Question: that's all the information I was given. its a calculus question 3. [8 points) An investor is looking to buy shares in two stocks, whose

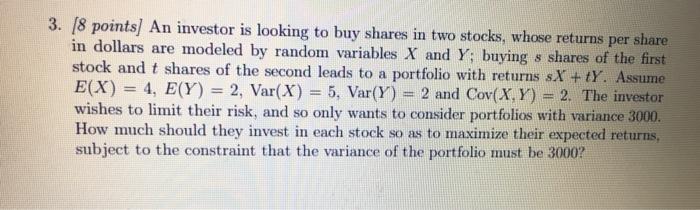

3. [8 points) An investor is looking to buy shares in two stocks, whose returns per share in dollars are modeled by random variables X and Y; buying s shares of the first stock and t shares of the second leads to a portfolio with returns sX + +Y. Assume E(X) = 4, E(Y) = 2, Var(X) = 5, Var(Y) = 2 and Cov(X,Y) 2. The investor wishes to limit their risk, and so only wants to consider portfolios with variance 3000. How much should they invest in each stock so as to maximize their expected returns, subject to the constraint that the variance of the portfolio must be 3000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts