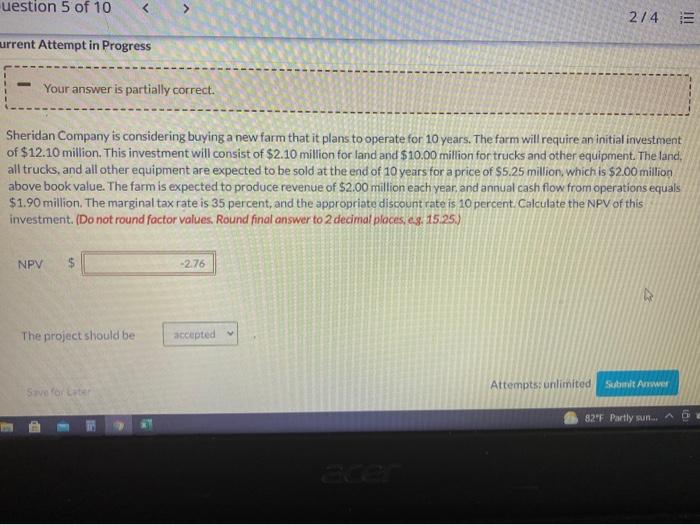

Question: The answer I calculated was -2.76 and therefore the project should be rejected but this is apperantley wrong uestion 5 of 10 2/4 = current

The answer I calculated was -2.76 and therefore the project should be rejected but this is apperantley wrong

The answer I calculated was -2.76 and therefore the project should be rejected but this is apperantley wronguestion 5 of 10 2/4 = current Attempt in Progress - Your answer is partially correct. Sheridan Company is considering buying a new farm that it plans to operate for 10 years. The farm will require an initial investment of $12.10 million. This investment will consist of $2.10 million for land and $10.00 million for trucks and other equipment. The land, all trucks, and all other equipment are expected to be sold at the end of 10 years for a price of $5.25 million, which is $2.00 million above book value. The farm is expected to produce revenue of $2.00 million each year, and annual cash flow from operations equals $1.90 million. The marginal tax rate is 35 percent, and the appropriate discount rate is 10 percent. Calculate the NPV of this investment. (Do not round factor values. Round final answer to 2 decimal places. 4.8. 15.25.) NPV -276 The project should be accepted Attempts unlimited Submit Answer Svoor te 82F Partly sun

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts