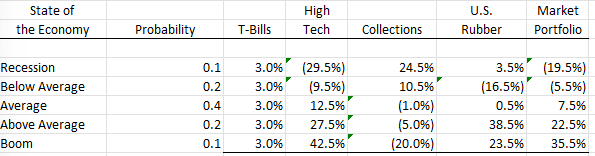

Question: The alternatives are recession, below average, average, above average, and boom. Please find each one The same alternatives. Thank You begin{tabular}{|c|c|c|c|c|c|c|} hline State of &

- The alternatives are recession, below average, average, above average, and boom. Please find each one

-

The same alternatives. Thank You

The same alternatives. Thank You

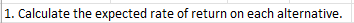

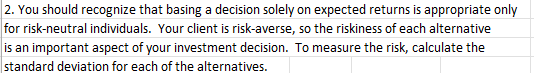

\begin{tabular}{|c|c|c|c|c|c|c|} \hline State of & & & High & & U.S. & Market \\ \hline the Economy & Probability & T-Bills & Tech & Collections & Rubber & Portfolio \\ \hline Recession & 0.1 & 3.0%" & (29.5%) & 24.5% & 3.5% & (19.5%) \\ \hline Below Average & 0.2 & 3.0% & (9.5%) & 10.5% & (16.5%) & (5.5%) \\ \hline Average & 0.4 & 3.0% & 12.5% & (1.0%) & 0.5% & 7.5% \\ \hline Above Average & 0.2 & 3.0% & 27.5% & (5.0%) & 38.5% & 22.5% \\ \hline Boom & 0.1 & 3.0% & 42.5% & (20.0%) & 23.5% & 35.5% \\ \hline \end{tabular} 1. Calculate the expected rate of return on each alternative. 2. You should recognize that basing a decision solely on expected returns is appropriate only for risk-neutral individuals. Your client is risk-averse, so the riskiness of each alternative is an important aspect of your investment decision. To measure the risk, calculate the standard deviation for each of the alternatives. \begin{tabular}{|c|c|c|c|c|c|c|} \hline State of & & & High & & U.S. & Market \\ \hline the Economy & Probability & T-Bills & Tech & Collections & Rubber & Portfolio \\ \hline Recession & 0.1 & 3.0%" & (29.5%) & 24.5% & 3.5% & (19.5%) \\ \hline Below Average & 0.2 & 3.0% & (9.5%) & 10.5% & (16.5%) & (5.5%) \\ \hline Average & 0.4 & 3.0% & 12.5% & (1.0%) & 0.5% & 7.5% \\ \hline Above Average & 0.2 & 3.0% & 27.5% & (5.0%) & 38.5% & 22.5% \\ \hline Boom & 0.1 & 3.0% & 42.5% & (20.0%) & 23.5% & 35.5% \\ \hline \end{tabular} 1. Calculate the expected rate of return on each alternative. 2. You should recognize that basing a decision solely on expected returns is appropriate only for risk-neutral individuals. Your client is risk-averse, so the riskiness of each alternative is an important aspect of your investment decision. To measure the risk, calculate the standard deviation for each of the alternatives

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts