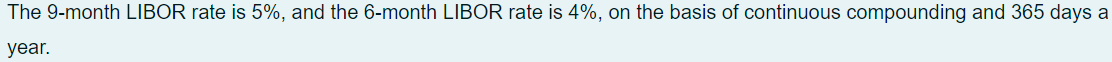

Question: The 9-month LIBOR rate is 5%, and the 6-month LIBOR rate is 4%, on the basis of continuous compounding and 365 days a year. Question

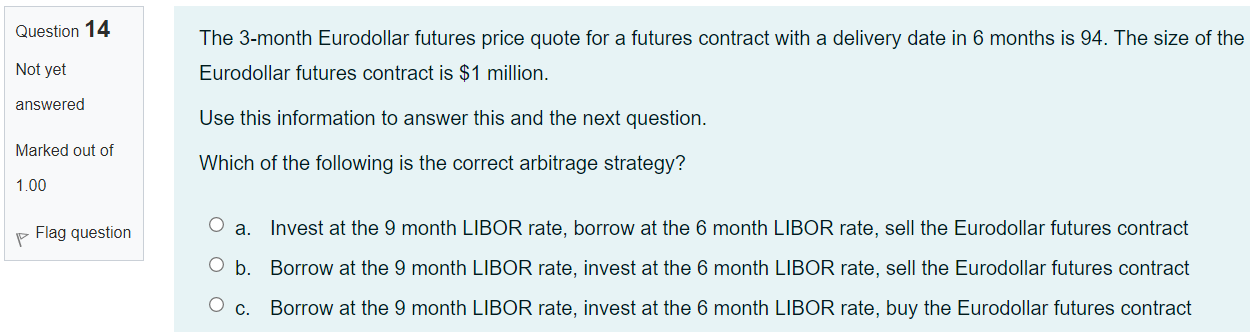

The 9-month LIBOR rate is 5%, and the 6-month LIBOR rate is 4%, on the basis of continuous compounding and 365 days a year. Question 14 The 3-month Eurodollar futures price quote for a futures contract with a delivery date in 6 months is 94. The size of the Eurodollar futures contract is $1 million. Not yet answered Use this information to answer this and the next question. Marked out of Which of the following is the correct arbitrage strategy? 1.00 Flag question . Invest at the 9 month LIBOR rate, borrow at the 6 month LIBOR rate, sell the Eurodollar futures contract b. Borrow at the 9 month LIBOR rate, invest at the 6 month LIBOR rate, sell the Eurodollar futures contract C. Borrow at the 9 month LIBOR rate, invest at the 6 month LIBOR rate, buy the Eurodollar futures contract The 9-month LIBOR rate is 5%, and the 6-month LIBOR rate is 4%, on the basis of continuous compounding and 365 days a year. Question 14 The 3-month Eurodollar futures price quote for a futures contract with a delivery date in 6 months is 94. The size of the Eurodollar futures contract is $1 million. Not yet answered Use this information to answer this and the next question. Marked out of Which of the following is the correct arbitrage strategy? 1.00 Flag question . Invest at the 9 month LIBOR rate, borrow at the 6 month LIBOR rate, sell the Eurodollar futures contract b. Borrow at the 9 month LIBOR rate, invest at the 6 month LIBOR rate, sell the Eurodollar futures contract C. Borrow at the 9 month LIBOR rate, invest at the 6 month LIBOR rate, buy the Eurodollar futures contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts