Question: That is the question I need help, please On a peer-to-peer (P2P) lending website, borrowers complete an approval scoring form that lenders use to assess

That is the question I need help, please

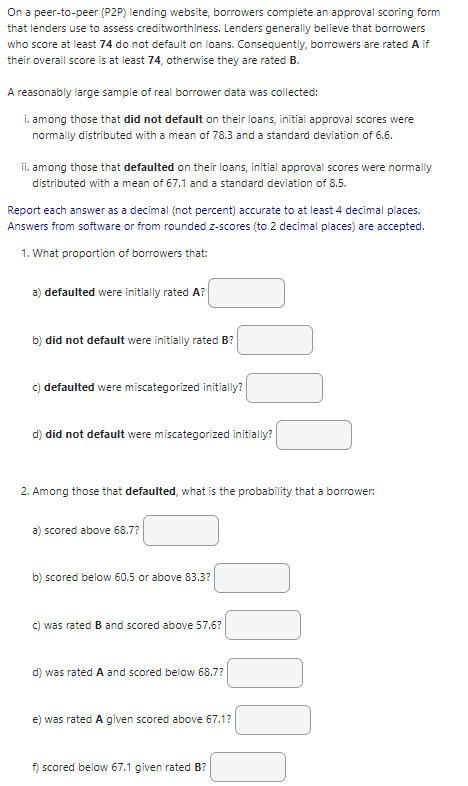

On a peer-to-peer (P2P) lending website, borrowers complete an approval scoring form that lenders use to assess creditworthiness. Lenders generally believe that borrowers who score at least 74 do not default on loans. Consequently, borrowers are rated A if their overall score is at least 74, otherwise they are rated B. A reasonably large sample of real borrower data was collected: i. among those that did not default on their loans, initial approval scores were normally distributed with a mean of 78.3 and a standard deviation of 6.6. ii. among those that defaulted on their loans, initial approval scores were normally distributed with a mean of 67.1 and a standard deviation of 8.5. Report each answer as a decimal (not percent) accurate to at least 4 decimal places. Answers from software or from rounded z-scores (to 2 decimal places) are accepted. 1. What proportion of borrowers that: a) defaulted were initially rated A? b) did not default were initially rated B? () defaulted were miscategorized initially? d) did not default were miscategorized initially? 2. Among those that defaulted, what is the probability that a borrower: a) scored above 68.7? b) scored below 60.5 or above 83.3? c) was rated B and scored above 57.6? d) was rated A and scored below 68.7? e) was rated A given scored above 67.1? f) scored below 67.1 given rated B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts