Question: That's how the question was given Brockton Ltd. began applying IFRS in 20X8. One of the necessary adjustments was to adjust past inventory records to

That's how the question was given

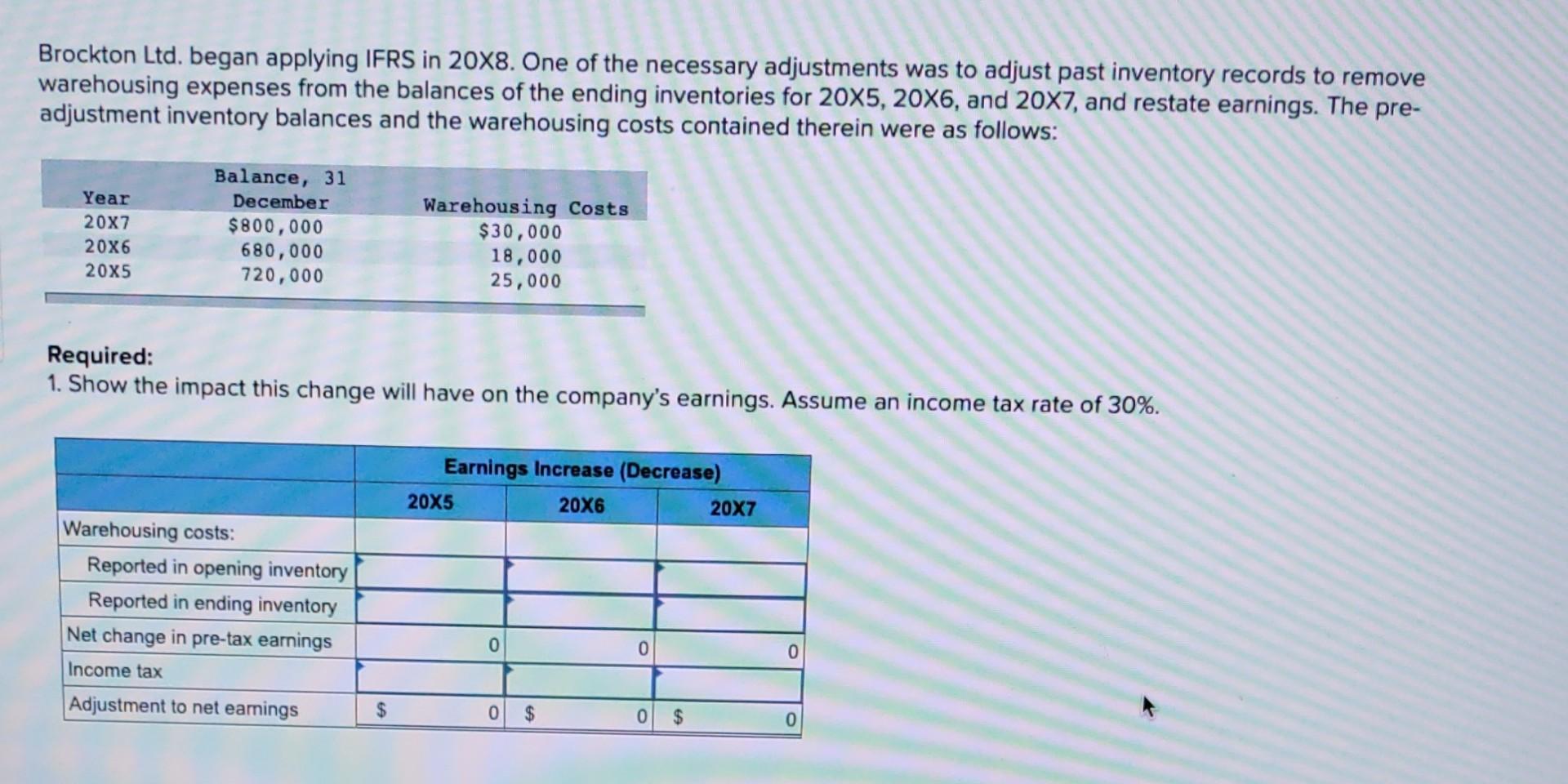

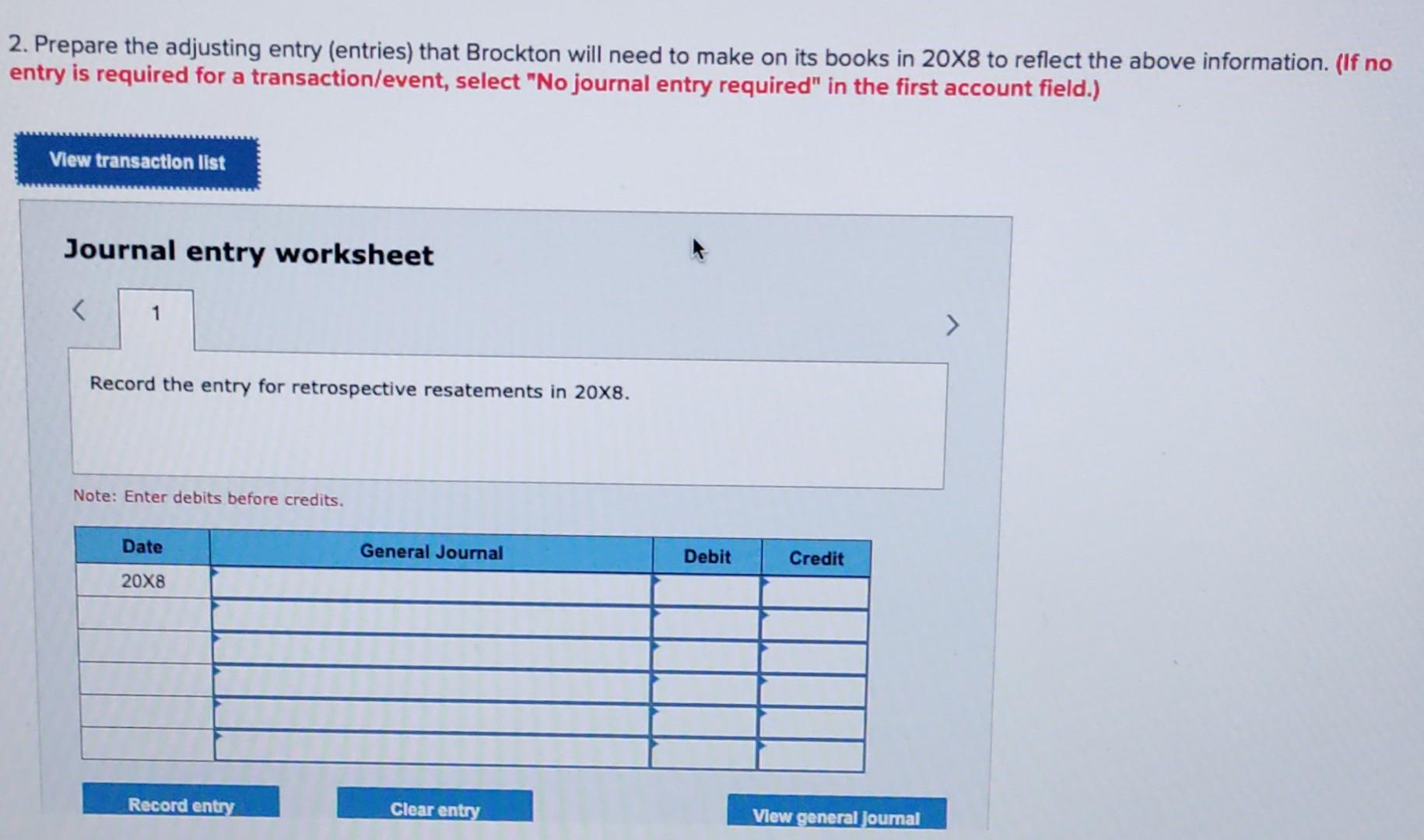

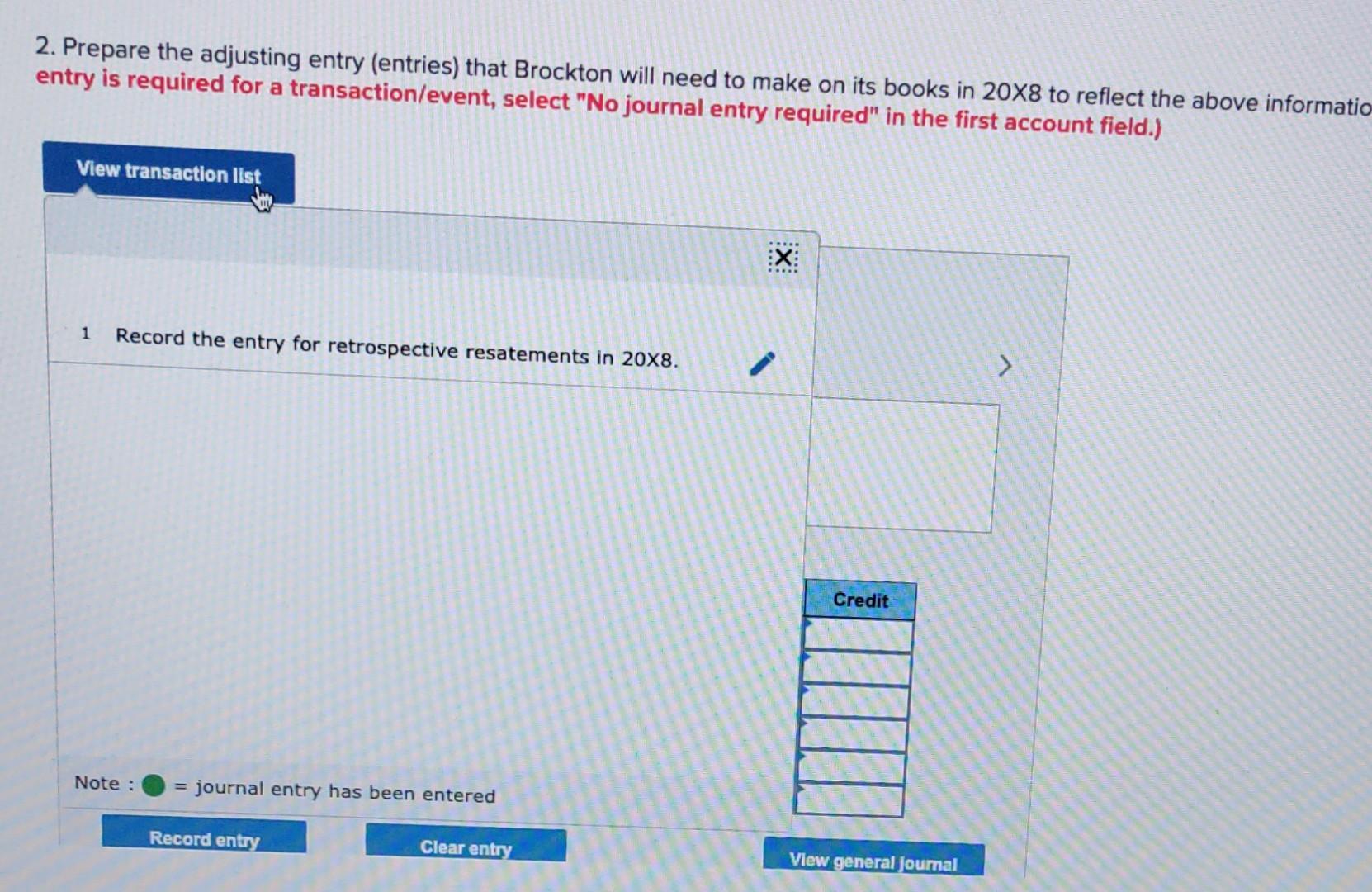

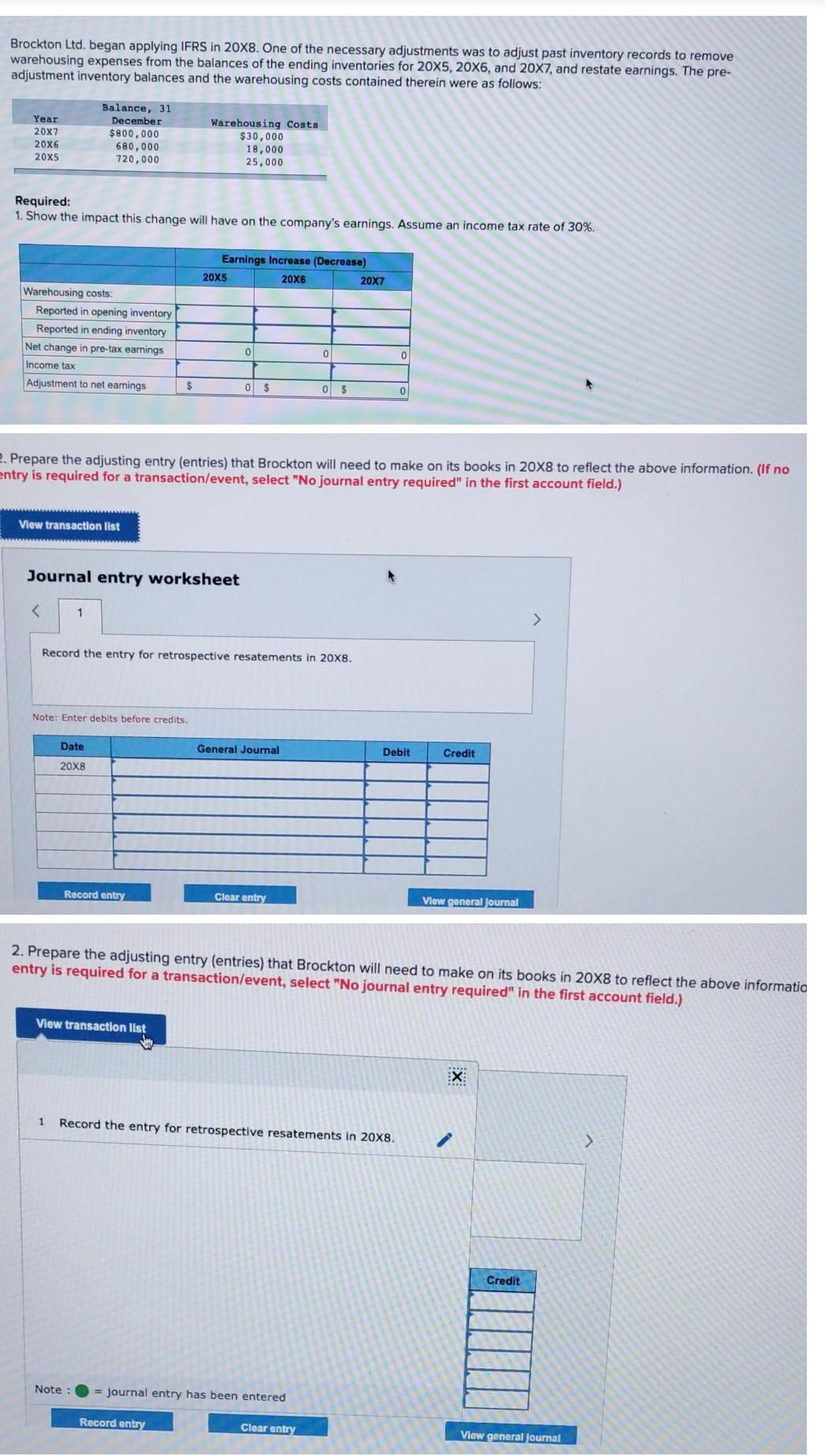

Brockton Ltd. began applying IFRS in 20X8. One of the necessary adjustments was to adjust past inventory records to remove warehousing expenses from the balances of the ending inventories for 20X5, 20X6, and 20X7, and restate earnings. The pre- adjustment inventory balances and the warehousing costs contained therein were as follows: Year 20x7 20X6 20X5 Balance, 31 December $800,000 680,000 720,000 Warehousing Costs $30,000 18,000 25,000 Required: 1. Show the impact this change will have on the company's earnings. Assume an income tax rate of 30%. Earnings Increase (Decrease) 20X5 20X6 20X7 Warehousing costs: Reported in opening inventory Reported in ending inventory Net change in pre-tax earnings Income tax Adjustment to net earings 0 0 0 $ $ 0 $ 2. Prepare the adjusting entry (entries) that Brockton will need to make on its books in 20X8 to reflect the above information. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry for retrospective resatements in 20X8. Note: Enter debits before credits. Date General Journal Debit Credit 20X8 Record entry Clear entry View general Journal 2. Prepare the adjusting entry (entries) that Brockton will need to make on its books in 20X8 to reflect the above informatio entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list :X: x 1 Record the entry for retrospective resatements in 20x8. Credit Note : = journal entry has been entered Record entry Clear entry View general Journal Brockton Ltd. began applying IFRS in 20X8. One of the necessary adjustments was to adjust past inventory records to remove warehousing expenses from the balances of the ending inventories for 20X5, 20X6, and 20X7, and restate earnings. The pre- adjustment inventory balances and the warehousing costs contained therein were as follows: Year 20x7 20X6 20x5 Balance, 31 December $800,000 680,000 720,000 Warehousing Costs $30,000 18,000 25,000 Required: 1. Show the impact this change will have on the company's earnings. Assume an income tax rate of 30%. Earnings Increase (Decrease) 20X5 20X6 20X7 Warehousing costs: Reported in opening inventory Reported in ending inventory Net change in pre-tax earnings Income tax Adjustment to net earnings 0 0 0 $ 0 $ 0 $ 0 2. Prepare the adjusting entry (entries) that Brockton will need to make on its books in 20x8 to reflect the above information. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry for retrospective resatements in 20x8. Note: Enter debits before credits. Date General Journal Debit Credit 20X8 Record entry Clear entry View general Journal 2. Prepare the adjusting entry (entries) that Brockton will need to make on its books in 20X8 to reflect the above informatio entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list X 1 Record the entry for retrospective resatements in 20X8. > Credit Note : = journal entry has been entered Record entry Clear entry View general Journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts