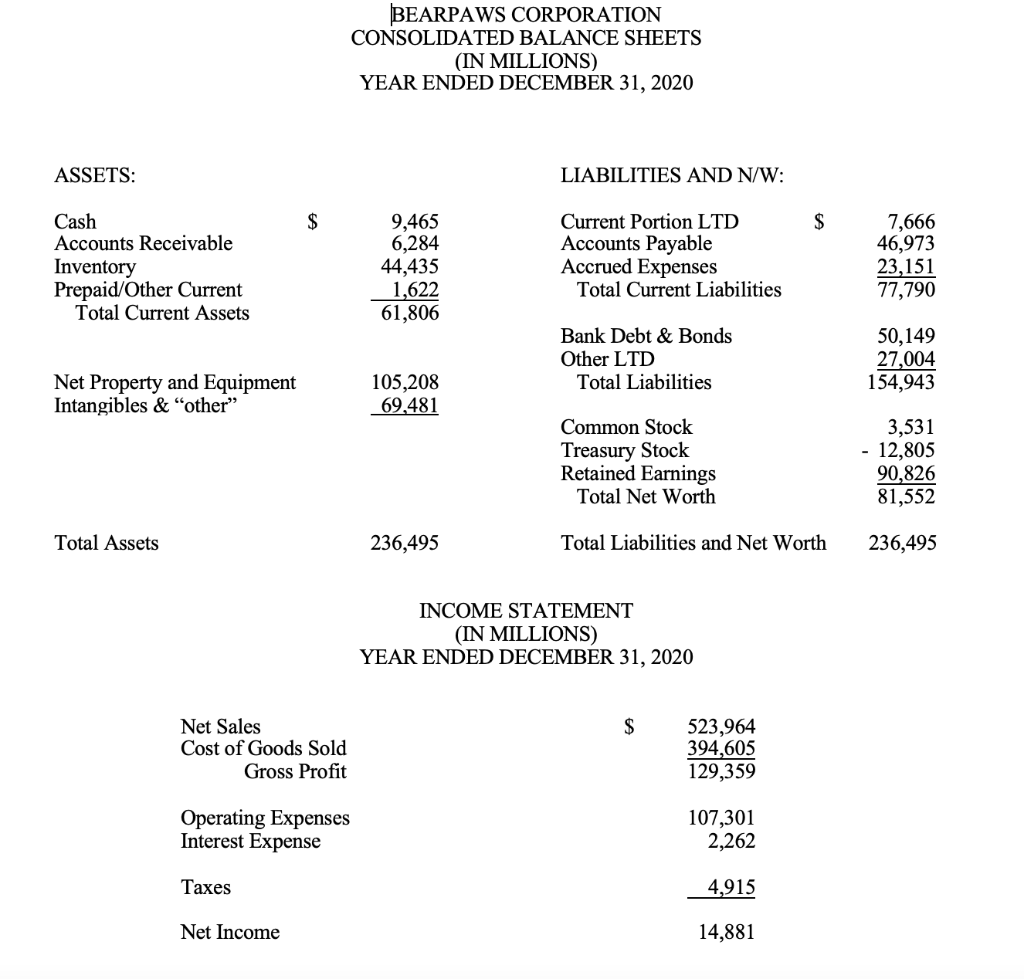

Question: That year, based on the income statement, BearPaws Corp would have been able to pay their interest expense how many times over? Select one: a.

That year, based on the income statement, BearPaws Corp would have been able to pay their interest expense how many times over?

Select one:

a. 9.8

b. 8.8

c. 3.4

d. 231.6

e. .1

Which of the following ratios best represents revenue-generating ability of all of BearPaws Corps Fixed Assets?:

Select one:

a. 3.8

b. 3.0

c. .3

d. 5.0

e. 2.3

BEARPAWS CORPORATION CONSOLIDATED BALANCE SHEETS (IN MILLIONS) YEAR ENDED DECEMBER 31, 2020 ASSETS: LIABILITIES AND N/W: $ $ Cash Accounts Receivable Inventory Prepaid/Other Current Total Current Assets 9,465 6,284 44,435 1,622 61,806 Current Portion LTD Accounts Payable Accrued Expenses Total Current Liabilities 7,666 46,973 23,151 77,790 Bank Debt & Bonds Other LTD Total Liabilities 50,149 27,004 154,943 Net Property and Equipment Intangibles & "other" 105,208 69,481 Common Stock Treasury Stock Retained Earnings Total Net Worth 3,531 - 12,805 90,826 81,552 Total Assets 236,495 Total Liabilities and Net Worth 236,495 INCOME STATEMENT (IN MILLIONS) YEAR ENDED DECEMBER 31, 2020 $ Net Sales Cost of Goods Sold Gross Profit 523,964 394,605 129,359 Operating Expenses Interest Expense 107,301 2,262 Taxes 4,915 Net Income 14,881

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts