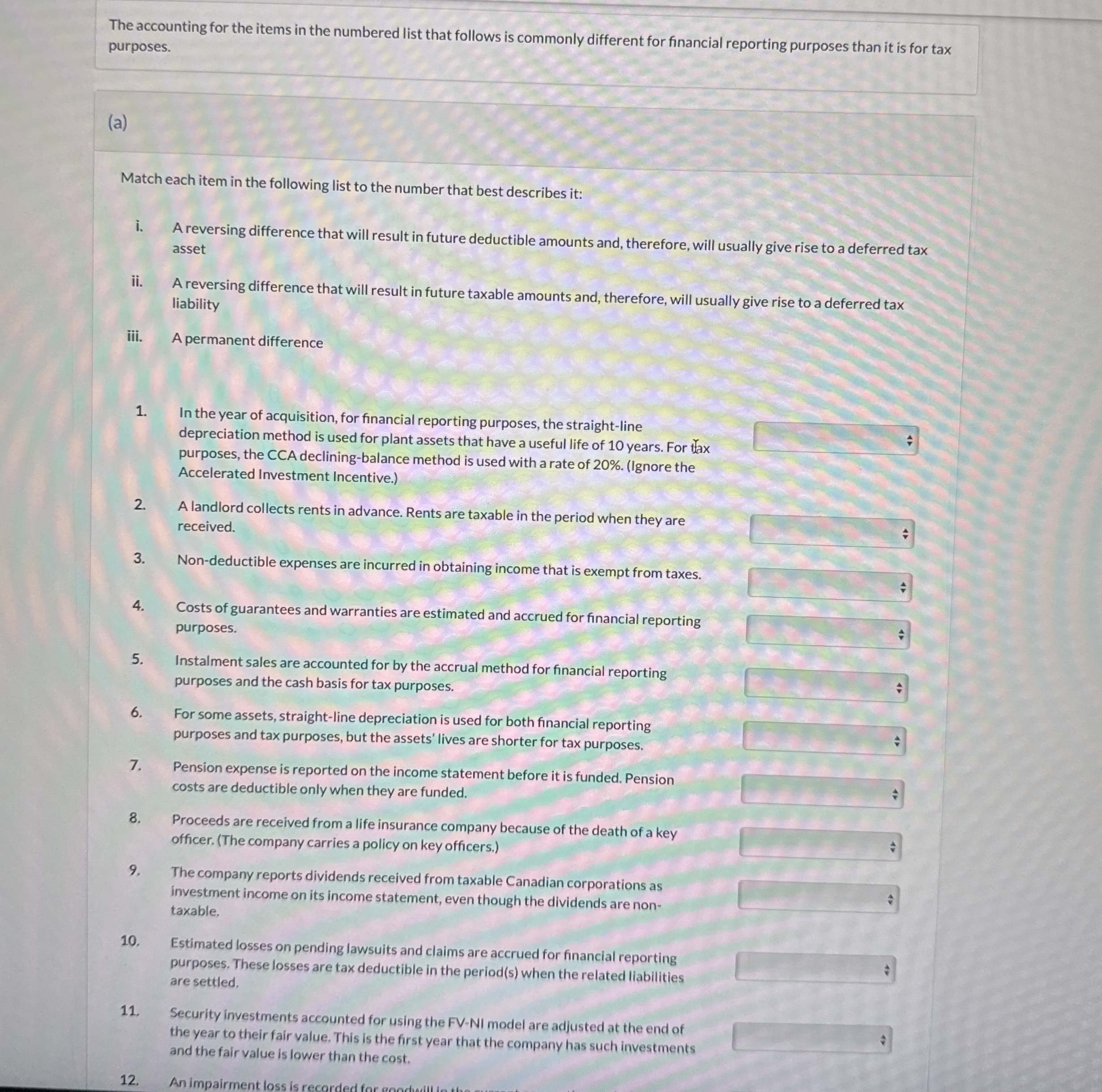

Question: The accounting for the items in the numbered list that follows is commonly different for financial reporting purposes than it is for tax purposes. (

The accounting for the items in the numbered list that follows is commonly different for financial reporting purposes than it is for tax purposes.

a

Match each item in the following list to the number that best describes it:

i A reversing difference that will result in future deductible amounts and, therefore, will usually give rise to a deferred tax asset

ii A reversing difference that will result in future taxable amounts and, therefore, will usually give rise to a deferred tax liability

iii. A permanent difference

In the year of acquisition, for financial reporting purposes, the straightline depreciation method is used for plant assets that have a useful life of years. For tax purposes, the CCA decliningbalance method is used with a rate of Ignore the Accelerated Investment Incentive.

A landlord collects rents in advance. Rents are taxable in the period when they are received.

Nondeductible expenses are incurred in obtaining income that is exempt from taxes.

Costs of guarantees and warranties are estimated and accrued for financial reporting purposes.

Instalment sales are accounted for by the accrual method for financial reporting purposes and the cash basis for tax purposes.

For some assets, straightline depreciation is used for both financial reporting purposes and tax purposes, but the assets' lives are shorter for tax purposes.

Pension expense is reported on the income statement before it is funded. Pension costs are deductible only when they are funded.

Proceeds are received from a life insurance company because of the death of a key officer. The company carries a policy on key officers.

The company reports dividends received from taxable Canadian corporations as investment income on its income statement, even though the dividends are nontaxable,

Estimated losses on pending lawsuits and claims are accrued for financial reporting purposes. These losses are tax deductible in the periods when the related liabilities are settled.

Security investments accounted for using the FVNI model are adjusted at the end of the year to their fair value. This is the first year that the company has such investments and the fair value is lower than the cost.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock