Question: The answer for 78 is C and for 119 it is B but i dont understand why the depreciation expense recorded in question 78 takes

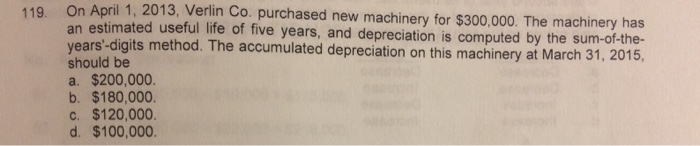

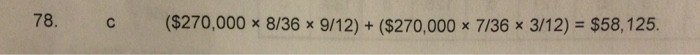

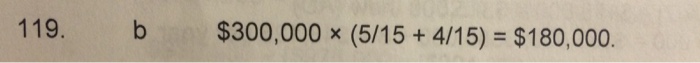

The answer for 78 is C and for 119 it is B but i dont understand why the depreciation expense recorded in question 78 takes into account the months to depreciate the asset over whereas the accumulated depreciation in question 119 does not

Can someone explain? Answers for both questions are provided

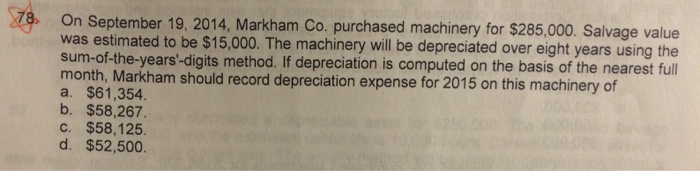

78. On September 19, 2014, Markham Co. purchased machinery for $285,000. Salvage value was estimated to be $15,000. The machinery will be depreciated over eight years using the sum-of-the-years'-digits method. If depreciation is computed on the basis of the nearest full month, Markham should record depreciation expense for 2015 on this machinery of a. $61,354. b. $58,267. c. $58,125. d. $52,500

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock