Question: The 3 month simple (add-on) interest rate is 4%, while the price of a 3-month maturity zero coupon bond is 98%. (a) There is an

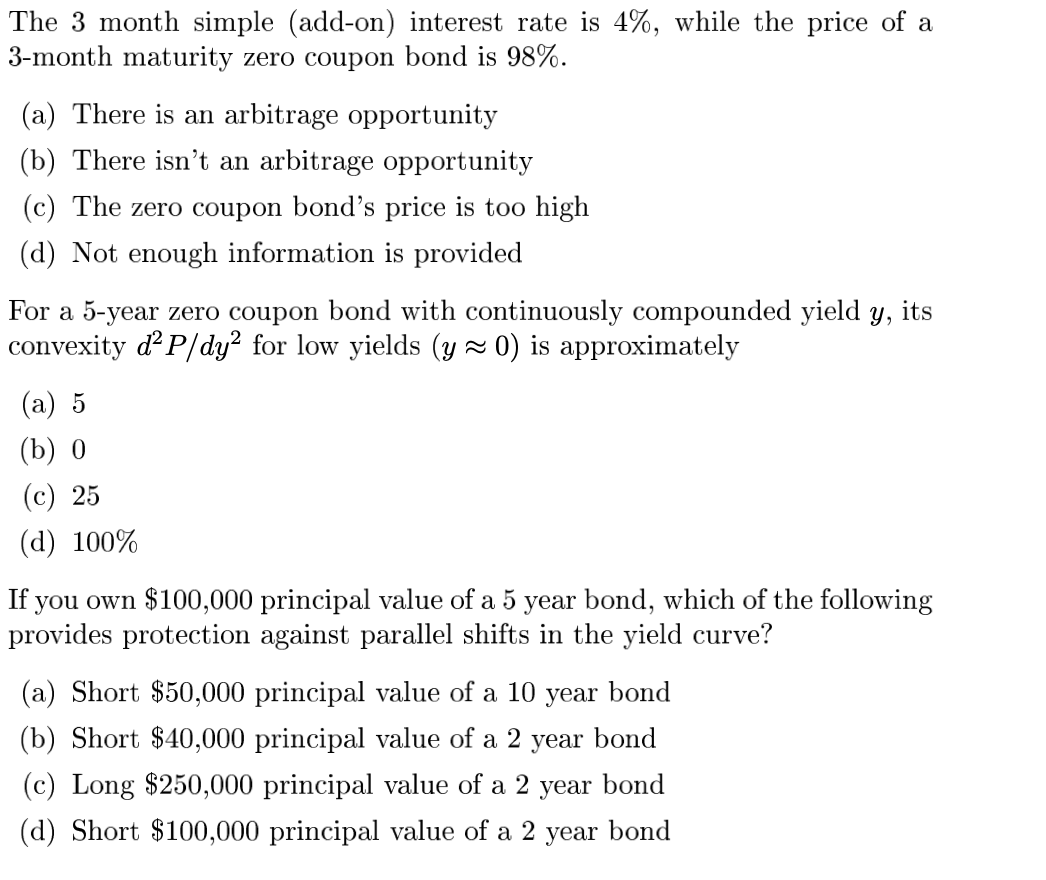

The 3 month simple (add-on) interest rate is 4%, while the price of a 3-month maturity zero coupon bond is 98%. (a) There is an arbitrage opportunity (b) There isn't an arbitrage opportunity (c) The zero coupon bond's price is too high (d) Not enough information is provided For a 5-year zero coupon bond with continuously compounded yield y, its convexity dP/dy2 for low yields (y = 0) is approximately (a) 5 (b) 0 (c) 25 (d) 100% If you own $100,000 principal value of a 5 year bond, which of the following provides protection against parallel shifts in the yield curve? (a) Short $50,000 principal value of a 10 year bond (b) Short $40,000 principal value of a 2 year bond (c) Long $250,000 principal value of a 2 year bond (d) Short $100,000 principal value of a 2 year bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts