Question: The Advanced Educational Services Inc. purchased a new office computer and other depreciable computer hardware for $12,000. During the third year, the computer is declared

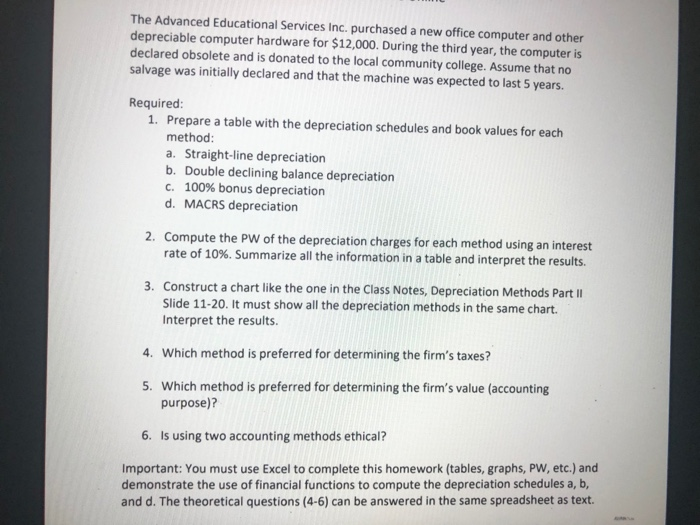

The Advanced Educational Services Inc. purchased a new office computer and other depreciable computer hardware for $12,000. During the third year, the computer is declared obsolete and is donated to the local community college. Assume that no salvage was initially declared and that the machine was expected to last 5 years. Required: 1. Prepare a table with the depreciation schedules and book values for each method: a. Straight-line depreciation b. Double declining balance depreciation C. 100% bonus depreciation d. MACRS depreciation 2. Compute the PW of the depreciation charges for each method using an interest rate of 10%. Summarize all the information in a table and interpret the results. 3. Construct a chart like the one in the Class Notes, Depreciation Methods Part II Slide 11-20. It must show all the depreciation methods in the same chart. Interpret the results. 4. Which method is preferred for determining the firm's taxes? 5. Which method is preferred for determining the firm's value (accounting purpose)? 6. Is using two accounting methods ethical? Important: You must use Excel to complete this homework (tables, graphs, PW, etc.) and demonstrate the use of financial functions to compute the depreciation schedules a, b, and d. The theoretical questions (4-6) can be answered in the same spreadsheet as text

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts