Question: The answer for 8) A, 9)E, 10)A. I have been struggling to figure out the steps to reach to the correct answer. Therefore, please show

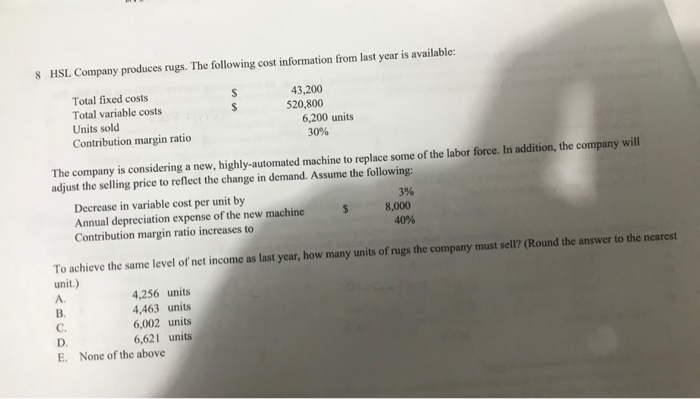

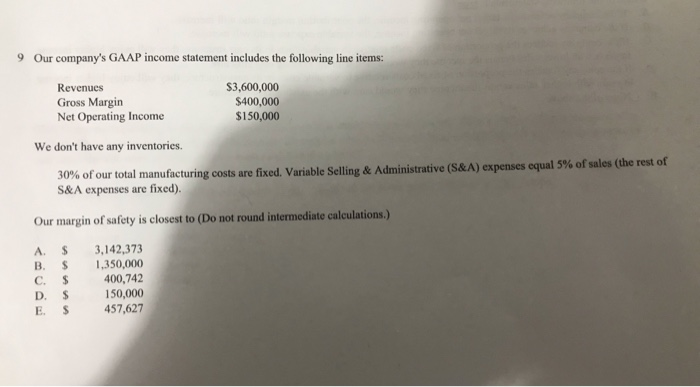

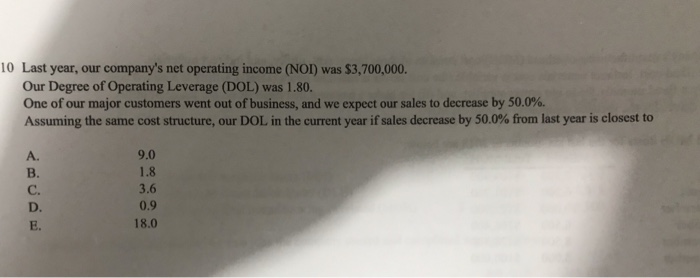

8 HSL Company produces rugs. The following cost information from last year is available: Total fixed costs s 43,200 Total variable costs s 520,800 Units sold 6,200 units Contribution margin ratio 30% The company is considering a new, highly-automated machine to replace some of the labor force. In addition, the company will adjust the selling price to reflect the change in demand. Assume the following: Decrease in variable cost per unit by 3% Annual depreciation expense of the new machine 8.000 Contribution margin ratio increases to 40% To achieve the same level of net income as last year, how many units of rugs the company must sell? (Round the answer to the nearest unit.) A 4,256 units B 4,463 units C. 6,002 units D 6,621 units E. None of the above 9 Our company's GAAP income statement includes the following line items: Revenues $3,600,000 Gross Margin $400,000 Net Operating Income $150,000 We don't have any inventories. 30% of our total manufacturing costs are fixed. Variable Selling & Administrative (S&A) expenses equal 5% of sales (the rest of S&A expenses are fixed). Our margin of safety is closest to (Do not round intermediate calculations.) A $ 3,142,373 B $ 1,350,000 C. $ 400,742 D $ 150,000 E S 457,627 10 Last year, our company's net operating income (NOI) was $3,700,000. Our Degree of Operating Leverage (DOL) was 1.80. One of our major customers went out of business, and we expect our sales to decrease by 50.0%. Assuming the same cost structure, our DOL in the current year if sales decrease by 50.0% from last year is closest to A. B. C. D. E. 9.0 1.8 3.6 0.9 18.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts