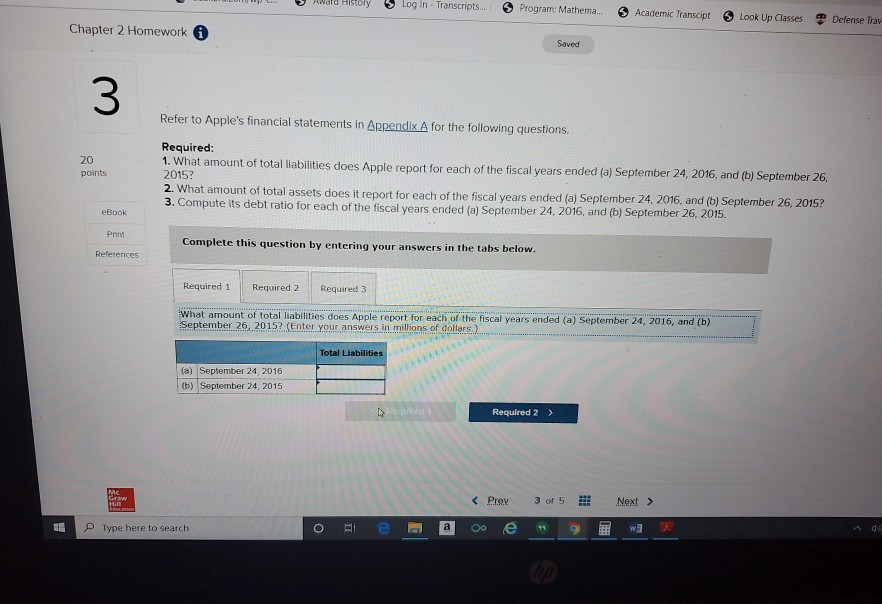

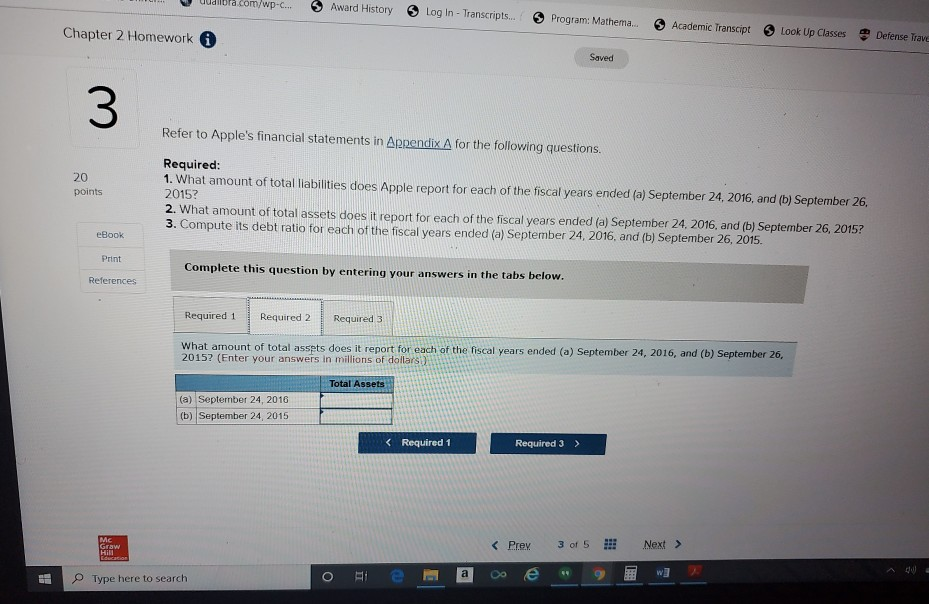

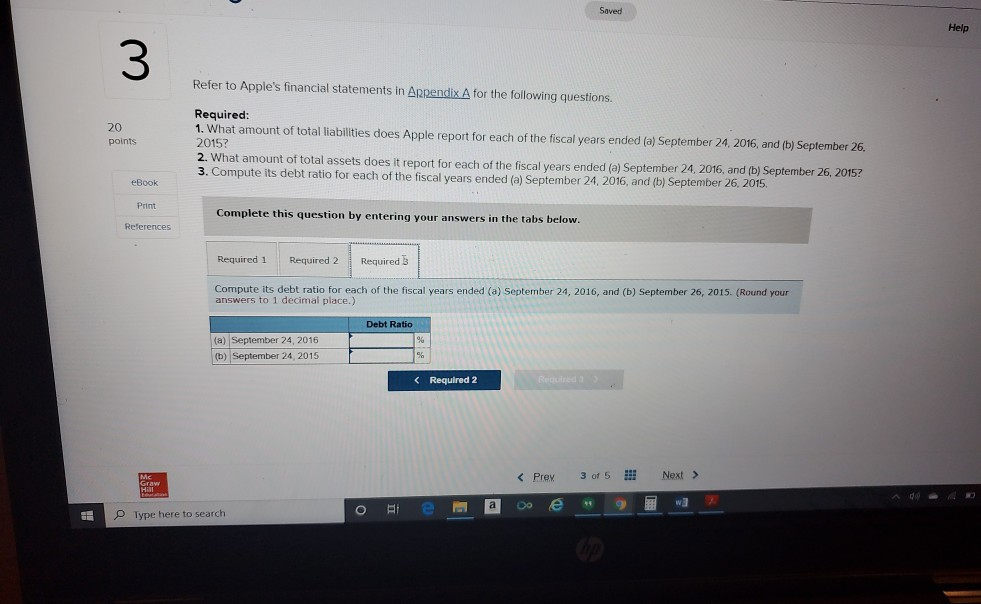

Question: THE ACCOUNTING PROBLEM IS A THREE PART QUESTION ,: REQUIRED 1,2,3. BASED ON THE IMAGES CAN YOU TELL ME WHAT GOES IN EACH. PLEASE AND

THE ACCOUNTING PROBLEM IS A

THREE PART QUESTION ,: REQUIRED 1,2,3. BASED ON THE IMAGES CAN YOU TELL ME WHAT GOES IN EACH. PLEASE AND THANK YOU

U L U ward History Log in - Transcripts... Program: Mathema. Academic Transcipt Look Up Classes Chapter 2 Homework Defense Trav Saved Refer to Apple's financial statements in Appendix A for the following questions. Required: 1. What amount of total liabilities does Apple report for each of the fiscal years ended (a) September 24, 2016, and (b) September 26. 2015? points 2. What amount of total assets does it report for each of the fiscal vears ended (a) September 24, 2016, and (b) September 26, 2015? 3. Compute its debt ratio for each of the fiscal years ended (a) September 24, 2016, and (b) September 26, 2015. eBook Punt Complete this question by entering your answers in the tabs below. References Required 1 Required 2 Required 3 What amount of total liabilities does Apple report for each of the fiscal years ended (a) September 24, 2016, and (b) September 26, 2015? (Enter your answers in millions of dollars.) Total Liabilities (a) September 24, 2016 (6) September 24, 2015 | Required 2 > Type here to search o tema e wa wana.com/wp-c Award History Log In - Transcripts... Program: Mathema. Academic Transcipt Look Up Classes Defense Team Chapter 2 Homework Saved 3 Refer to Apple's financial statements in Appendix A for the following questions. 20 points Required: 1. What amount of total liabilities does Apple report for each of the fiscal years ended (a) September 24, 2016, and (b) September 26, 2015? 2. What amount of total assets does it report for each of the fiscal years ended (a) September 24, 2016, and (b) September 26, 2015? 3. Compute its debt ratio for each of the fiscal years ended (a) September 24, 2016, and (b) September 26, 2015 eBook Print Complete this question by entering your answers in the tabs below. References Required 1 Required 2 Required 3 What amount of total assets does it report for each of the fiscal years ended (a) September 24, 2016, and (b) September 26, 2015? (Enter your answers in millions of dollars) Total Assets (a) September 24, 2016 (b) September 24, 2015 Type here to search Saved Help Refer to Apple's financial statements in Arpendix A for the following questions. 20 points Required: 1. What amount of total liabilities does Apple report for each of the fiscal years ended (a) September 24, 2016, and (b) September 26. 2015? 2. What amount of total assets does it report for each of the fiscal vears ended (a) September 24, 2016, and (b) September 26, 2015? 3. Compute its debt ratio for each of the fiscal years ended (a) September 24, 2016, and (b) September 26, 2015 eBook Print Complete this question by entering your answers in the tabs below. References Required 1 Required 2 Required 3 Compute its debt ratio for each of the fiscal years ended (a) September 24, 2016, and (b) September 26, 2015. (Round your answers to 1 decimal place.) Debt Ratio (a) September 24, 2016 (b) September 24, 2015 Oi e me e 9 Type here to search wa U L U ward History Log in - Transcripts... Program: Mathema. Academic Transcipt Look Up Classes Chapter 2 Homework Defense Trav Saved Refer to Apple's financial statements in Appendix A for the following questions. Required: 1. What amount of total liabilities does Apple report for each of the fiscal years ended (a) September 24, 2016, and (b) September 26. 2015? points 2. What amount of total assets does it report for each of the fiscal vears ended (a) September 24, 2016, and (b) September 26, 2015? 3. Compute its debt ratio for each of the fiscal years ended (a) September 24, 2016, and (b) September 26, 2015. eBook Punt Complete this question by entering your answers in the tabs below. References Required 1 Required 2 Required 3 What amount of total liabilities does Apple report for each of the fiscal years ended (a) September 24, 2016, and (b) September 26, 2015? (Enter your answers in millions of dollars.) Total Liabilities (a) September 24, 2016 (6) September 24, 2015 | Required 2 > Type here to search o tema e wa wana.com/wp-c Award History Log In - Transcripts... Program: Mathema. Academic Transcipt Look Up Classes Defense Team Chapter 2 Homework Saved 3 Refer to Apple's financial statements in Appendix A for the following questions. 20 points Required: 1. What amount of total liabilities does Apple report for each of the fiscal years ended (a) September 24, 2016, and (b) September 26, 2015? 2. What amount of total assets does it report for each of the fiscal years ended (a) September 24, 2016, and (b) September 26, 2015? 3. Compute its debt ratio for each of the fiscal years ended (a) September 24, 2016, and (b) September 26, 2015 eBook Print Complete this question by entering your answers in the tabs below. References Required 1 Required 2 Required 3 What amount of total assets does it report for each of the fiscal years ended (a) September 24, 2016, and (b) September 26, 2015? (Enter your answers in millions of dollars) Total Assets (a) September 24, 2016 (b) September 24, 2015 Type here to search Saved Help Refer to Apple's financial statements in Arpendix A for the following questions. 20 points Required: 1. What amount of total liabilities does Apple report for each of the fiscal years ended (a) September 24, 2016, and (b) September 26. 2015? 2. What amount of total assets does it report for each of the fiscal vears ended (a) September 24, 2016, and (b) September 26, 2015? 3. Compute its debt ratio for each of the fiscal years ended (a) September 24, 2016, and (b) September 26, 2015 eBook Print Complete this question by entering your answers in the tabs below. References Required 1 Required 2 Required 3 Compute its debt ratio for each of the fiscal years ended (a) September 24, 2016, and (b) September 26, 2015. (Round your answers to 1 decimal place.) Debt Ratio (a) September 24, 2016 (b) September 24, 2015 Oi e me e 9 Type here to search wa

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts