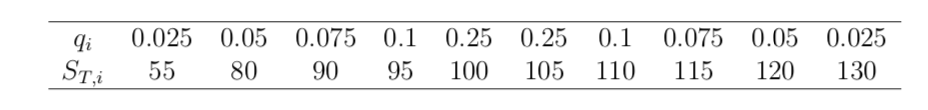

Question: The above table represents risk neutral probabilities, qi over future possible stock prices ST where T is one year from now. The Q-expected stock price

The above table represents risk neutral probabilities, qi over future possible stock prices ST where T is one year from now. The Q-expected stock price is $101.75 and the variance EQ(ST EQ(ST ))2 = 153.18 and the standard deviation of returns of 12.16%. Use this infor- mation to answer questions 28 - 29.

28. (10pts) Assume that the interest rate is 5% (continuous compounding), find the value of a Put option with a one year maturity and strike 90.

29. (10pts) Compute the market price of a one-year 90 strike Put with Black-Scholes implied volatility of 12.16%, interest rate of 5% (continuously compounding). Assume that the initial stock price is 96.79.

Page 12

30. (5pts) Prove that S0 = 96.79 (stock price today).

31. (10pts) Two call options with the same maturity and strikes K1 and K2 with K1 li ST, 0.025 55 0.05 0.075 0.1 80 90 95 0.25 0.25 100 105 0.1 110 0.075 0.05 115 120 0.025 130 li ST, 0.025 55 0.05 0.075 0.1 80 90 95 0.25 0.25 100 105 0.1 110 0.075 0.05 115 120 0.025 130

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts