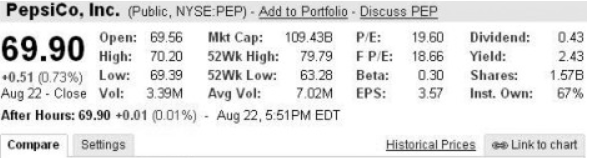

Question: The above screen shot from Google Finance shows basic stock information for PepsiCo. If you owned 2700 shares of PepsiCo for the period? shown, how

The above screen shot from Google Finance shows basic stock information for PepsiCo. If you owned 2700 shares of PepsiCo for the period? shown, how much would you have earned in dividend? payments? PLEASE READ: I understand that the answer is B because 2700 x 0.43, but why am i supposed to use the "dividend" value of 0.43 and not the "yield" value? If the eq. is dividend yield = (Div)/P_0, shouldnt I be multiplying by the "yield"? Thank you in advance

A. $810.00

B. $1,161.00

C .$986.85

D. $1,111.11

PepsiCo, Inc. (Public, NYSE:PEP) - Add to Portfolio - Discuss PEP Open: 69.56 Mkt Cap: 109.43B 52Wk High: 79.79 52Wk Low: Avg Vol: 63.28 7.02M 69.90 High: 70.20 +0.51 (0.73 % ) Low: 69.39 Aug 22 Close Vol: 3.39M After Hours: 69.90 +0.01 (0.01% ) Aug 22, 5:51PM EDT Compare Settings P/E: 19.60 F P/E: 18.66 Beta: 0.30 EPS: 3.57 Dividend: 0.43 Yield: 2.43 Shares: 1.57B Inst. Own: 67% Historical Prices Link to chart

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Since the requirement is the earnings in dividend payments so we wi... View full answer

Get step-by-step solutions from verified subject matter experts