Question: The answer given in box is wrong... please do it in 30 minutes please urgently... I'll give you up thumb definitely Use the marginal tax

The answer given in box is wrong... please do it in 30 minutes please urgently... I'll give you up thumb definitely

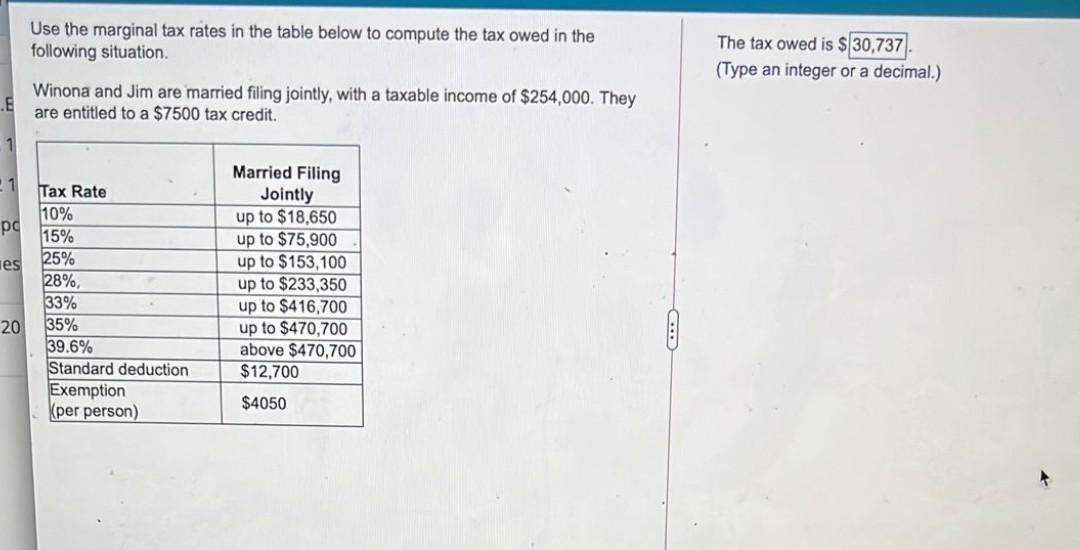

Use the marginal tax rates in the table below to compute the tax owed in the following situation. The tax owed is $ 30,737 (Type an integer or a decimal.) Winona and Jim are married filing jointly, with a taxable income of $254,000. They are entitled to a $7500 tax credit. :1 nes Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption Kper person) Married Filing Jointly up to $18,650 up to $75,900 up to $153,100 up to $233,350 up to $416,700 up to $470,700 above $470,700 $12,700 20 $4050

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts