Question: That's all for this question, pls use the given information to solve it. Thank you. I will give 3 upvotes TRUST CHEMICAL RESEARCH SDN. BHD.

That's all for this question, pls use the given information to solve it. Thank you. I will give 3 upvotes

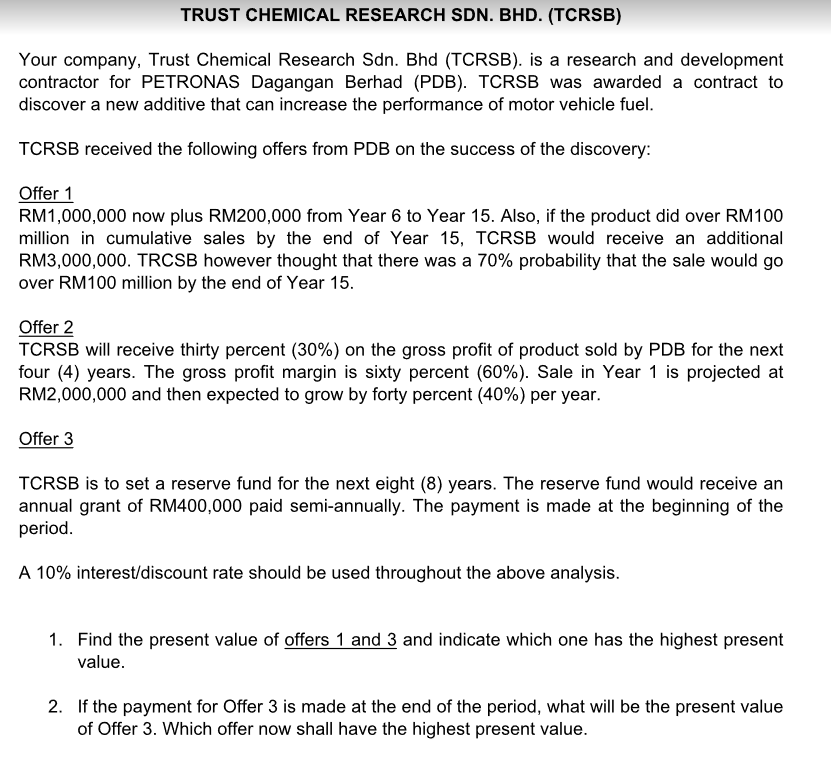

TRUST CHEMICAL RESEARCH SDN. BHD. (TCRSB) Your company, Trust Chemical Research Sdn. Bhd (TCRSB). is a research and development contractor for PETRONAS Dagangan Berhad (PDB). TORSB was awarded a contract to discover a new additive that can increase the performance of motor vehicle fuel. TCRSB received the following offers from PDB on the success of the discovery: Offer 1 RM1,000,000 now plus RM200,000 from Year 6 to Year 15. Also, if the product did over RM100 million in cumulative sales by the end of Year 15, TORSB would receive an additional RM3,000,000. TRCSB however thought that there was a 70% probability that the sale would go over RM100 million by the end of Year 15. Offer 2 TCRSB will receive thirty percent (30%) on the gross profit of product sold by PDB for the next four (4) years. The gross profit margin is sixty percent (60%). Sale in Year 1 is projected at RM2,000,000 and then expected to grow by forty percent (40%) per year. Offer 3 TCRSB is to set a reserve fund for the next eight (8) years. The reserve fund would receive an annual grant of RM400,000 paid semi-annually. The payment is made at the beginning of the period. A 10% interest/discount rate should be used throughout the above analysis. 1. Find the present value of offers 1 and 3 and indicate which one has the highest present value. 2. If the payment for Offer 3 is made at the end of the period, what will be the present value of Offer 3. Which offer now shall have the highest present value. TRUST CHEMICAL RESEARCH SDN. BHD. (TCRSB) Your company, Trust Chemical Research Sdn. Bhd (TCRSB). is a research and development contractor for PETRONAS Dagangan Berhad (PDB). TORSB was awarded a contract to discover a new additive that can increase the performance of motor vehicle fuel. TCRSB received the following offers from PDB on the success of the discovery: Offer 1 RM1,000,000 now plus RM200,000 from Year 6 to Year 15. Also, if the product did over RM100 million in cumulative sales by the end of Year 15, TORSB would receive an additional RM3,000,000. TRCSB however thought that there was a 70% probability that the sale would go over RM100 million by the end of Year 15. Offer 2 TCRSB will receive thirty percent (30%) on the gross profit of product sold by PDB for the next four (4) years. The gross profit margin is sixty percent (60%). Sale in Year 1 is projected at RM2,000,000 and then expected to grow by forty percent (40%) per year. Offer 3 TCRSB is to set a reserve fund for the next eight (8) years. The reserve fund would receive an annual grant of RM400,000 paid semi-annually. The payment is made at the beginning of the period. A 10% interest/discount rate should be used throughout the above analysis. 1. Find the present value of offers 1 and 3 and indicate which one has the highest present value. 2. If the payment for Offer 3 is made at the end of the period, what will be the present value of Offer 3. Which offer now shall have the highest present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts