Question: That is all details about this question Question 3 A company has a liability of 6 million due in four years from now and it

That is all details about this question

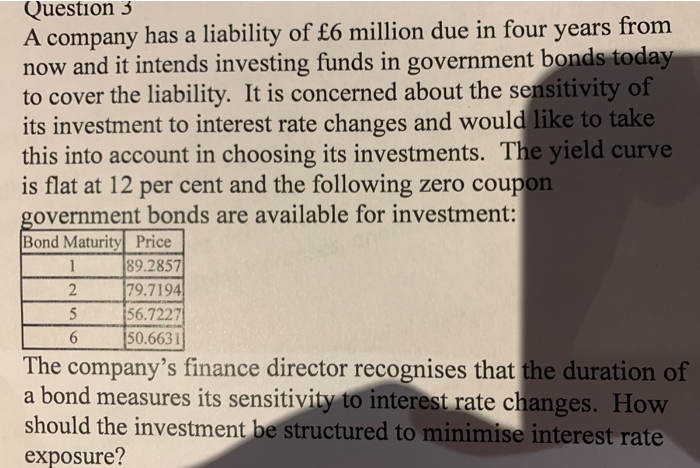

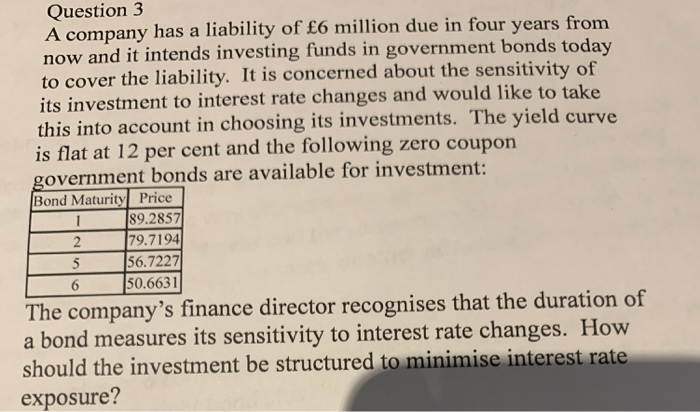

That is all details about this questionQuestion 3 A company has a liability of 6 million due in four years from now and it intends investing funds in government bonds today to cover the liability. It is concerned about the sensitivity of its investment to interest rate changes and would like to take this into account in choosing its investments. The yield curve is flat at 12 per cent and the following zero coupon government bonds are available for investment: Bond Maturity Price 189.28571 79.71941 156.7227 6 150.66311 The company's finance director recognises that the duration of a bond measures its sensitivity to interest rate changes. How should the investment be structured to minimise interest rate exposure? 2 Question 3 A company has a liability of 6 million due in four years from now and it intends investing funds in government bonds today to cover the liability. It is concerned about the sensitivity of its investment to interest rate changes and would like to take this into account in choosing its investments. The yield curve is flat at 12 per cent and the following zero coupon government bonds are available for investment: Bond Maturity Price 1 89.2857 1 2 79.7194 5 56.7227| 6 50.6631 The company's finance director recognises that the duration of a bond measures its sensitivity to interest rate changes. How should the investment be structured to minimise interest rate exposure? Question 3 A company has a liability of 6 million due in four years from now and it intends investing funds in government bonds today to cover the liability. It is concerned about the sensitivity of its investment to interest rate changes and would like to take this into account in choosing its investments. The yield curve is flat at 12 per cent and the following zero coupon government bonds are available for investment: Bond Maturity Price 189.28571 79.71941 156.7227 6 150.66311 The company's finance director recognises that the duration of a bond measures its sensitivity to interest rate changes. How should the investment be structured to minimise interest rate exposure? 2 Question 3 A company has a liability of 6 million due in four years from now and it intends investing funds in government bonds today to cover the liability. It is concerned about the sensitivity of its investment to interest rate changes and would like to take this into account in choosing its investments. The yield curve is flat at 12 per cent and the following zero coupon government bonds are available for investment: Bond Maturity Price 1 89.2857 1 2 79.7194 5 56.7227| 6 50.6631 The company's finance director recognises that the duration of a bond measures its sensitivity to interest rate changes. How should the investment be structured to minimise interest rate exposure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts