The Acme Insurance Company purchased a five-year bond whose interest rate floats with LIBOR. Specifically, the...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

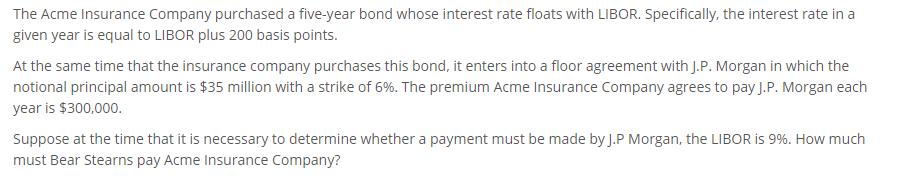

The Acme Insurance Company purchased a five-year bond whose interest rate floats with LIBOR. Specifically, the interest rate in a given year is equal to LIBOR plus 200 basis points. At the same time that the insurance company purchases this bond, it enters into a floor agreement with J.P. Morgan in which the notional principal amount is $35 million with a strike of 6%. The premium Acme Insurance Company agrees to pay J.P. Morgan each year is $300,000. Suppose at the time that it is necessary to determine whether a payment must be made by J.P Morgan, the LIBOR is 9%. How much must Bear Stearns pay Acme Insurance Company? The Acme Insurance Company purchased a five-year bond whose interest rate floats with LIBOR. Specifically, the interest rate in a given year is equal to LIBOR plus 200 basis points. At the same time that the insurance company purchases this bond, it enters into a floor agreement with J.P. Morgan in which the notional principal amount is $35 million with a strike of 6%. The premium Acme Insurance Company agrees to pay J.P. Morgan each year is $300,000. Suppose at the time that it is necessary to determine whether a payment must be made by J.P Morgan, the LIBOR is 9%. How much must Bear Stearns pay Acme Insurance Company?

Expert Answer:

Answer rating: 100% (QA)

To solve this problem we need to determine whether the interest rate on the bond is below the floor ... View the full answer

Related Book For

Statistics For Business And Economics

ISBN: 9780132745659

8th Edition

Authors: Paul Newbold, William Carlson, Betty Thorne

Posted Date:

Students also viewed these banking questions

-

The total cost for a production process is equal to 500 plus two times the number of units produced. The mean and variance for the number of units produced are 700 and 600, respectively. Find the...

-

DePaul Insurance Company purchased a call option on an S&P 500 futures contract. The option premium is quoted as $6. The exercise price is $1,430. Assume the index on the futures contract becomes...

-

What professional judgment and estimation decisions must be made by auditors when applying statistical sampling in test of controls audit work?

-

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firms weighted...

-

In November 2011, Wehav Funds, a profitable engineering firm, signed a loan guarantee as a third party for No Certainty Company, a newly formed organization focused on pharmaceutical research and...

-

Dollarmite Company has 10,000,000 shares of common stock authorised, but to date, has only 6,000,000 shares outstanding, each with a $2.00 par value. The company has $20,000,000 in additional paid-in...

-

Social Jetlag Social jetlag refers to the difference between circadian and social clocks, and is measured as the difference in sleep and wake times between work days and free days. For example, if...

-

The General Fund of Attmore County has a total fund balance of $ 850,000 at December 31, 2013. Based on the following data, prepare the fund balance section of its General Fund balance sheet. 1....

-

What variables affect the value of a stock according to the dividend-growth model? What role do earnings play in this model? How do interest rates and risk affect a stock's price in the Capital...

-

Multiple regression is used by accountants in cost analysis to shed light on the factors that cause costs to be incurred and the magnitudes of their effects. Sometimes, it is desirable to use...

-

A proposed project that ranks high on most criteria may not be selected because the organization's portfolio already includes too many projects with the same characteristics. True or False

-

1.) Use the Master Theorem (2-version) to give tight bounds, or argue why it is not applicable. a. T(n) 4T(n/2) -n 4T(n/4) + 1/4 b. T(n) 4T(n/4) + O(1) c. T(n) = 8T(n/2) + n! d. T(n) 8T(n/2) + log n...

-

Write a recursive version of binary search in a sorted array A[1..n] search for a value, called key. 1.) 2.) 3.) What is the time complexity of the algorithm? Write the recurrence and solve with any...

-

Consider a pair of molecules: They have an energy (u) that is a function of their distance (r). There are two possibilities for this function: a. u= 0.0073 +12 0.41 b. u 2.5 exp(-0.68r2) Here, u is...

-

1. Which risk management method would you advise mining companies to use, root cause analysis method, Incident Cause Analysis method (ICAM ), Fault Tree Analysis( FTA ), and Bowie analysis? And how...

-

Discuss the role of the micro-environment and its components in an organisations success. 2. As a manager, do you think its important for an organisation to develop a competitive advantage in todays...

-

You will be receiving cash flows of: $5,000 today, $5,500 at the end of year 1, $1,000 at the end of year 3, and $5,000 at the end of year 5. What is the net present value of these cash flows at an...

-

On 1 July 2018, Parent Ltd acquired all the shares of Son Ltd, on a cum-div. basis, for $2,057,000. At this date, the equity of Son Ltd consisted of: $ 1,000,000 Share capital 500 000 shares...

-

Consider a problem with four subgroups with the sum of ranks in each of the subgroups equal to 49, 84, 76, and 81 and with subgroup sizes equal to 4, 6, 7, and 6. Complete the Kruskal-Wallis test and...

-

An agency offers preparation courses for a graduate school admissions test to students. As part of an experiment to evaluate the merits of the course, 12 students were chosen and divided into 6 pairs...

-

A random sample of data has a mean of 75 and a variance of 25. a. Use Chebyshev's theorem to determine the percent of observations between 65 and 85. b. If the data are mounded, use the empirical...

-

Using a search engine such as Google, search for power of a hypothesis test. Describe what the power of a hypothesis test is.

-

H 0 : The lottery is fair. Ha: The lottery is biased. Without using the terms null hypothesis and alternative hypothesis, identify the type I error and identify the type II error.

-

What do p, p, and P-value represent?

Study smarter with the SolutionInn App