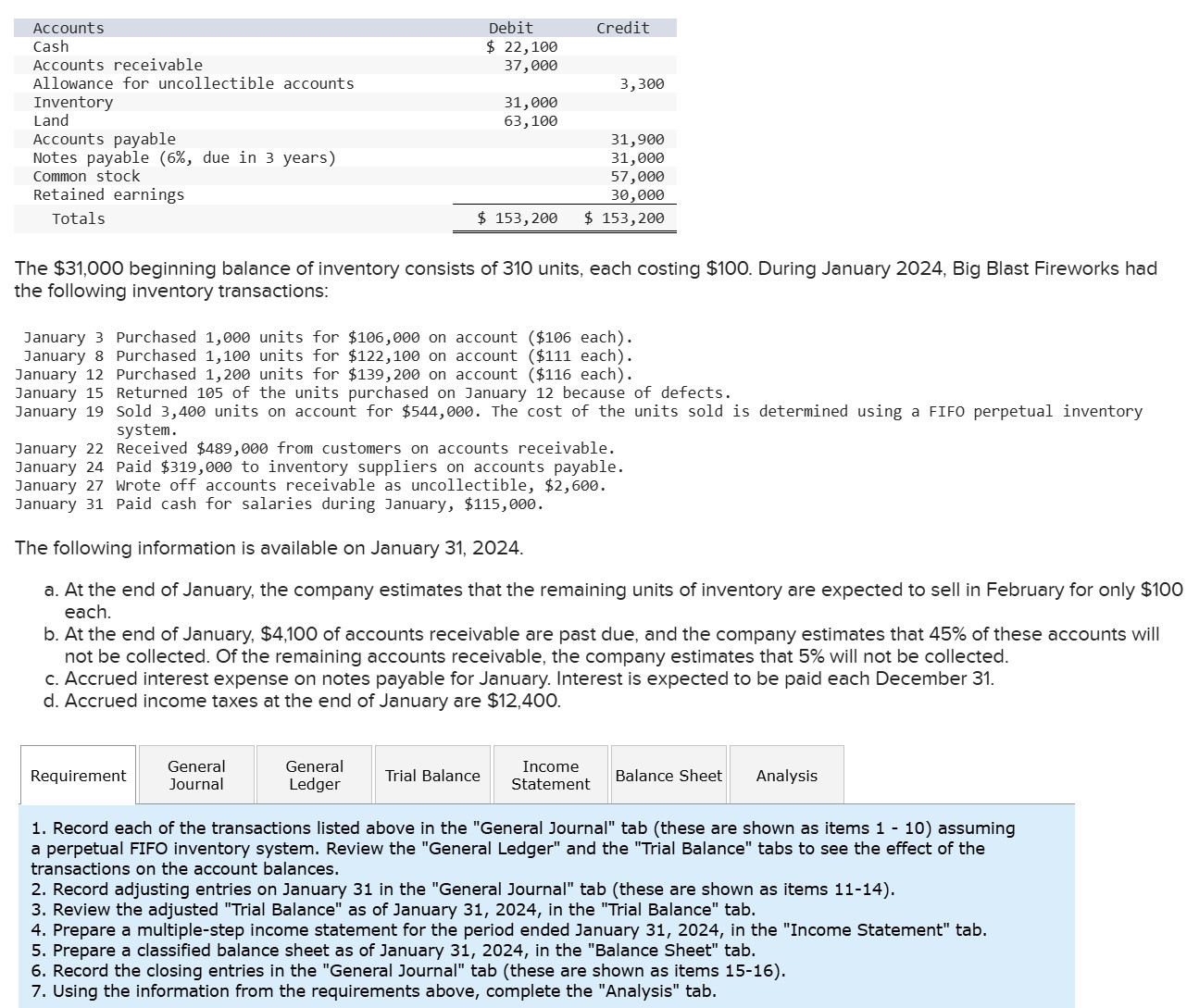

Question: The $ 3 1 , 0 0 0 beginning balance of inventory consists of 3 1 0 units, each costing $ 1 0 0 .

The $ beginning balance of inventory consists of units, each costing $ During January Big Blast Fireworks had Analyze how well Big Blast Fireworks' manages its inventory:

a Calculate the inventory turnover ratio for the month of January. If the industry average of the inventory turnover ratio for the month of January is times, is the company

managing its inventory more or less efficiently than other companies in the same industry?

The inventory turnover ratio is:

The company managing its inventory more efficiently. True or False

b Calculate the gross profit ratio for the month of January. If the industry average gross profit ratio is is the company more or less profitable per dollar of sales than other

companies in the same industry?

The gross profit ratio is:

Is the company more or less profitable per dollar of sales?

c Used together, what might the inventory turnover ratio and gross profit ratio suggest about Big Blast Fireworks' business strategy? Is the company's strategy to sell a higher

volume of less expensive items or does the company appear to be selling a lower volume of more expensive items?

Based on the inventory turnover ratio and the gross profit ratio, Big Blast Fireworks' business strategy appears to be selling a

the following inventory transactions:January Purchased units for $ on account $ each

January Purchased units for $ on account $ each

January Returned of the units purchased on January because of defects.

January Sold units on account for $ The cost of the units sold is determined using a FIFO perpetual inventory

system.

January Received $ from customers on accounts receivable.

January Paid $ to inventory suppliers on accounts payable.

January Wrote off accounts receivable as uncollectible, $

January Paid cash for salaries during January, $The following information is available on January

a At the end of January, the company estimates that the remaining units of inventory are expected to sell in February for only $

each.

b At the end of January, $ of accounts receivable are past due, and the company estimates that of these accounts will

not be collected. Of the remaining accounts receivable, the company estimates that will not be collected.

c Accrued interest expense on notes payable for January. Interest is expected to be paid each December

d Accrued income taxes at the end of January are $

Record each of the transactions listed above in the "General Journal" tab these are shown as items assuming

a perpetual FIFO inventory system. Review the "General Ledger" and the "Trial Balance" tabs to see the effect of the

transactions on the account balances.

Record adjusting entries on January in the "General Journal" tab these are shown as items

Review the adjusted "Trial Balance" as of January in the "Trial Balance" tab.

Prepare a multiplestep income statement for the period ended January in the "Income Statement" tab.

Prepare a classified balance sheet as of January in the "Balance Sheet" tab.

Record the closing entries in the "General Journal" tab these are shown as items

Using the information from the requirements above, complete the "Analysis" tab.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock