Question: that mer presenta u be made a greater length in Chapter 6 3.3 EXAMPLE: AGING WINE In this section we pro mathematical example a supporting

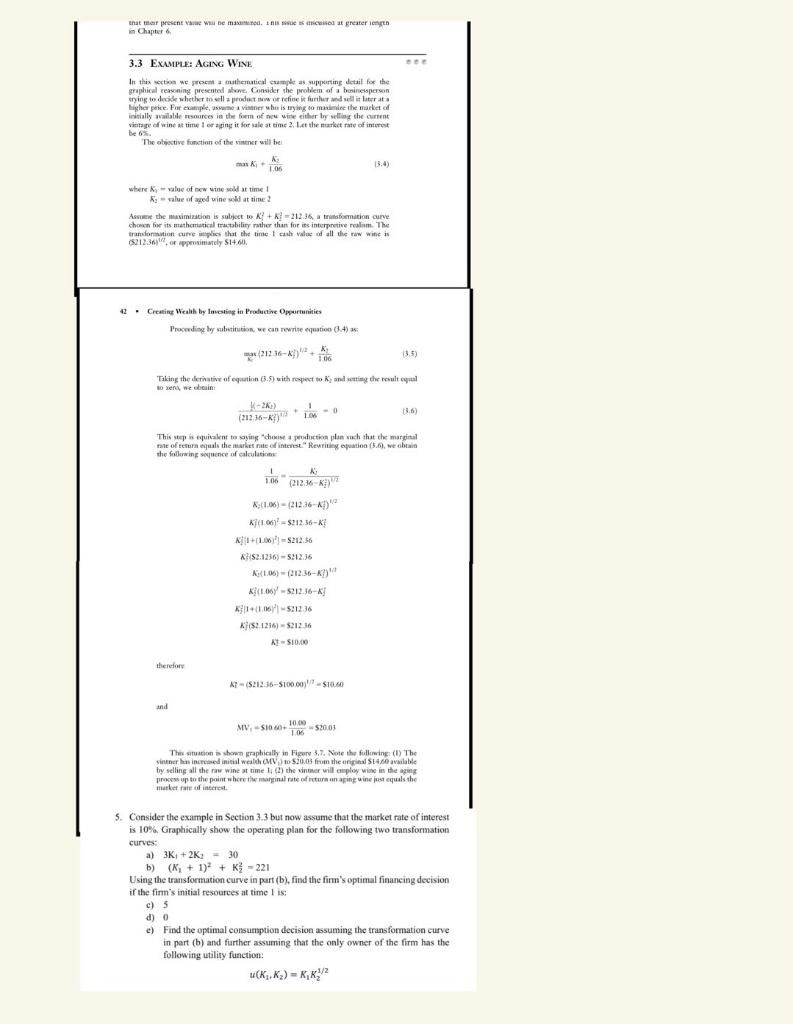

that mer presenta u be made a greater length in Chapter 6 3.3 EXAMPLE: AGING WINE In this section we pro mathematical example a supporting detail for the graphical regning presented bow. Consider the problem of csinessperson trying to decide whether to sell a product or refine it further and literata higher price. For example, assume a viner who is trying to mamine the market of initially wable resources in the form of new wine either by selling the cu vintage of wine at time or ping it for sale at time 2. Let the market rate of interest be 6%. The objective function of the inner will be mano 1.06 wherek - age of new wine sold at time Kvalue of wine at time As the maximization is subject to +212.36, a tristomation curve chombor its mathematical tractability rather than for its interpretive realm. The transformation curve is that the time I cash value of all the raw wine in (5212:36). or approximately S1460. 2. Creating Wealth by lasting in Productive Opportunities Proceedingly substitution, we can write to 3.4) (21236- 106 13.5) Taking the derivative of equation (3.5) with respect to Kanding the result webcam -21) 18.6) (212.36-K) - 10 This stap is equivalent to saying "hoose a production plan ach that the marginal such rate of return equals the market rite of interest Rewriting equation (, we obtain the following quence of calculation 1 106 212.16-?) ( K;(106) - (212:36-1 K(100)-5212.16-K K1+00')-5212.56 KS2.1236) -5212.36 K:1:06) 0212.36-?) ki(1067-5212.36- K110611-5:12.36 K}(521216) 5212.16 KS1000 thereby A7 (5212.36-510000100 and MV-10.10.00 - 52003 This situation is shown graphically in Figure 3.7. Note the following (1) The vinner han increased initial wealth MV) to $2005 from the original S40 valable by selling all the wine at time 11 () the immer will employ wine in the aging prekes up to the point where the marginal rate of return an aping wine just equals the marketer $. Consider the example in Section 3.3 but now assume that the market rate of interest is 10% Graphically show the operating plan for the following two transformation curves: a) 3K+2K-30 b) (K + 1) + K -221 Using the transformation curve in part (b), find the firm's optimal financing decision if the firm's initial resources at time I is c) 5 d) 0 c) Find the optimal consumption decision assuming the transformation curve in part (b) and further assuming that the only owner of the firm has the following utility function: u(KK) = KKT2 that mer presenta u be made a greater length in Chapter 6 3.3 EXAMPLE: AGING WINE In this section we pro mathematical example a supporting detail for the graphical regning presented bow. Consider the problem of csinessperson trying to decide whether to sell a product or refine it further and literata higher price. For example, assume a viner who is trying to mamine the market of initially wable resources in the form of new wine either by selling the cu vintage of wine at time or ping it for sale at time 2. Let the market rate of interest be 6%. The objective function of the inner will be mano 1.06 wherek - age of new wine sold at time Kvalue of wine at time As the maximization is subject to +212.36, a tristomation curve chombor its mathematical tractability rather than for its interpretive realm. The transformation curve is that the time I cash value of all the raw wine in (5212:36). or approximately S1460. 2. Creating Wealth by lasting in Productive Opportunities Proceedingly substitution, we can write to 3.4) (21236- 106 13.5) Taking the derivative of equation (3.5) with respect to Kanding the result webcam -21) 18.6) (212.36-K) - 10 This stap is equivalent to saying "hoose a production plan ach that the marginal such rate of return equals the market rite of interest Rewriting equation (, we obtain the following quence of calculation 1 106 212.16-?) ( K;(106) - (212:36-1 K(100)-5212.16-K K1+00')-5212.56 KS2.1236) -5212.36 K:1:06) 0212.36-?) ki(1067-5212.36- K110611-5:12.36 K}(521216) 5212.16 KS1000 thereby A7 (5212.36-510000100 and MV-10.10.00 - 52003 This situation is shown graphically in Figure 3.7. Note the following (1) The vinner han increased initial wealth MV) to $2005 from the original S40 valable by selling all the wine at time 11 () the immer will employ wine in the aging prekes up to the point where the marginal rate of return an aping wine just equals the marketer $. Consider the example in Section 3.3 but now assume that the market rate of interest is 10% Graphically show the operating plan for the following two transformation curves: a) 3K+2K-30 b) (K + 1) + K -221 Using the transformation curve in part (b), find the firm's optimal financing decision if the firm's initial resources at time I is c) 5 d) 0 c) Find the optimal consumption decision assuming the transformation curve in part (b) and further assuming that the only owner of the firm has the following utility function: u(KK) = KKT2

Step by Step Solution

There are 3 Steps involved in it

To solve problem 5 well work through three parts graphically showing the operating plan finding the firms optimal financing decision and finding the o... View full answer

Get step-by-step solutions from verified subject matter experts