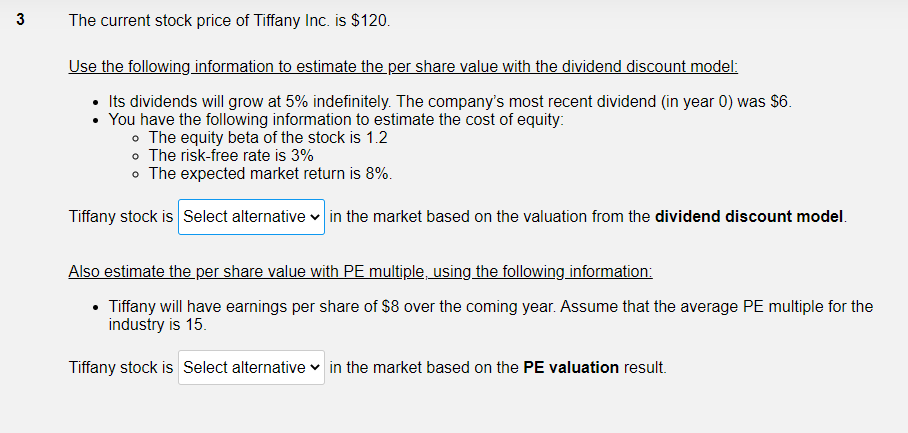

Question: The alternative options are fairly valued, undervalued and overvalued 3 The current stock price of Tiffany Inc. is $120. Use the following information to estimate

The alternative options are fairly valued, undervalued and overvalued

3 The current stock price of Tiffany Inc. is $120. Use the following information to estimate the per share value with the dividend discount model: Its dividends will grow at 5% indefinitely. The company's most recent dividend (in year 0) was $6. You have the following information to estimate the cost of equity: o The equity beta of the stock is 1.2 o The risk-free rate is 3% . The expected market return is 8%. Tiffany stock is Select alternative in the market based on the valuation from the dividend discount model. Also estimate the per share value with PE multiple, using the following information: Tiffany will have earnings per share of $8 over the coming year. Assume that the average PE multiple for the industry is 15 Tiffany stock is Select alternative in the market based on the PE valuation result

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts