Question: thats all the information it gives me Practice Problems Help Required information (The following information applies to the questions displayed below.) Laker Company reported the

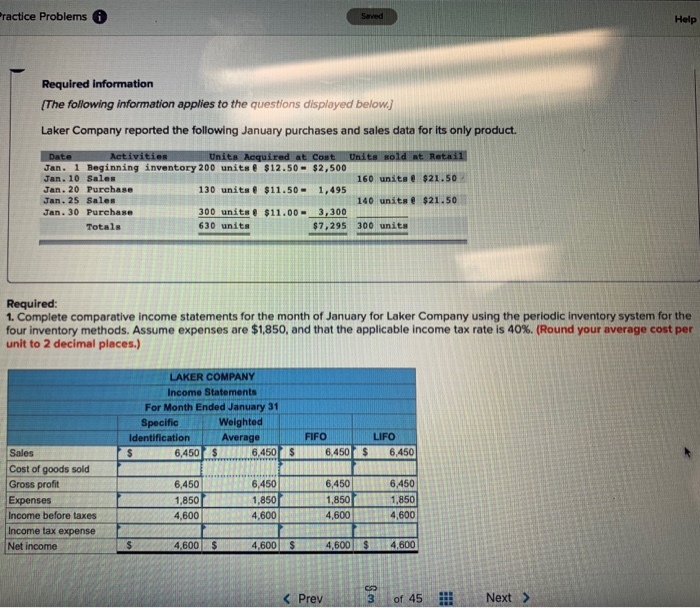

Practice Problems Help Required information (The following information applies to the questions displayed below.) Laker Company reported the following January purchases and sales data for its only product. Date Activities Units Aequired at cont Units sold at Retail Jan. 1 Beginning inventory 200 units $12.50 - $2,500 Jan. 10 Sales 160 units $21.50 Jan. 20 Purchase 130 units @ $11.50 - 1,495 Jan. 25 Sales 140 units @ $21.50 Jan. 30 Purchase 300 units @ $11.00 - 3,300 Totals 630 units $7,295 300 units Required: 1. Complete comparative income statements for the month of January for Laker Company using the periodic inventory system for the four inventory methods. Assume expenses are $1,850, and that the applicable income tax rate is 40%. (Round your average cost per unit to 2 decimal places.) LAKER COMPANY Income Statements For Month Ended January 31 Specific Weighted Identification Average FIFO LIFO $ 6,450 $ 6,450ES6450 $ 6,450 T 6,4506 ,4506 ,4506 ,450 1,850 1 ,850 1,850 1,850 4,600 4,600 4,600 4,600 Sales Cost of goods sold P Gross profit Expenses Income before taxes Income tax expense Net income $ 4,600 $ 4,600 $ 4,600 $ 4,600 Practice Problems Help Required information (The following information applies to the questions displayed below.) Laker Company reported the following January purchases and sales data for its only product. Date Activities Units Aequired at cont Units sold at Retail Jan. 1 Beginning inventory 200 units $12.50 - $2,500 Jan. 10 Sales 160 units $21.50 Jan. 20 Purchase 130 units @ $11.50 - 1,495 Jan. 25 Sales 140 units @ $21.50 Jan. 30 Purchase 300 units @ $11.00 - 3,300 Totals 630 units $7,295 300 units Required: 1. Complete comparative income statements for the month of January for Laker Company using the periodic inventory system for the four inventory methods. Assume expenses are $1,850, and that the applicable income tax rate is 40%. (Round your average cost per unit to 2 decimal places.) LAKER COMPANY Income Statements For Month Ended January 31 Specific Weighted Identification Average FIFO LIFO $ 6,450 $ 6,450ES6450 $ 6,450 T 6,4506 ,4506 ,4506 ,450 1,850 1 ,850 1,850 1,850 4,600 4,600 4,600 4,600 Sales Cost of goods sold P Gross profit Expenses Income before taxes Income tax expense Net income $ 4,600 $ 4,600 $ 4,600 $ 4,600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts