Question: the 2 tax tables are from the same link Use the 2015 tax table to find the Income tax for a taxpayer with taxable income

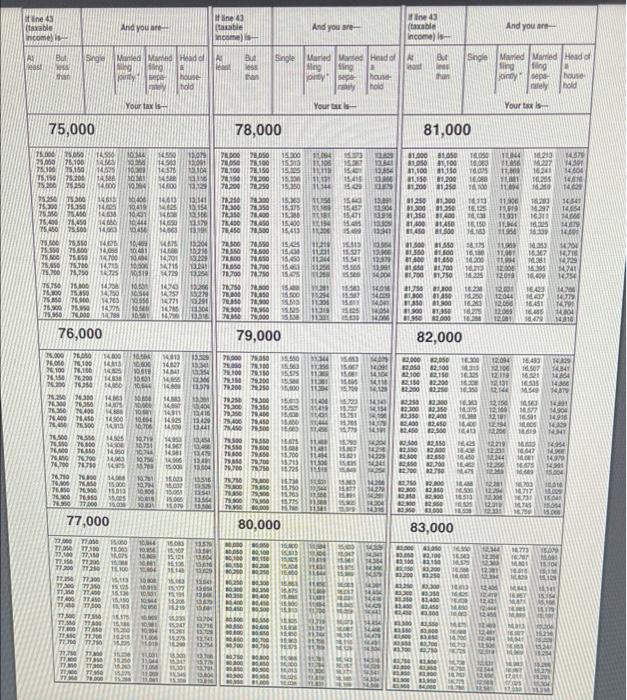

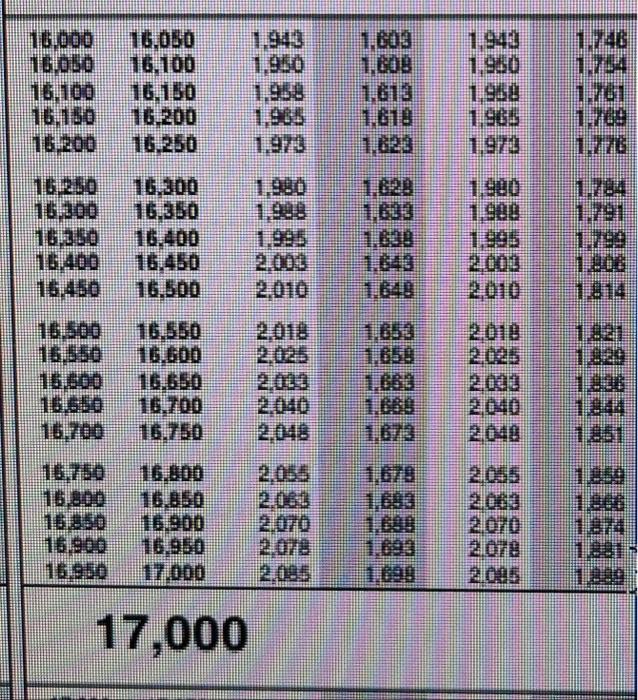

Use the 2015 tax table to find the Income tax for a taxpayer with taxable income of $77,541 filing as single 15163 Use the 2015 tax table to find the income tax for a taxpayer with taxable income of $16,031 filing as married in separately. Question Help: Message Instructor Submit Question line 43 (taxable Income And you are Sne 43 table Income And you are ne 43 taxable Income) And you Single Manted Marie Head of Sngle Mandanted Haidot sing ting houd hold Single Marie Marie Head of fing fing ty house hold house ppu em Your Your Your tas 75,000 78,000 81,000 0957 TO 13.00 PELDOO 7.00 15300 123 SAT 75.000 . 23,00 76100 18.00 75,190 75.00 14 14.30 SH ITVE NEWS 102 TASA TE H 13 ! RE 10 13.454 102 15.411 PROSE 10 00 14100 FERRE 81.000 1.050 $100,100 11.100 110 21.150.200 1200 1.250 01.250.00 11.300 11.350 0 0.400 11.00 14. 140 2. 300 1921 14.00 CHOOSE 13:41 13.194 USER 12.50 3.250 T300 TO T.46 we 156 15.41 399 TI 14341 1404 74 4 KUD 28.450 BELSBERGE 2839 FEB 25.350 75.00 749 TSASO7.500 3.80 7.SO 7. 75.850 5.00.250 1 SCE SEL MA 73.29 13204 OSYE BREE REBRE ER 323 E93 BURE . 30 1.400 at 81700 == 4718 DNA 7170 DO 16.000 1643 DER 75.750 75.000 78.10075.810 75.50 75.000 75,00 76750 78.000 SCHE SAN 9.341 1472 or 9 TO 7.00 T10 1771 10 14 BE HOSTI 200 300 NON 14 76,000 79,000 82,000 25.000 76.00 14 HA 14013 1027 1330 CERE 35.55 4 490 14 . 1.100 76,166 76.200 166 71.000 7.00 100 INCE CO ww PERE 7,10 55 000 200 20 82.30 100 21 8220 82.200 220 SAN 3 7100 78110 70.00 2350 2.500 78350 OCEN 129 1. 11.00 150 14 DER ER 149 20.20 16.30 26.300 26350 7.0 7.50 7, 7.500 70200 78.250 20.30 DOWN she 12.300 123 22:350 7.400 TAS TES LHER 22 23 3 5 183338 33259999999999 10. 114 13 13.304 Partii si REBE SEE LATE 14 14. 1.000 104 7.00 2015 1700 76,700 701 78.00 T. 76 20.550 790 77.000 105 POSE OLEH 356 OS . 2009 2.0 . EN 13 CE NE 77,000 80,000 83,000 16.00 2.00 500 M. 18.04 DITE 1.100 12.000 72.00 TA 1710 77.00 720 17.30 7100 77.200 7250 17.20 17200 7700 T30 7135 770 71,400 STA TAS TTSDO 775 T. 77.100 77.00 73.1 1862 98833 0200 30 25 in die FEL BRES 882 HE T7 ELE Use the 2015 tax table to find the income tax for a taxpayer with taxable income of $77,511 Piling as Stoele Use the 2015 tax table to find the income tax for a taxpayer with taxable income of $16,031 fiting as married filing separately 1.248 16.000 16.050 15.100 16.130 16.200 16.050 16.100 16.150 16. 200 16.250 1.943 1.950 1.958 1.985 1.608 1.013 1.610 1.823 1950 1.965 1.972 1.761 1.709 1.980 1.784 1.829 1.633 16250 16.300 161210 16,400 15.450 16.300 15.350 16.400 16.450 16.500 1990 1995 1.799 2003 2.010 1.648 1814 2010 15.500 16.550 2.025 1220 16.550 116.500 16.550 16.700 16.750 1658 1.BBE 1.683 2040 16.550 16.700 1844 1351 16.30D 1.679 2.055 2055 2069 16.750 16.800 15350 16.900 16.30 16.900 16.950 17.000 20010 2070 16 18 2.078 2.085 1.693 1939 17,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts