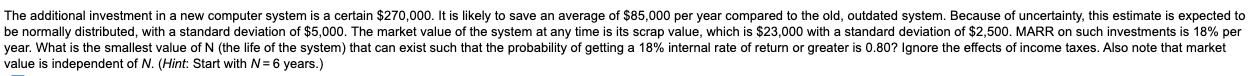

Question: The additional investment in a new computer system is a certain $270,000. It is likely to save an average of $85,000 per year compared to

The additional investment in a new computer system is a certain $270,000. It is likely to save an average of $85,000 per year compared to the old, outdated system. Because of uncertainty, this estimate is expected to be normally distributed, with a standard deviation of $5,000. The market value of the system at any time is its scrap value, which is $23,000 with a standard deviation of $2,500. MARR on such investments is 18% per year. What is the smallest value of N (the life of the system) that can exist such that the probability of getting a 18% internal rate of return or greater is 0.80? Ignore the effects of income taxes. Also note that market value is independent of N. (Hint: Start with N=6 years.) The additional investment in a new computer system is a certain $270,000. It is likely to save an average of $85,000 per year compared to the old, outdated system. Because of uncertainty, this estimate is expected to be normally distributed, with a standard deviation of $5,000. The market value of the system at any time is its scrap value, which is $23,000 with a standard deviation of $2,500. MARR on such investments is 18% per year. What is the smallest value of N (the life of the system) that can exist such that the probability of getting a 18% internal rate of return or greater is 0.80? Ignore the effects of income taxes. Also note that market value is independent of N. (Hint: Start with N=6 years.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts