Question: The 1st picture is what has to be completed using the data and information from picture 2. As stated in the video recordings, select one

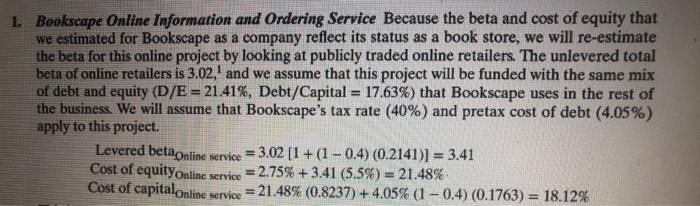

As stated in the video recordings, select one of the examples in Chapter 5 of the textbook (Vale, Tata, Bookscape etc.) and replicate in Excel the calculation of its cash flow to firm or cash flow to equity, based on what is done for that particular example in the textbook. Again, you are replicating what is done in the textbook; you have all the calculations and numbers given to you. The point of this problem is that you individually go through an example of estimating cash flow for a realistic (or real) example. You have to complete this in Excel, and upload your file below. BAB 1 AEE 1. Bookscape Online Information and Ordering Service Because the beta and cost of equity that we estimated for Bookscape as a company reflect its status as a book store, we will re-estimate the beta for this online project by looking at publicly traded online retailers. The unlevered total beta of online retailers is 3.02, and we assume that this project will be funded with the same mix of debt and equity (D/E = 21.41%, Debt/Capital = 17.63%) that Bookscape uses in the rest of the business. We will assume that Bookscape's tax rate (40%) and pretax cost of debt (4.05%) apply to this project Levered beta Online service = 3.02 [1 + (1 -0.4) (0.2141)] = 3.41 Cost of equityonline service = 2.75% +3.41 (5.5%) = 21.48% Cost of capitalOnline service = 21.48% (0.8237) + 4.05% (1 -0.4) (0.1763) = 18.12% As stated in the video recordings, select one of the examples in Chapter 5 of the textbook (Vale, Tata, Bookscape etc.) and replicate in Excel the calculation of its cash flow to firm or cash flow to equity, based on what is done for that particular example in the textbook. Again, you are replicating what is done in the textbook; you have all the calculations and numbers given to you. The point of this problem is that you individually go through an example of estimating cash flow for a realistic (or real) example. You have to complete this in Excel, and upload your file below. BAB 1 AEE 1. Bookscape Online Information and Ordering Service Because the beta and cost of equity that we estimated for Bookscape as a company reflect its status as a book store, we will re-estimate the beta for this online project by looking at publicly traded online retailers. The unlevered total beta of online retailers is 3.02, and we assume that this project will be funded with the same mix of debt and equity (D/E = 21.41%, Debt/Capital = 17.63%) that Bookscape uses in the rest of the business. We will assume that Bookscape's tax rate (40%) and pretax cost of debt (4.05%) apply to this project Levered beta Online service = 3.02 [1 + (1 -0.4) (0.2141)] = 3.41 Cost of equityonline service = 2.75% +3.41 (5.5%) = 21.48% Cost of capitalOnline service = 21.48% (0.8237) + 4.05% (1 -0.4) (0.1763) = 18.12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts