Question: The answer for the first part (E21-10) has been answered already. E21-11 is the question I need help with. E21-11 (L02,4) (Lessor Entries with Bargain

The answer for the first part (E21-10) has been answered already. E21-11 is the question I need help with.

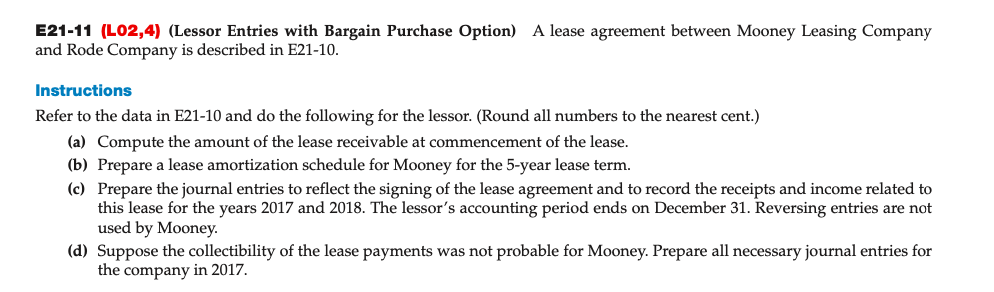

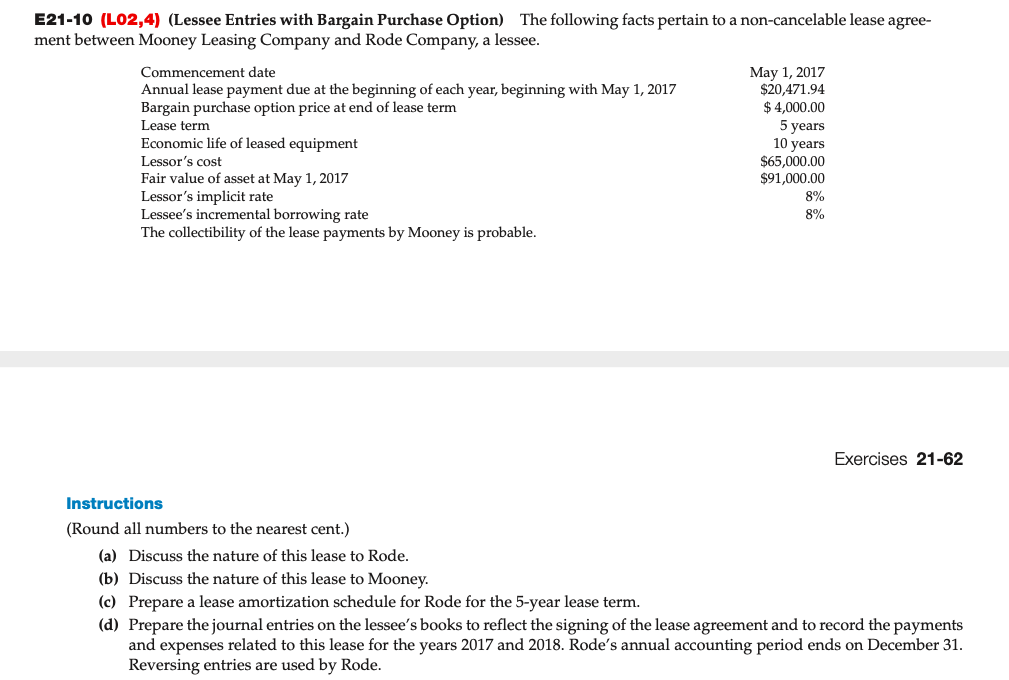

E21-11 (L02,4) (Lessor Entries with Bargain Purchase Option) A lease agreement between Mooney Leasing Company and Rode Company is described in E21-10. Instructions Refer to the data in E21-10 and do the following for the lessor. (Round all numbers to the nearest cent.) (a) Compute the amount of the lease receivable at commencement of the lease. (b) Prepare a lease amortization schedule for Mooney for the 5-year lease term. (c) Prepare the journal entries to reflect the signing of the lease agreement and to record the receipts and income related to this lease for the years 2017 and 2018. The lessor's accounting period ends on December 31. Reversing entries are not used by Mooney. (d) Suppose the collectibility of the lease payments was not probable for Mooney. Prepare all necessary journal entries for the company in 2017 E21-10 (L02,4) (Lessee Entries with Bargain Purchase Option) The following facts pertain to a non-cancelable lease agree- ment between Mooney Leasing Company and Rode Company, a lessee. Commencement date Annual lease payment due at the beginning of each year, beginning with May 1, 2017 Bargain purchase option price at end of lease term Lease term Economic life of leased equipment Lessor's cost Fair value of asset at May 1, 2017 Lessor's implicit rate Lessee's incremental borrowing rate The collectibility of the lease payments by Mooney is probable. May 1, 2017 $20,471.94 $ 4,000.00 5 years 10 years $65,000.00 $91,000.00 8% 8% Exercises 21-62 Instructions (Round all numbers to the nearest cent.) (a) Discuss the nature of this lease to Rode. (b) Discuss the nature of this lease to Mooney. (c) Prepare a lease amortization schedule for Rode for the 5-year lease term. (d) Prepare the journal entries on the lessee's books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2017 and 2018. Rode's annual accounting period ends on December 31. Reversing entries are used by Rode. E21-11 (L02,4) (Lessor Entries with Bargain Purchase Option) A lease agreement between Mooney Leasing Company and Rode Company is described in E21-10. Instructions Refer to the data in E21-10 and do the following for the lessor. (Round all numbers to the nearest cent.) (a) Compute the amount of the lease receivable at commencement of the lease. (b) Prepare a lease amortization schedule for Mooney for the 5-year lease term. (c) Prepare the journal entries to reflect the signing of the lease agreement and to record the receipts and income related to this lease for the years 2017 and 2018. The lessor's accounting period ends on December 31. Reversing entries are not used by Mooney. (d) Suppose the collectibility of the lease payments was not probable for Mooney. Prepare all necessary journal entries for the company in 2017 E21-10 (L02,4) (Lessee Entries with Bargain Purchase Option) The following facts pertain to a non-cancelable lease agree- ment between Mooney Leasing Company and Rode Company, a lessee. Commencement date Annual lease payment due at the beginning of each year, beginning with May 1, 2017 Bargain purchase option price at end of lease term Lease term Economic life of leased equipment Lessor's cost Fair value of asset at May 1, 2017 Lessor's implicit rate Lessee's incremental borrowing rate The collectibility of the lease payments by Mooney is probable. May 1, 2017 $20,471.94 $ 4,000.00 5 years 10 years $65,000.00 $91,000.00 8% 8% Exercises 21-62 Instructions (Round all numbers to the nearest cent.) (a) Discuss the nature of this lease to Rode. (b) Discuss the nature of this lease to Mooney. (c) Prepare a lease amortization schedule for Rode for the 5-year lease term. (d) Prepare the journal entries on the lessee's books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2017 and 2018. Rode's annual accounting period ends on December 31. Reversing entries are used by Rode

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts