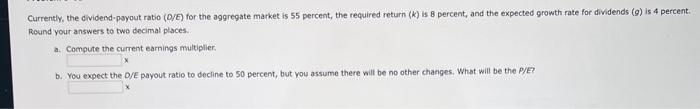

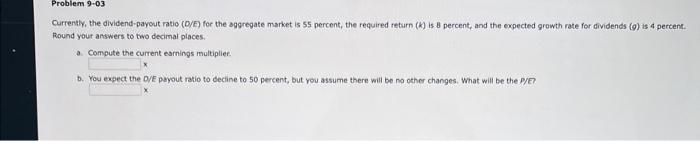

Question: thats the only thing the question is asking Currently, the dividend-psyout ratio (D/E) for the aggregate market is 55 percent, the required return (k )

Currently, the dividend-psyout ratio (D/E) for the aggregate market is 55 percent, the required return (k ) is 8 percent, and the expected growth rate for dividends ( g ) is 4 percent. Round your answers to two decimal piaces. a. Comoute the current earnings multiplier. b. You expect the D/E payout ratio to decline to 50 percent, but wou assume there will be no other changes. What will be the P/E? Currently, the dividend-payout ratio (D/E) for the sggregate market is 55 percent, the required return (k) is 8 percent, and the expected growth rate for dividends (g) is 4 percent. Round your answers to two decimal places. a. Comoute the current earnings multiplier. b. You exsect the OVE payout ratio to decine to 50 percent, but you assume there will be no other changes. What will be the P/F7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts