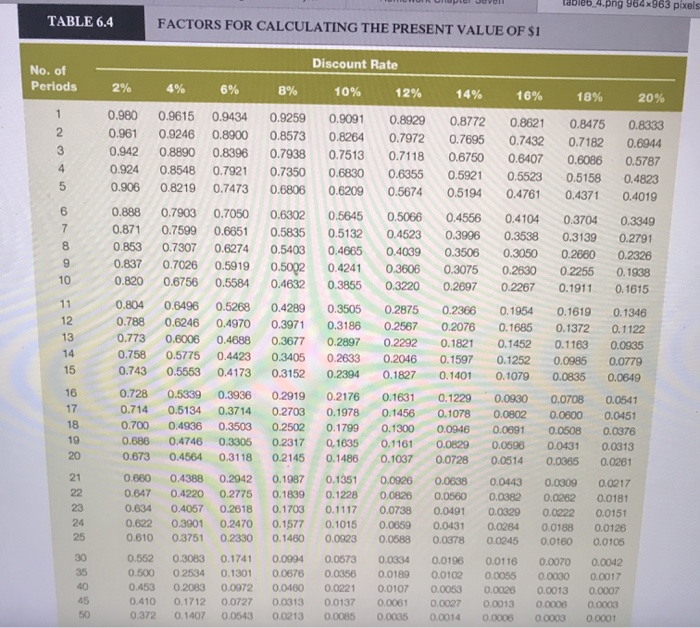

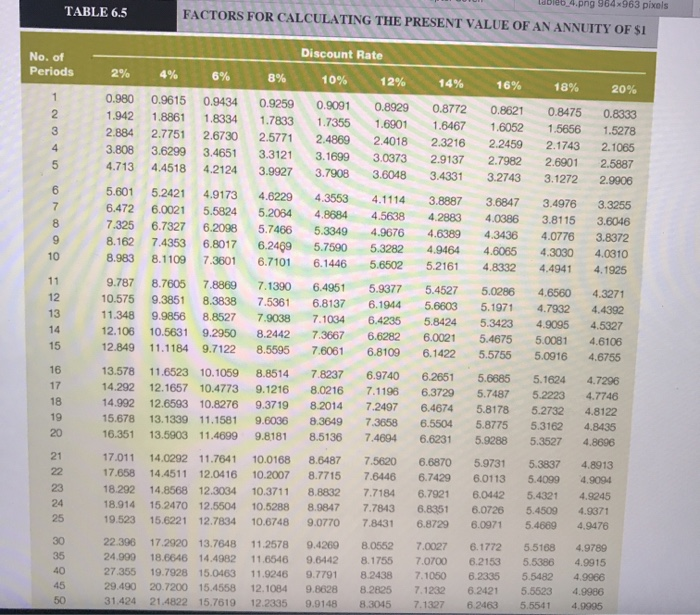

Thapter Seven Help Save & Exit Submit Check my work Required information (The following information applies to the questions displayed below! On January 1, 2019, Drennen Inc. issued $5 million face amount of 10-year, 14% stated rate bonds when market interest rates were 12%. The bonds pay semiannual interest each June 30 and December 31 and mature on December 31, 2028. Table 6-4, Table 6.5 (Use appropriate factor from the table provided.) b-1. Assume instead that the proceeds were $4,820.000. Use the horizontal model to record the payment of semiannual interest and the related discount amortization on June 30, 2019, assuming that the discount of $180,000 is amortized on a straight-line basis. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect.) Balance Sheet Assets Stockholders' Equity Net Income 2028. Table 6-4. Table 6-5 (Use appropriate factor from the table provided.) b-1. Assume instead that the proceeds were $4,820,000. Use the horizontal model to record the payment of semiannual interest and the related discount amortization on June 30, 2019, assuming that the discount of $180,000 is amortized on a straight-line basis. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect) Balance Sheet Assets Liabilities Stockholders' Equity Net Income WER Trulilole irket interest ber 31 niannual interest and aight-line basis ment effect.) Income Statement Net Income Revenues Expenses Check my work Required information (The following information applies to the questions displayed below.) On January 1, 2019. Drennen Inc. issued $5 million face amount of 10-year, 14% stated rate bonds when market interest rates were 12%. The bonds pay semiannual interest each June 30 and December 31 and mature on December 31, 2028. Table 6-4. Table 6.5 (Use appropriate factor from the table provided.) b-2. Assume instead that the proceeds were $4,820,000. Record the journal entry to show the payment of semiannual interest and the related discount amortization on June 30, 2019, assuming that the discount of $180,000 is amortized on a straight-line basis.(if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the semiannual cash payment and amortization of discount Note: Enter debits before credits 3 Prev 4 of 8 !!! Next > Sirved Help Save & Exit Submit Check my work b-2. Assume instead that the proceeds were $4,820,000. Record the journal entry to show the payment of semiannual interest and the related discount amortization on June 30, 2019, assuming that the discount of $180,000 is amortized on a straight-line basis.(If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Record the semiannual cash payment and amortization of discount. Note: Enter debits before credits Debit General Journal Event Credit TABLE 6.4 FACTORS FOR CALCULATING THE PRESENT VALUE OF SI Discount Rate No. of Periods 2% 4% 6% 8% 10% 12% 14% 16% 10% 20% 0.980 0.9615 0.9434 0.961 0.9246 0.89000 0.942 0.8890 0.8396 0.924 0.8548 0.7921 0.906 0.8219 0.7473 0.888 0.7903 0.7050 0.871 0.7599 0.6651 0.853 0.7307 0.6274 0.837 0.7026 0.5919 0.820 0.6756 0.5584 0.804 0.6496 0.5268 0.788 0.6246 0.4970 0.773 0.6006 0.4688 0.758 0.5775 0.4423 0.743 0.5553 0.4173 0.728 0.5339 0.3936 0.714 0.5134 0.3714 0.700 0.4936 0.3503 0.686 0.4746 0.3306 0.673 0.4564 0.3118 0.660 0.4388 0.2942 0.647 0.42200.2775 0.634 0.4057 0.2618 0.622 0.3001 0.2470 0.610 0.3751 0.2330 0.552 0.3083 0.1741 0.500 0.2534 0.1301 0.453 0.2083 0.0972 0.410 0.1712 0.0727 0.372 0.1007 0.0543 0.9259 .8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 0.5002 0.4632 0.4289 0.3971 0.3677 0.3405 0.3152 0.2919 0.2703 0.2502 0.2317 0.2145 0.1987 0.1839 0.1703 0.1577 0.1460 0.0094 0.0678 0.0460 0.0313 0.0213 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 0.3505 0.3186 0.2897 0.2633 0.2394 0.2176 0.1978 0.1799 01635 0.1635 0.1486 0.1351 0.1228 0.1117 0.1015 0.0923 0.0573 0.0356 0.0221 0.0137 0.0085 0.8929 0.8772 0.8621 0.8475 0.8333 0.7972 0.7695 0.7432 0.7182 0.6944 0.7118 0.6750 0.6407 0.6086 0.5787 0.6355 0.5921 0.5523 0.5158 0.4823 0.5674 0.5194 0.4761 0.4371 0.4019 0.5066 0.4556 0.4104 0.3704 0.3349 0.4523 0.3996 0.3538 0.3139 0.2791 0.40390.3506 0.3050 0.2680 0.2326 0.3606 0.3075 0.2630 0.2255 0.1938 0.3220 0.2097 0.2267 0.1911 0.1615 0.2875 0.2366 0.1954 0.1619 0.1346 0.2567 0.2076 0.1685 0.1372 0.2292 0.18210.1452 0.1163 0.0935 0.2046 0.1597 0.1252 0.0985 0.0779 0.1827 0.1401 0.1079 0.0835 0.0649 0.1631 0.1229 0.0930 0.0708 0.0541 0.1456 0.1078 0.0802 0.0600 0.0451 0.1300 0.0946 0.0891 0.0508 0.0376 0.1161 0.0829 0.0598 0.0431 0.0313 0.1037 0.0728 0.0514 0.0365 0.0261 0.0926 0.0638 0.0443 0.0309 0.0217 0.0826 0.0560 0.0382 0.0262 0.0181 0.0738 0.0491 0.0329 0.0222 0.0151 0.0659 0.0431 0.0284 0.0188 0.0126 0.0588 0.0578 0.0245 0.0160 0.0106 0.0334 0.0196 0.0118 0.0070 0.0042 0.0189 0.0102 0.0055 0.0030 0.0017 0.0107 0.0063 0.0026 0.0013 0.0007 0.0061 0.0027 0.0013 0.0008 .0003 0.0035 0.0014 0.0006 0.0003 0.0001 TABLE 6.5 FACTORS FOR CALCULATING THE PRESENT VALUE OF AN ANNUITY OF SI No. of Periods Discount Rate 2% 4% 6% 8% 10% 12% 14% 0.980 0.9615 0.9434 0.9259 0.9091 0.8929 0.8772 1.942 1.8861 1.8334 1.7833 1.7355 1.6901 1.6467 884 2.7751 2.67302.5771 2.4869 2.4018 2.3216 3.6299 3.4651 3.3121 3.1699 3.0373 2.9137 4.4518 4.2124 3.9927 3.7908 3.6048 3.4331 5.601 5.2421 4.9173 4.62294.3553 4.1114 3.8887 472 6.0021 5.5824 5.2054 4.8684 4.5638 4.2883 6.7327 6.2098 5.7466 5.3349 4.9676 4.6389 8.162 7.4353 6.8017 6.2469 5.7590 5.3282 4.9464 8.9838.1109 .3601 6.71016.1446 5.6502 5.2161 9.787 8.7805 7.8869 7.1390 6.4961 5.9377 5.4527 10.575 9.3851 8.3838 7.5361 6.8137 6.1944 5.6603 11.348 9.9856 8.8527 7.9038 7.1034 6.4235 5.8424 12.106 10.5631 9.2950 8.2442 7.3667 6.6282 6.0021 12.849 11.1184 9.71228.5595 7.6061 6.81096.1422 13.578 11.6523 10.1059 8.8514 7.8237 6.9740 6.2651 14.292 12.1657 10.4773 9.1216 8.0216 7.1198 6.3729 14.992 12.6593 10.8276 9.37198.2014 7.2497 6.4674 15.678 13.1339 11.1581 9,6036 83649 73658 6.5504 16.351 13.5903 11.4699 9.8181 8.5136 7.4694 6.6231 17.011 14.0292 11.7641 10.0168 8.64877.5620 6.6870 17.658 14.4511 12.0416 10.2007 8.7715 7.6446 6.7429 18.292 14.8568 12.3034 10.3711 8.8832 7.71846.7921 18.914 15.2470 12.5504 10.5288 8.9847 7.7843 6.8351 19.523 15.6221 12.7834 10.6748 9.0770 7.8431 6.8729 22.306 17.2920 13.7648 11.2578 9.4260 8.0552 7.0027 24.900 18.6646 14.4982 11.6546 9.6442 8.1755 7.0700 27.355 19.7928 15.0463 11.9246 9.7791 8.2438 7.1050 29.490 20.7200 15.4558 12.1084 9.8628 8 2825 7.1232 31.424 21.4822 15.7619 12.2335 9.9148 8.3045 7.1327 16% 18% 20% 0.8621 0.8475 0.8333 1.6052 1.5656 1.5278 2.2459 2.1743 2.1065 2.7982 2.6901 2.5887 3.2743 3.1272 2.9906 3.6847 3.4976 3.3255 4.0386 3.8115 3.6046 4.3436 4.0776 3.8372 4.6065 4.3030 4.0310 4.83324.4941 4.1925 5.0286 4.6560 4.3271 5.1971 4.7932 4.4392 5.34234.9095 4.5327 5.4675 5.0081 4.6106 5.5756 5.0916 4.6755 5.6685 5.1624 4.7296 5.7487 5.2223 4.7746 5.8178 5.2732 4.8122 5.8775 5.3162 4.8435 5.9288 5.3527 4.8696 5.9731 5.3837 4.8913 6.0113 5.4099 4.9094 6.0442 5.4321 4.9245 6.0726 5.4509 4.9371 6.0971 5.4689 4.9476 6.1772 5.5168 4.9789 6.2153 5.5386 4.9915 8.2335 5.5482 4.9966 5.2421 5.5523 4.9986 6.2463 5.5541 4.9995

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts