Question: The adjusted trial balance for Lily Developments Ltd. as at March 31, 2021, was as follows: Prepare Closing Entries Cash $ 50,000 Accounts receivable 180,000

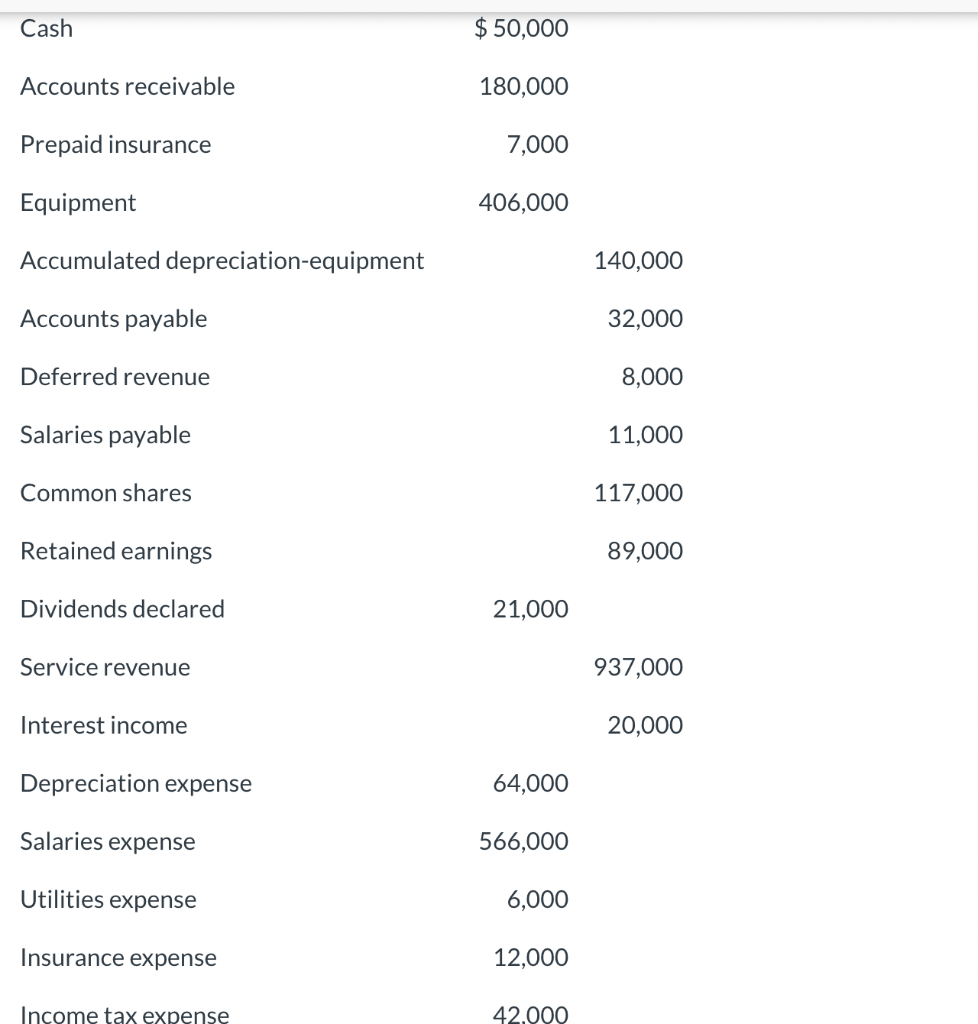

The adjusted trial balance for Lily Developments Ltd. as at March 31, 2021, was as follows:

Prepare Closing Entries

Cash $ 50,000 Accounts receivable 180,000 Prepaid insurance 7,000 Equipment 406,000 Accumulated depreciation-equipment 140,000 Accounts payable 32,000 Deferred revenue 8,000 Salaries payable 11,000 Common shares 117,000 Retained earnings 89,000 Dividends declared 21,000 Service revenue 937,000 Interest income 20,000 Depreciation expense 64,000 Salaries expense 566,000 Utilities expense 6,000 Insurance expense 12,000 Income tax expense 42.000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock