Question: thats why i sent four pages its a continuation, i can not get everything on one page so i tool it bit by bit Variable

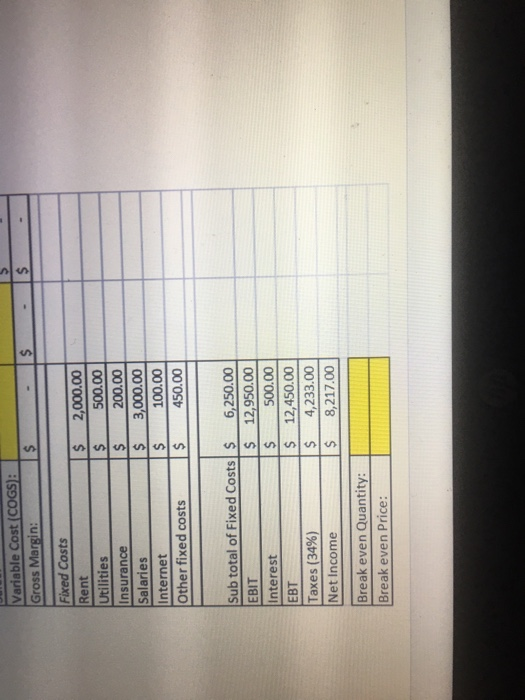

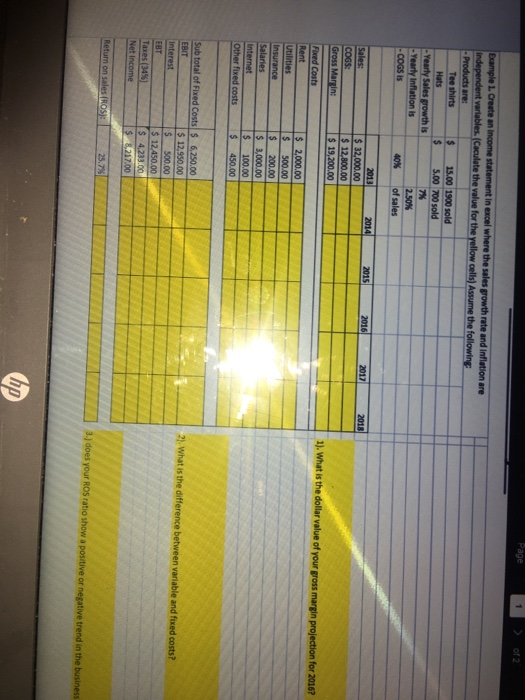

Variable Cost (COGS): Gross Margin: Fixed Costs Rent Utilities Insurance Salaries Internet Other fixed costs $ $ $ $ $ $ 2,000.00 500.00 200.00 3,000.00 100.00 450.00 Sub total of Fixed Costs $ EBIT $ Interest $ EBT $ Taxes (34%) $ Net Income $ 6,250.00 12,950.00 500.00 12,450.00 4,233.00 8,217.00 Break even Quantity: Break even Price: Bumple L. Create an income statement in excel where the sales prowth rate and inflation are Independent variables. (Caculate the value for the yellow cells) Assume the following - Products are: Tee shirts 15.00 1900 sold 5.00 700 sold -Yearly Sales growth is -Yearly Inflation is 2505 -COGS is 40% of sales 7 2014 2015 2016 2017 2018 Sales COGS: Gross Martin 2013 $ 32.000.00 $ 12,800.00 $ 19,200.00 1). What is the dollar value of your gross margin projection for 20167 Fored Costs Rent Utilities Insurance Salaries 2.000.00 500.00 $ $ $ $ $ $ 200.00 1.000.00 100.00 450.00 Internet Other fixed costs Sub total of Fixed costs 6.250.00 $ 12,950.00 the difference between variable and fixed costs? Interest $ 12.450.00 $ 4.2010 $ 8.217.00 Net Income Return on sales (ROSJE 25.75 3. does your ROS ratio show a positive or negative trend in the busine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts