Question: The AFN Question (please answer all questions shown) 1. The AFN equation Aa Aa Blue Elk Manufacturing has the following end-of-year balance sheet: Blue Elk

The AFN Question (please answer all questions shown)

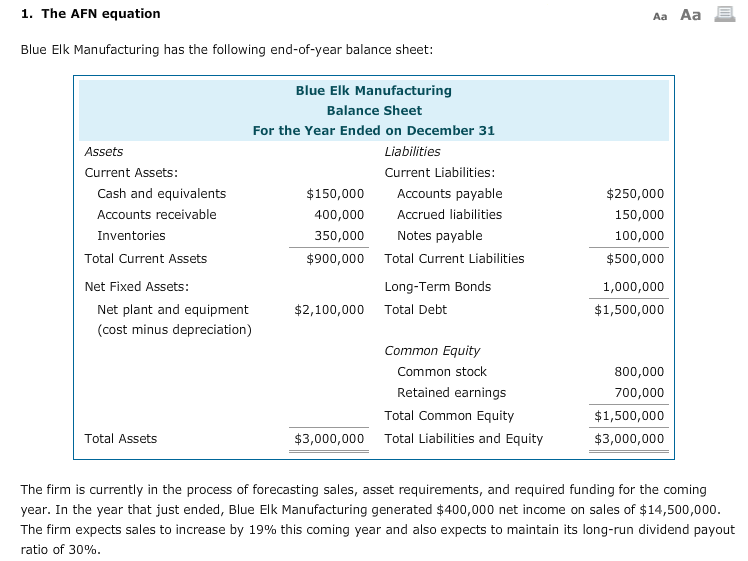

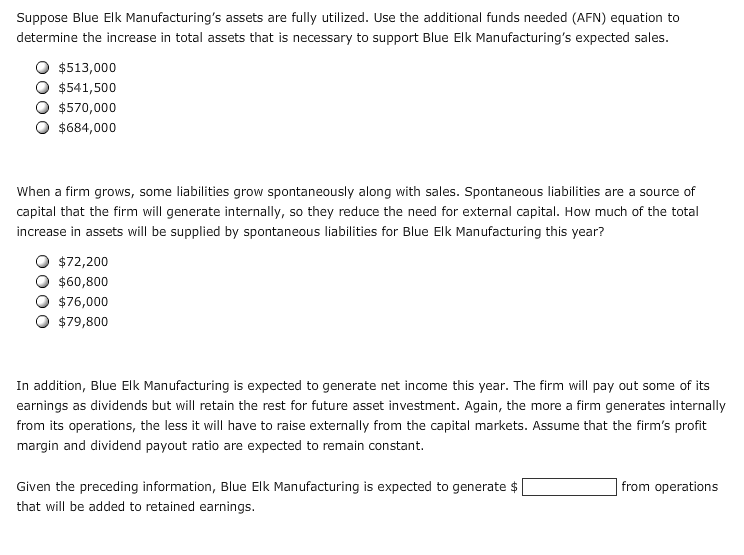

1. The AFN equation Aa Aa Blue Elk Manufacturing has the following end-of-year balance sheet: Blue Elk Manufacturing Balance Sheet For the Year Ended on December 31 Assets Liabilities Current Assets: Current Liabilities $150,000 Accounts payable $250,000 150,000 100,000 $500,000 1,000,000 $1,500,000 Cash and equivalents Accounts receivable Inventories Accrued liabilities 400,000 350,000 $900,000 Notes payable Total Current Assets Total Current Liabilities Net Fixed Assets: Long-Term Bonds Net plant and equipment (cost minus depreciation) $2,100,000 Total Debt Common Equity Common stock 800,000 700,000 $1,500,000 $3,000,000 Retained earnings Total Common Equity Total Liabilities and Equity Total Assets $3,000,000 The firm is currently in the process of forecasting sales, asset requirements, and required funding for the coming year. In the year that just ended, Blue Elk Manufacturing generated $400,000 net income on sales of $14,500,000 The firm expects sales to increase by 19% this coming year and also expects to maintain its long-run dividend payout ratio of 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts