Question: The above question 3 is here: Q6. Consider the data in question Q3. above. a) What is the forward price today for delivering at date

The above question 3 is here:

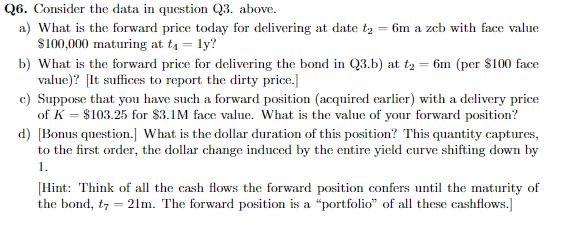

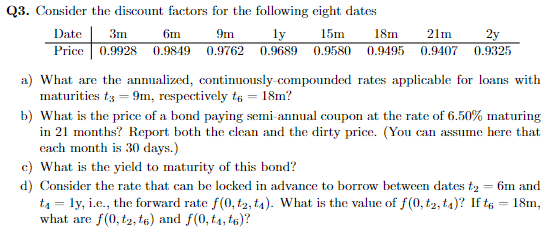

Q6. Consider the data in question Q3. above. a) What is the forward price today for delivering at date tz = 6m a wcb with face value $100,000 maturing at tg = ly? b) What is the forward price for delivering the bond in Q3.b) at t2 = 6m (per $100 face value)? [It suffices to report the dirty price. c) Suppose that you have such a forward position (acquired earlier) with a delivery price of K = $103.25 for $3.1M face value. What is the value of your forward position? d) [Bonus question. What is the dollar duration of this position? This quantity captures, to the first order, the dollar change induced by the entire yield curve shifting down by 1. [Hint: Think of all the cash flows the forward position confers until the maturity of the bond, t7 = 21m. The forward position is a portfolio" of all these cashflows. 6m 9m 15m 18m Q3. Consider the discount factors for the following eight dates Date 3m ly 21m 2y Price 0.9928 0.9849 0.9762 0.9689 0.9580 0.9495 0.9407 0.9325 a) What are the annualized, continuously compounded rates applicable for loans with maturities t3 = 9m, respectively to = 18m? b) What is the price of a bond paying semi-annual coupon at the rate of 6.50% maturing in 21 months? Report both the clean and the dirty price. (You can assume here that each month is 30 days.) c) What is the yield to maturity of this bond? d) Consider the rate that can be locked in advance to borrow between dates ty ta = ly, i.e., the forward rate f(0, t2, ta). What is the value of f(0, t2, ta)? If t6 = 18m, what are f(0,t2, te) and f(0, ta, t)? = 6m and Q6. Consider the data in question Q3. above. a) What is the forward price today for delivering at date tz = 6m a wcb with face value $100,000 maturing at tg = ly? b) What is the forward price for delivering the bond in Q3.b) at t2 = 6m (per $100 face value)? [It suffices to report the dirty price. c) Suppose that you have such a forward position (acquired earlier) with a delivery price of K = $103.25 for $3.1M face value. What is the value of your forward position? d) [Bonus question. What is the dollar duration of this position? This quantity captures, to the first order, the dollar change induced by the entire yield curve shifting down by 1. [Hint: Think of all the cash flows the forward position confers until the maturity of the bond, t7 = 21m. The forward position is a portfolio" of all these cashflows. 6m 9m 15m 18m Q3. Consider the discount factors for the following eight dates Date 3m ly 21m 2y Price 0.9928 0.9849 0.9762 0.9689 0.9580 0.9495 0.9407 0.9325 a) What are the annualized, continuously compounded rates applicable for loans with maturities t3 = 9m, respectively to = 18m? b) What is the price of a bond paying semi-annual coupon at the rate of 6.50% maturing in 21 months? Report both the clean and the dirty price. (You can assume here that each month is 30 days.) c) What is the yield to maturity of this bond? d) Consider the rate that can be locked in advance to borrow between dates ty ta = ly, i.e., the forward rate f(0, t2, ta). What is the value of f(0, t2, ta)? If t6 = 18m, what are f(0,t2, te) and f(0, ta, t)? = 6m and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts