Question: The answer given each time uses the calculations correctly, HOWEVER, does not take into consideration the 1 6 0 2 0 0 salary cap for

The answer given each time uses the calculations correctly, HOWEVER, does not take into consideration the salary cap for the tax. The th and th pay dates should not be paid at those amounts, therefore the calculations that have continually been given are wrong and are not helpful.

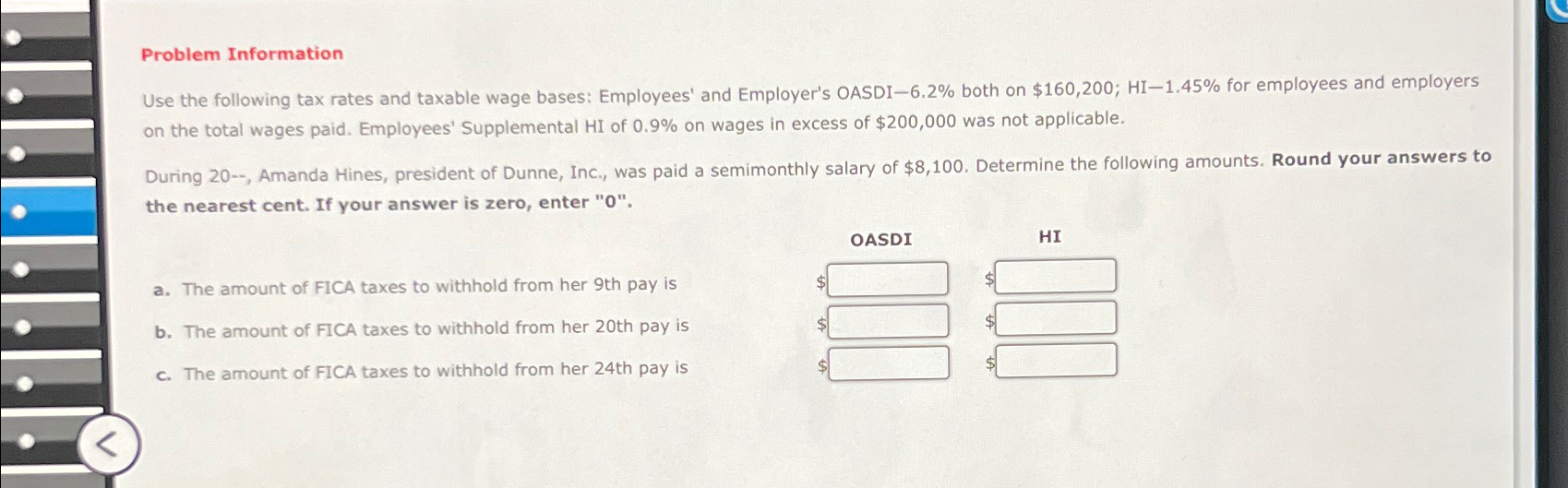

Problem Information

Use the following tax rates and taxable wage bases: Employees' and Employer's OASDI both on $; for employees and employers on the total wages paid. Employees' Supplemental HI of on wages in excess of $ was not applicable.

During Amanda Hines, president of Dunne, Inc., was paid a semimonthly salary of $ Determine the following amounts. Round your answers to the nearest cent. If your answer is zero, enter

a The amount of FICA taxes to withhold from her th pay is

b The amount of FICA taxes to withhold from her th pay is

c The amount of FICA taxes to withhold from her th pay is

tableOASDIHI$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock