Question: the above values are book values and should be converted into market value The following is the balance sheet of a VRY-SMPL Bank. All the

the above values are book values and should be converted into market value

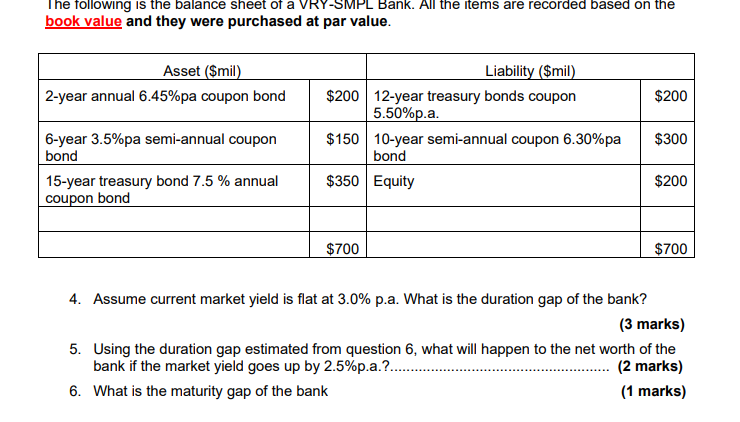

The following is the balance sheet of a VRY-SMPL Bank. All the items are recorded based on the book value and they were purchased at par value. Asset ($mil) 2-year annual 6.45%pa coupon bond $200 Liability ($mil) $200 12-year treasury bonds coupon 5.50%p.a. $150 10-year semi-annual coupon 6.30%pa bond $350 Equity $300 6-year 3.5%pa semi-annual coupon bond 15-year treasury bond 7.5 % annual coupon bond $200 $700 $700 4. Assume current market yield is flat at 3.0% p.a. What is the duration gap of the bank? (3 marks) 5. Using the duration gap estimated from question 6, what will happen to the net worth of the bank if the market yield goes up by 2.5%p.a.?.. (2 marks) 6. What is the maturity gap of the bank (1 marks) The following is the balance sheet of a VRY-SMPL Bank. All the items are recorded based on the book value and they were purchased at par value. Asset ($mil) 2-year annual 6.45%pa coupon bond $200 Liability ($mil) $200 12-year treasury bonds coupon 5.50%p.a. $150 10-year semi-annual coupon 6.30%pa bond $350 Equity $300 6-year 3.5%pa semi-annual coupon bond 15-year treasury bond 7.5 % annual coupon bond $200 $700 $700 4. Assume current market yield is flat at 3.0% p.a. What is the duration gap of the bank? (3 marks) 5. Using the duration gap estimated from question 6, what will happen to the net worth of the bank if the market yield goes up by 2.5%p.a.?.. (2 marks) 6. What is the maturity gap of the bank (1 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts