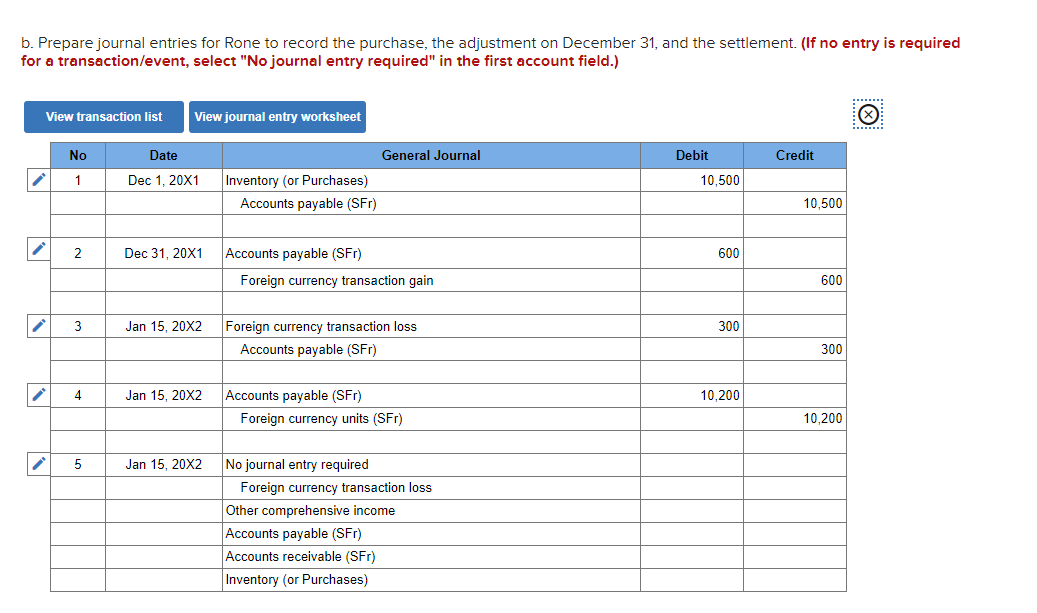

Question: The accounts are wrong on the third journal entry and the fourth journal entry is obviously wrong. Will give thumbs up. Thanks! E11-7 Foreign Purchase

The accounts are wrong on the third journal entry and the fourth journal entry is obviously wrong. Will give thumbs up. Thanks!

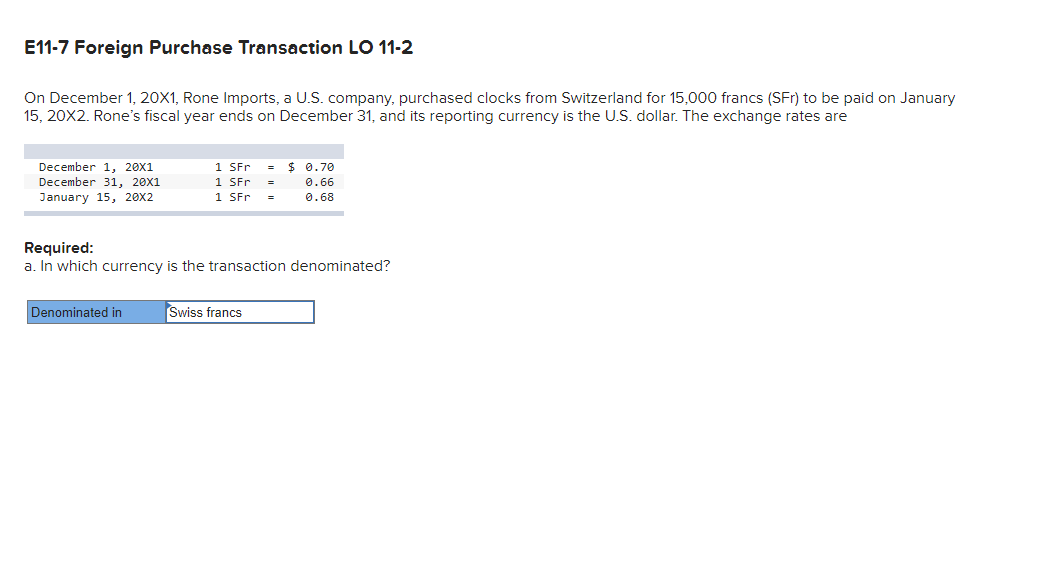

E11-7 Foreign Purchase Transaction LO 11-2 On December 1, 20X1, Rone Imports, a U.S. company, purchased clocks from Switzerland for 15,000 francs (SFr) to be paid on January 15, 20X2. Rone's fiscal year ends on December 31, and its reporting currency is the U.S. dollar. The exchange rates are December 1, 20x1 December 31, 20x1 January 15, 20x2 1 Sir 1 Sir 1 Sir = $ 0.70 0.66 0.68 = Required: a. In which currency is the transaction denominated? Denominated in Swiss francs b. Prepare journal entries for Rone to record the purchase, the adjustment on December 31, and the settlement. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet No Date Debit Credit 1 Dec 1, 20X1 General Journal Inventory (or Purchases) Accounts payable (SFr) 10,500 10,500 N 2 Dec 31, 20X1 600 Accounts payable (SFr) Foreign currency transaction gain 600 3 Jan 15, 20X2 300 Foreign currency transaction loss Accounts payable (SFr) 300 4 Jan 15, 20X2 10.200 Accounts payable (SFr) Foreign currency units (SFr) 10,200 5 Jan 15, 20X2 No journal entry required Foreign currency transaction loss Other comprehensive income Accounts payable (SFr) Accounts receivable (SFr) Inventory (or Purchases)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts